IOTA price looks to come full circle by rallying 30%

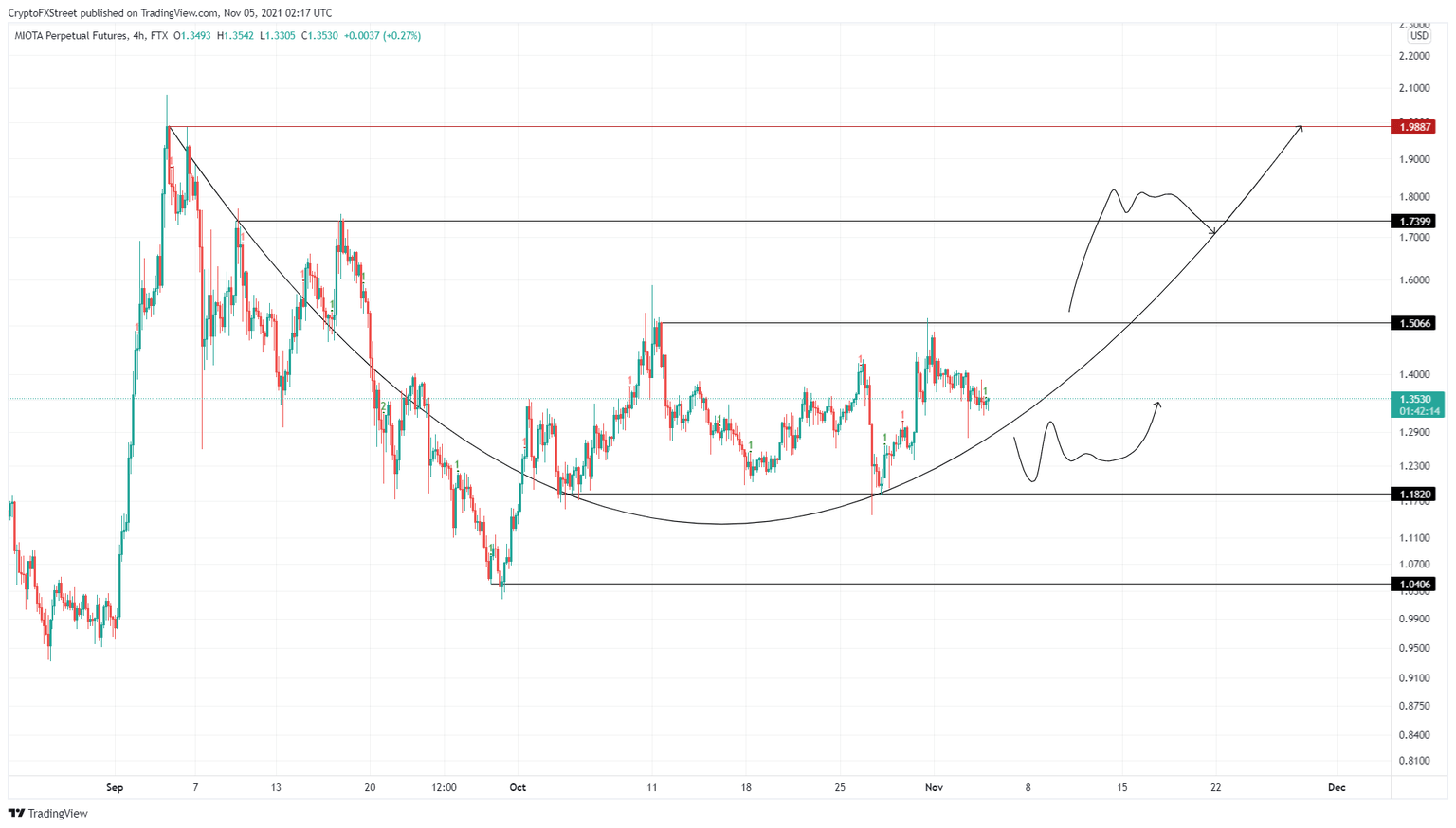

- IOTA price seems to be completing a very loosely put rounded bottom pattern.

- The bounce from the $1.18 support level is likely to continue its ascent to $1.74.

- The MRI also flashed a green ‘one’ buy signal supporting the bullish outlook.

IOTA price has been on a downward trend for roughly 43 days and seems to have bottomed out. The next half is likely to see IOTA climb higher through immediate resistance barriers and make a run for the September 5 highs.

IOTA price pulls a 180

IOTA price dropped 48% from September 5 to September 29 but stabilized above the $1.18 support level. The slow, choppy nature of the price action suggests that IOTA price could be heading back to September 5 levels, forming a makeshift rounded bottom pattern.

Therefore, the IOTA price is likely to continue its ascent toward the immediate resistance level at $1.51, followed by $1.74. In some cases, IOTA price could also extend this 30% ascent to $1.99 or the $2 psychological level, constituting a 46% ascent in total.

Supporting this ascent is the Momentum Reversal Indicator (MRI) that has flashed a green ‘one’ buy signal. This setup forecasts a one-to-four candlestick upswing.

IOTA/USDT 4-hour chart

While the upswing seems promising for IOTA price, investors should be aware that the price action has been choppy and will likely continue being the same. Although unlikely, IOTA price could also make a run toward the $1.18 support level before heading higher.

The bullish thesis will remain intact as long as IOTA price does not produce a daily close below $1.18. However, a breakdown of this barrier will likely knock the altcoin down to $1.04.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.