IOTA buyers wait for clear bullish entry, anticipating a 70% breakout

- IOTA price had rallied more than 23% since October 27th, creating bullish conditions when most of the market was facing intense selling pressure.

- A prolonged consolidation event has lasted for over two months.

- Nearby long and short opportunities exist, but current market sentiment and structure favor the bulls.

IOTA price is stuck inside the Cloud. The Cloud is a miserable place for any trader to participate in. One of the benefits of the Ichimoku Kinko Hyo system is that it tells traders when not to trade – and inside the Cloud is one of those times.

IOTA price prepares for a move above the Cloud, bulls and bears indecisive

IOTA price action has finally shown some evidence that the two-month-long consolidation by end soon. Trading inside the Cloud for the past five trading days builds pressure for a move out of consolidation. The Cloud represents volatility, indecision, whipsaws and misery. It is the place where trading accounts go to die. However, the Cloud is the final resting place before new trends begin or old ones resume.

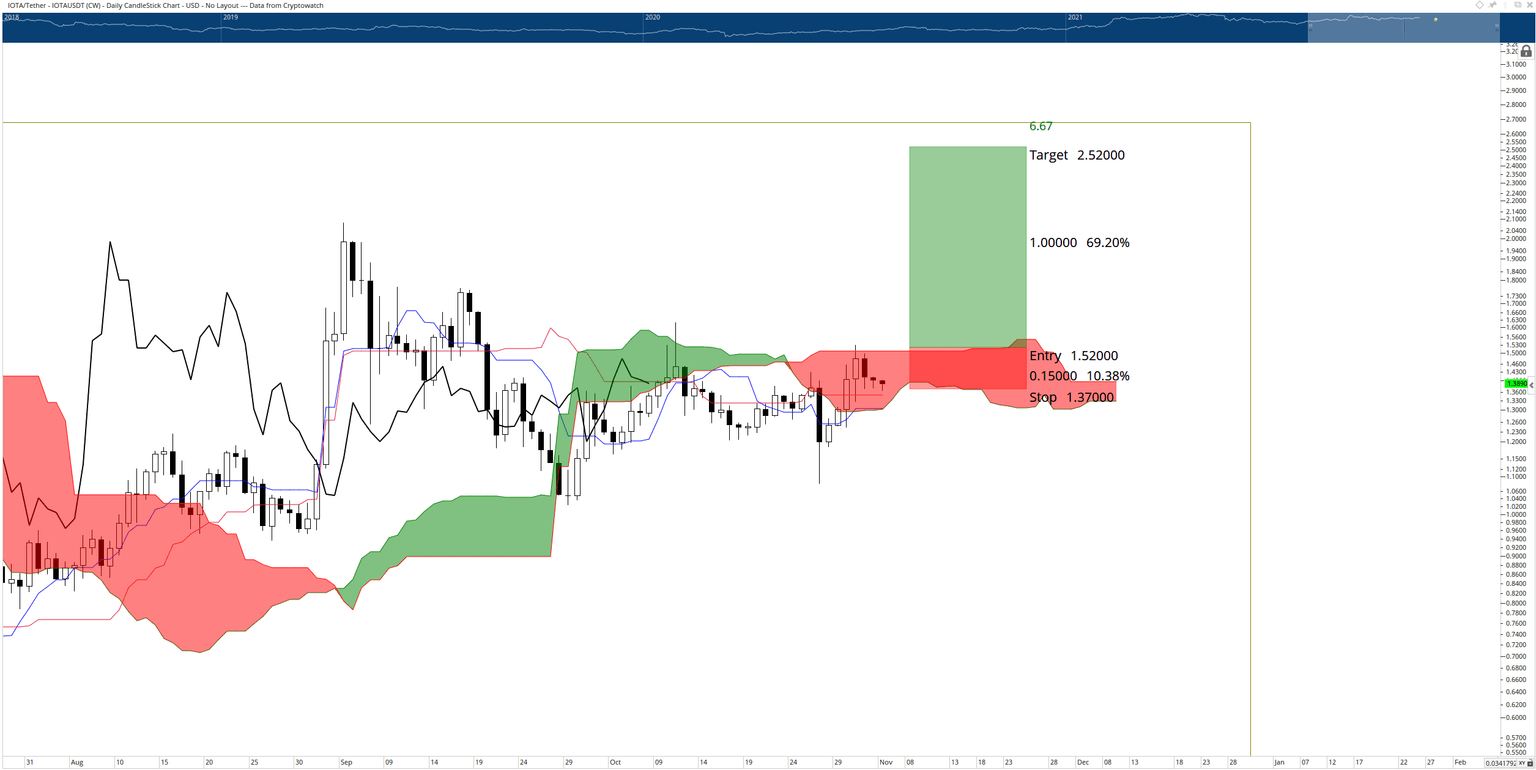

Bulls eye a hypothetical long entry above the Cloud at $1.52. A daily close at or slightly above $1.52 would confirm IOTA price in an Ideal Bullish Ichimoku Breakout entry. The stop loss would be slightly below the Cloud at $1.38 with a projected profit target at $2.52 – slightly below the all-time high. A trailing stop would help protect any implied profits made due to a swift move above the Cloud.

IOTA/USD Daily Ichiumoku Chart

The long idea is invalidated if the short entry triggers.

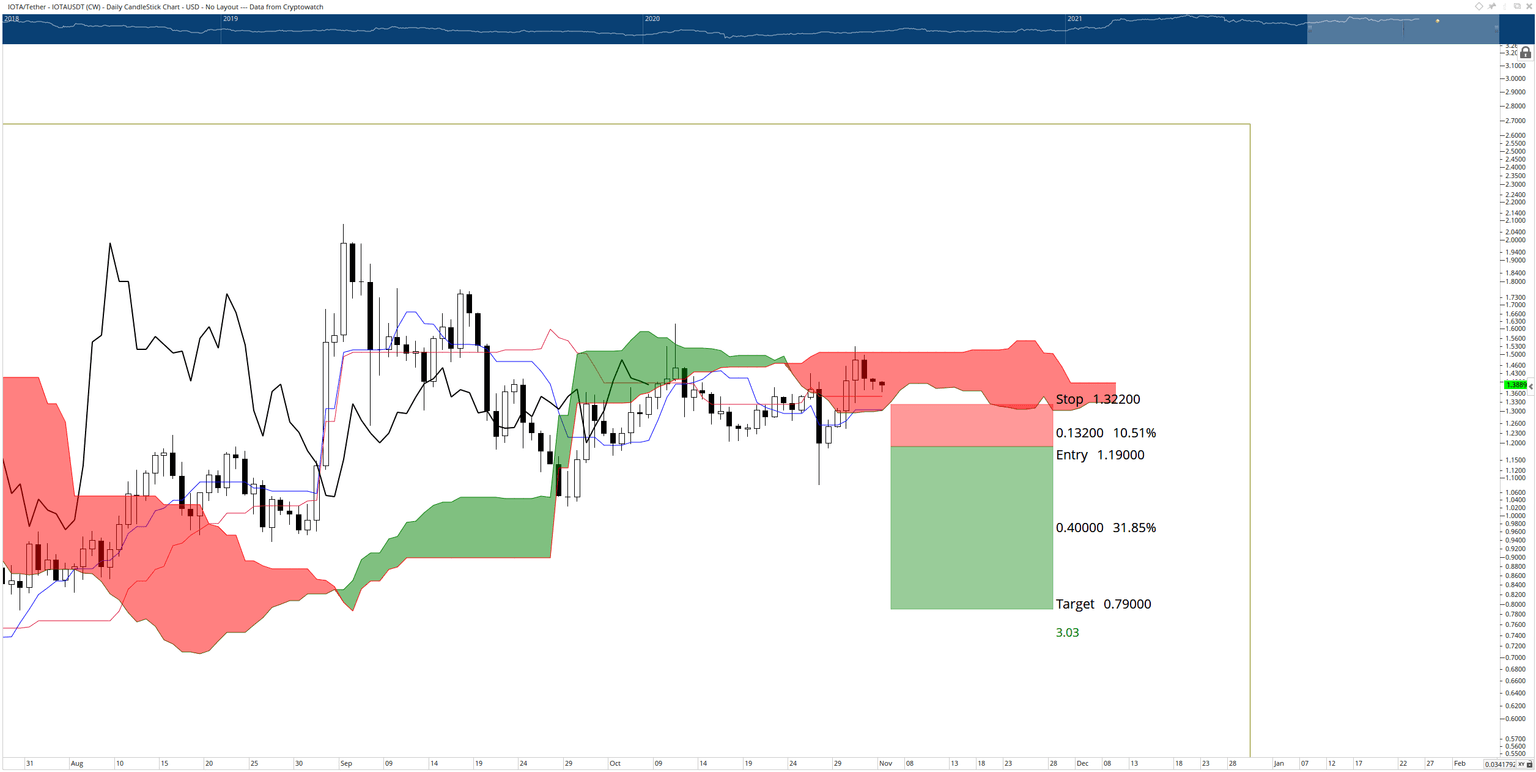

Significant support for IOTA price exists between$1.30 and $1.35. The Tenkan-Sen, Kijun-Sen, Senkou Span A, and 2021 Volume Point Of Control all reside within that price range. If support fails in that price range, then a potential short setup develops with an entry at a daily close near $1.19, a stop loss at $1.32 and a profit target at $0.79. A tight trailing stop would help limit any potential profit, especially as dip buyers may step in very soon after the entry is triggered.

IOTA/USD Daily Ichimoku Chart

The short idea is invalidated if the long entry triggers.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.