IOTA Market Update: IOT/USD has a bullish start to the day as IOTA Foundation introduces the alpha version of “Chronicle”

- Chronicle provides for quick, secure and scalable storage of all IOTA transactions.

- Chronicle is now in alpha stage with some new features to offer.

- Users can customize the new framework as per their requirements.

- IOT/USD had a bullish start to the day, following a bearish Monday.

The IOTA Foundation recently announced that its official "permanode" solution - Chronicle -is now in alpha. In September last year, the firm had unveiled Chronicle as a permanent storage solution for all IOTA transactions.

Storage requirements will become a significant issue for node operators, down the line. Storage is also a problem on the Internet of Things (IoT), where low-level devices work with limited resources. Hence, IOTA now offers local snapshots that permit node owners to delete old transactions and keep their Tangle database concise.

Notably, enterprises may need to store data for long periods. For instance, in Germany, financial data should be stored for over ten years. Some decentralized entities may even need to save data permanently. In a recent blog post, Jake Cahill from the IOTA Foundation said:

For example, consider the case of a transaction that contains a decentralized identity (DID) document. A user shares this DID with a government to request a driving license. However, when the government looks for the DID on the Tangle, it may no longer be available and the request may be denied.

IOTA has developed the permanode as a solution for use-cases such as the one mentioned above. Chronicle allows node owners to store and query all IOTA transactions in a fast, secure, scalable and distributed database. The alpha version announced recently is expected to increase the adoption of IOTA in the industrial enterprise sector. Cahill added:

Now, with this new release, corporate partners can use a more stable version of our decentralized storage framework Chronicle. We anticipate that more industrial use cases can be built on the tangle as a result of this release.

The alpha version was ported from the programming language Erlang to Rust to enable interoperability with future IOTA projects. It is also released with a command-line interface (CLI), enabling the creation of a permanode in just a few minutes.

Furthermore, it lets users create customized solutions and make company-specific settings. A future version of the IOTA Chronicle is expected to introduce a web dashboard to make it even easier to use.

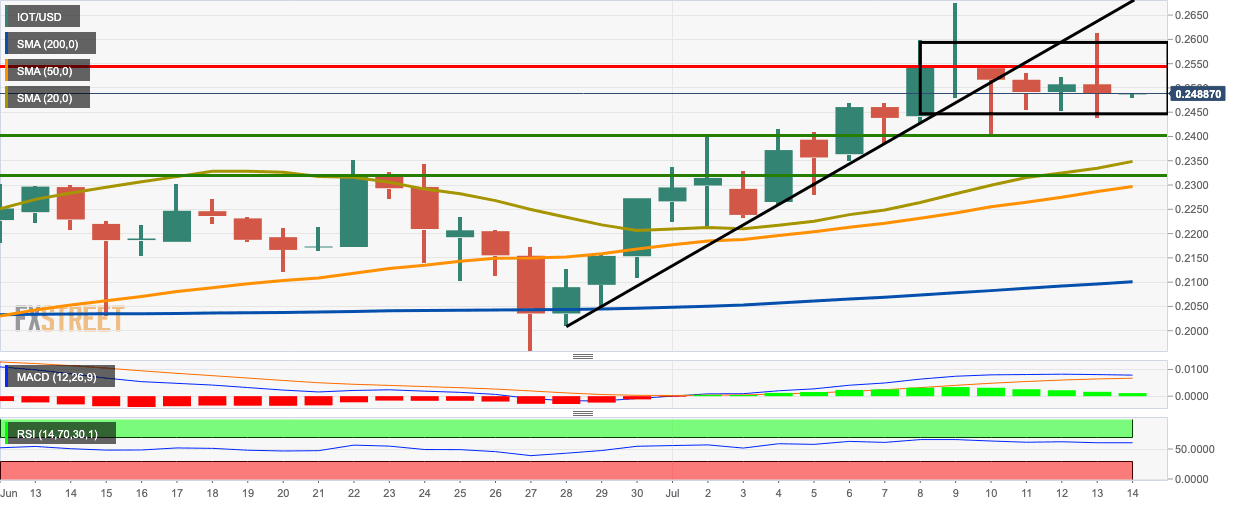

IOT/USD daily chart

IOT/USD went up from $0.2487 to $0.2488 following a bearish Monday. The price is still trending horizontally in a flag formation. The MACD shows decreasing bullish momentum. The RSI is trending horizontally around 60.34, right below the overbought zone.

Support and Resistance

IOT/USD has strong resistance at $0.2544. On the downside, healthy support lies at $0.24, $0.235 (SMA 20), $0.232 and $0.23 (SMA 50).

Key levels

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.