Institutional investors are paying $2,750 for Litecoin as the price premium widens

- Litecoin price is currently $86.76, but some investors are paying a lot more to purchase the digital asset.

- The Grayscale Litecoin Trust is trading at a premium of 3,193% to NAV.

Grayscale is known for its massive investments in Bitcoin, but the trust fund has also purchased Ethereum, Litecoin, and other digital currencies in the past. Institutional investors are currently paying a lot more for the LTCN shares than the real value of Litecoin, which is around $86.

The chart of the Grayscale Litecoin Trust Premium to NAV shows 3,193%, which means that investors are effectively buying LTC at an implied price of $2,750.

Can Litecoin price benefit from the massive premium institutional investors are currently paying?

In the past four months, the price of LTC and the Grayscale Litecoin Trust Premium to NAV have been directly correlated. The last spike happened around the beginning of November. Litecoin price had a 72% increase since then.

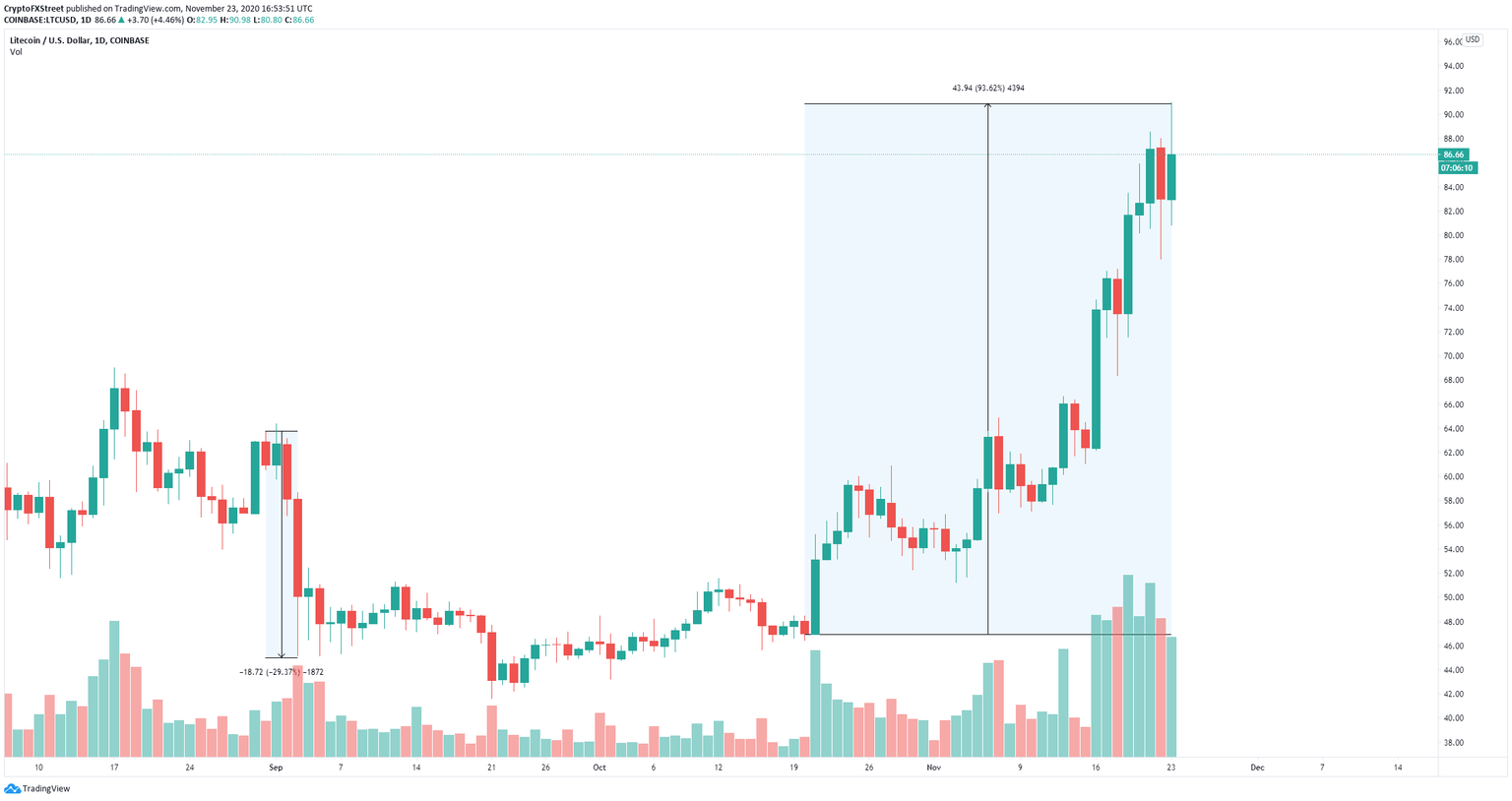

The correlation between the LTCN shares and Litecoin price doesn’t necessarily seem to be benefiting the digital asset. On August 31, LTCN shares were worth $1.95 and spiked to $42.15 on September 1. On the other hand, the price of Litecoin dropped from $64 to a low of $45 three days later, representing a 29% decline.

LTC/USD daily chart

However, from October 20 until the current date, the correlation does seem to be positive. Despite this correlation, Litecoin price is already on par with the LTCN shares, which would suggest it will not necessarily continue growing.

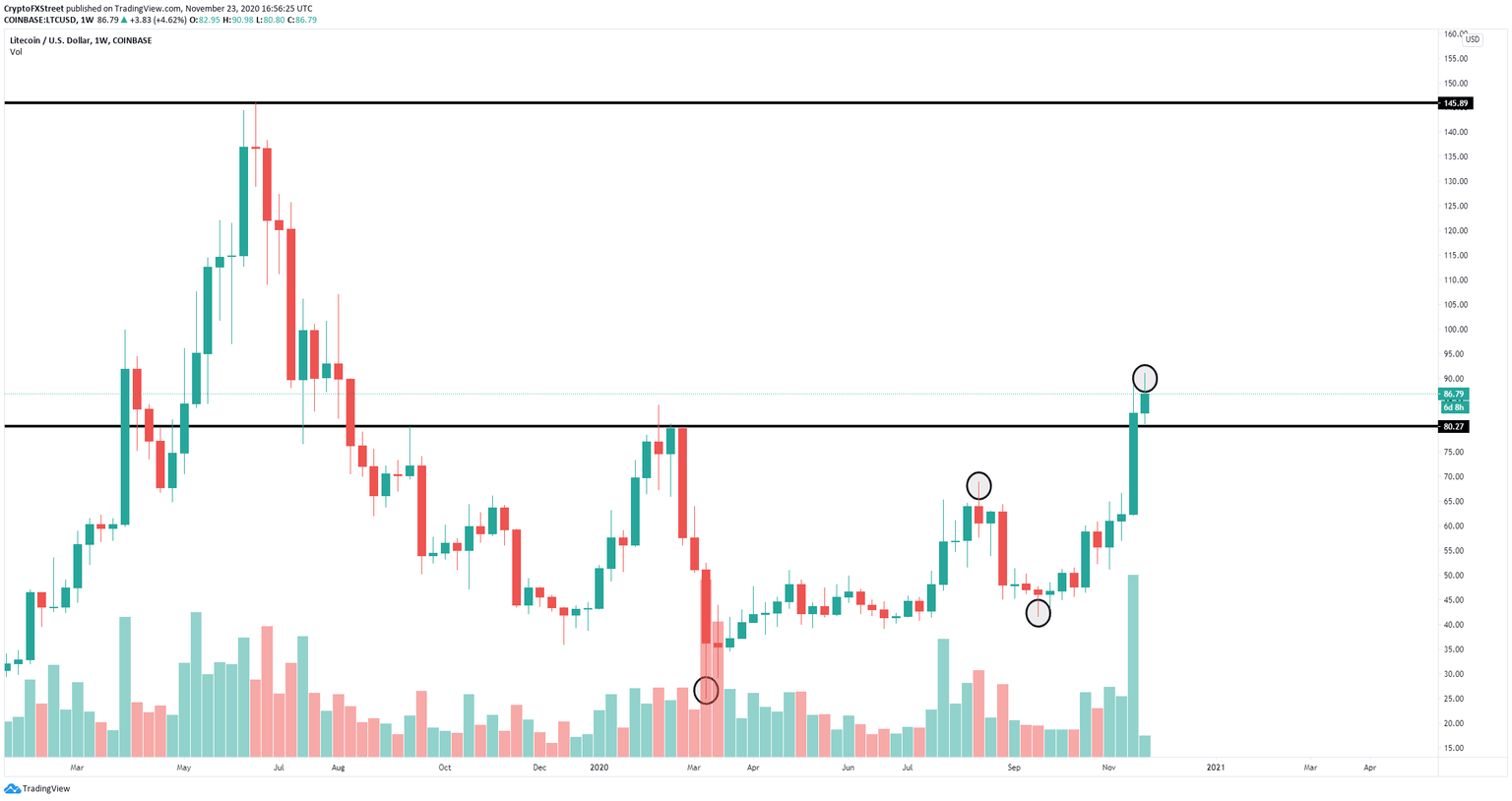

LTC/USD weekly chart

On the weekly chart, Litecoin price has confirmed an uptrend after establishing a clear higher low at $41.64, compared to $25 and a higher high at $90.98 compared to the last high at $69. The significant resistance level at $80 was also broken on November 16. Litecoin seems to be aiming for $145 now.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.