Inordinately high – Bitcoin Ordinals send BTC transaction fees to new five-month peak

Bitcoin (BTC $34,714) transaction fees are at their highest in nearly six months as a new wave of inscriptions boosts competition for block space.

Data from statistics resource BitInfoCharts shows the average BTC transaction fee approaching $6 as of Nov. 7.

Ordinals taking up Bitcoin mempool again

The return of Bitcoin Ordinals is making its presence felt this week as on-chain transactions attract highly elevated fees.

In an environment reminiscent of Q2 this year, blockspace is being taken up by ordinal inscriptions.

Ordinals are nonfungible tokens (NFTs) that store data directly on the blockchain. BRC-20 Ordinals can add significant transaction numbers for Bitcoin miners to process on-chain, clogging up the mempool and resulting in more competition for confirmations.

The result is that higher fees are required, and transactions without them will confirm much more slowly than normal.

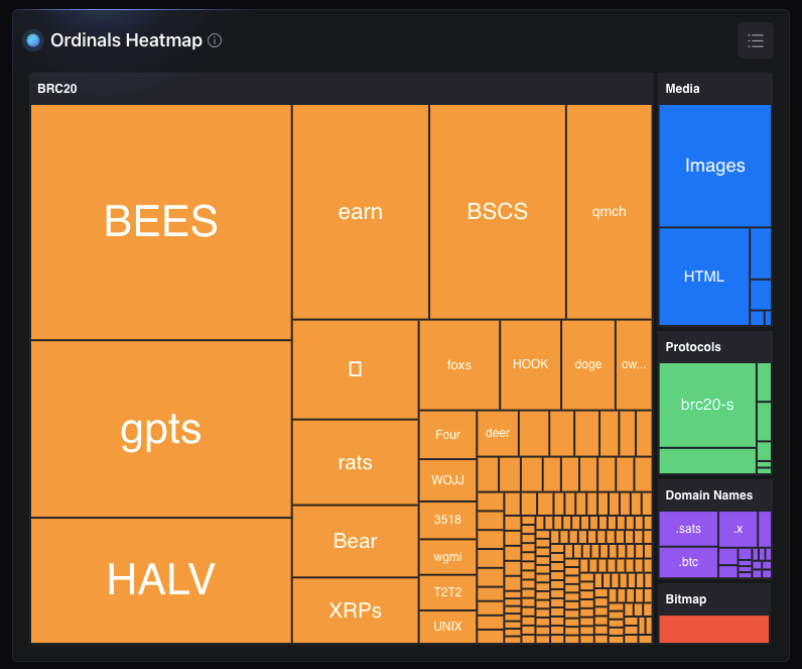

Bitcoin Ordinals heatmap (screenshot). Source: GeniiData

Per statistics from GeniiData, almost 1 million ordinal “mints” have occurred in the past seven days.

The most active projects have changed in that time, with the most active minters coming from BEES, gpts and HALV at the time of writing.

BRC-20 coin $RATS is clogging up the mempool, causing a significant rise in Bitcoin transaction fees.

— Ordinals Wallet (@ordinalswallet) November 4, 2023

Can anyone give us more information about this token? pic.twitter.com/O7EAPHy83F

Bitcoin’s mempool currently has a backlog of over 120,000 unconfirmed transactions, according to live data from Mempool.space.

By contrast, at the beginning of October, the queue contained fewer than 30,000.

Bitcoin mempool data overview (screenshot). Source: Mempool.space

Increased profits for BTC miners

Discussing what might happen to the fee trend next, social media users warned that new minting projects would come to take over once others had completed.

$BEES have turned mempool into ordhive

— pawellwitt.xbt (@pawellwitt) November 6, 2023

Fees are now around 70 sats!!

We already had $RATS $FOXS $OWLS $BNBS what’s next?!

Also, which Bee Collection will take off now that the token is minted out?! pic.twitter.com/PjMJdzRkyA

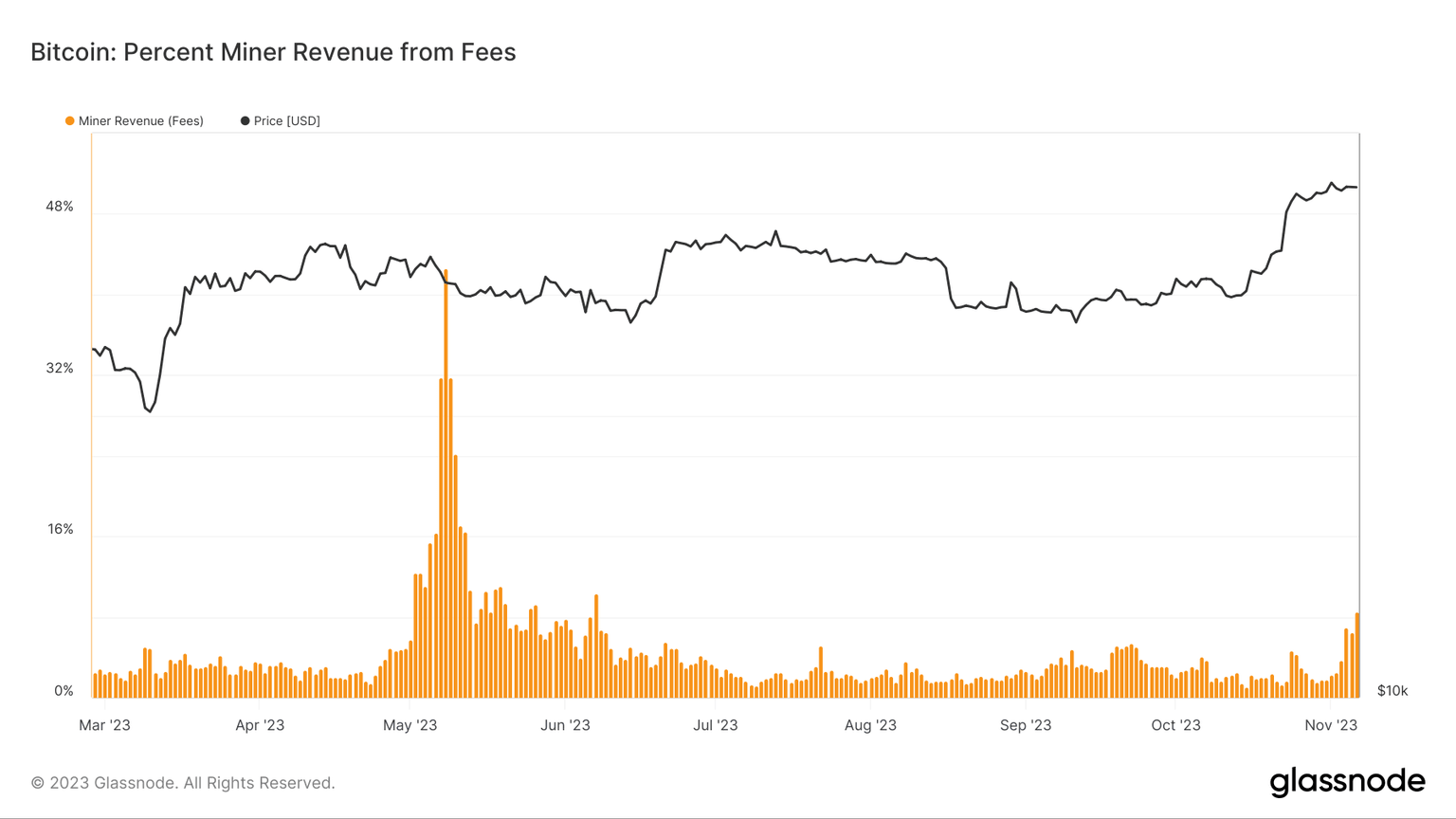

Reaping the benefits, meanwhile, are Bitcoin miners, whose income from fees is rapidly rising.

According to on-chain analytics firm Glassnode, for Nov. 6, 8.5% of miners’ revenue came from the increased fee rates — the biggest daily proportion since early June.

Bitcoin miner % revenue from fees chart. Source: Glassnode

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.