Hyperliquid Price Forecast: HYPE holds near record high as retail demand steadies

- Hyperliquid remains bullish near its record high of $51.50 amid rising interest in the token.

- BitGo has added support for HyperEVM, allowing institutional access to qualified custody and scalable infrastructure.

- HYPE futures Open Interest surges to record levels, supporting the token's short-term bullish case.

Hyperliquid (HYPE) price remains near the token's record high of $51.50, reached on Wednesday, supported by growing retail interest and speculative demand. Up over 2%, HYPE exchanges hands in a narrow range of $49.00 to $50.00 at the time of writing.

BitGo adds custody support for Hyperliquid

BitGo, a digital company offering crypto custody services, announced its support for HyperEVM on Tuesday. HyperEVM is an Ethereum-compatible smart contract layer tailored for the Hyperliquid ecosystem.

With this support, BitGo users can access secure custody services and interact with assets on HyperEVM, including the native token, HYPE.

BitGo is an institutional-grade digital custody provider, ensuring access to regulated services like self-custody cold and hot wallets. Users on the platform have complete control over their assets while taking advantage of customizable policies such as whitelists and spending limits.

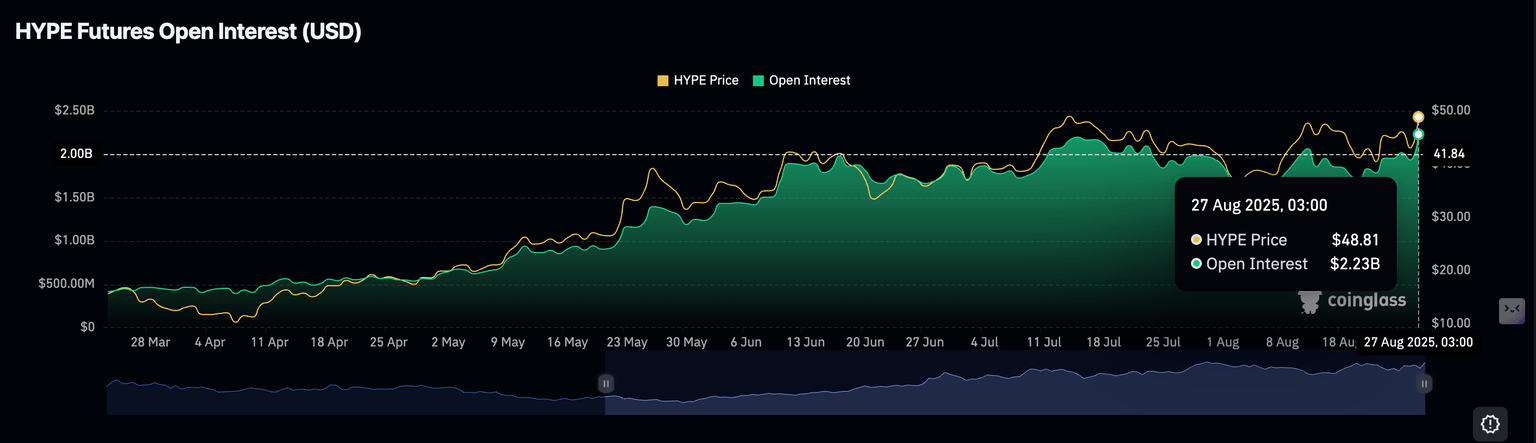

Interest in HYPE remains significantly elevated as the token trades near its record high, underpinned by a steady increase in the futures Open Interest (OI). According to CoinGlass data, Hyperliquid's OI, representing the value of outstanding futures contracts, stands at $2.23 billion, the highest level on record.

Hyperliquid Futures Open Interest | Source: CoinGlass

The steady increase in OI indicates that sentiment around Hyperliquid is positive, while the spike in volume implies heightened market activity. If this trend continues, Hyperliquid's price could confirm support above $50.00, paving the way for a new price discovery phase.

Technical outlook: Hyperliquid bulls target new record high

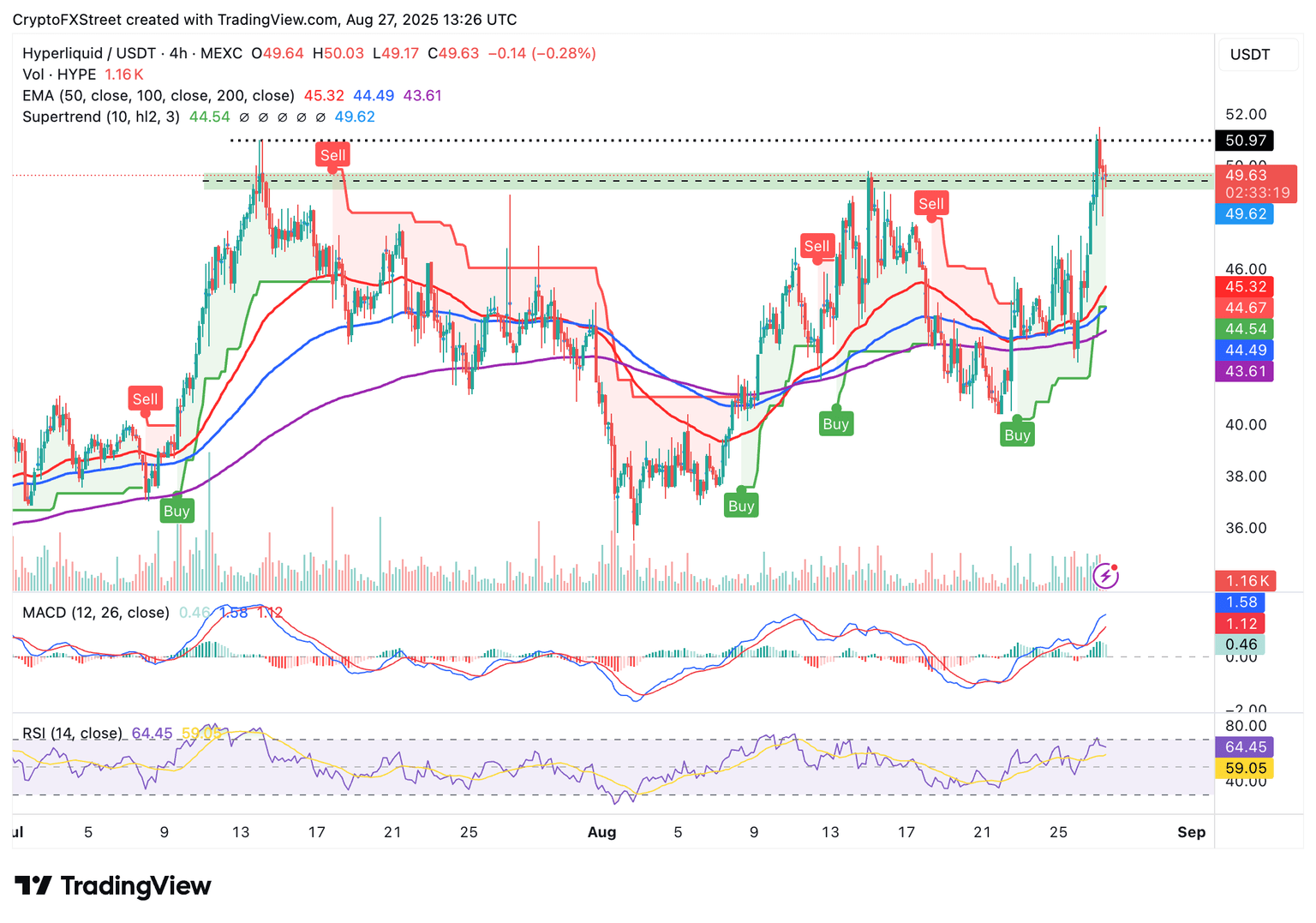

Hyperliquid price holds near its record high of $51.50, with short-term support at $49.00, while the round-figure supply zone at $50.00 caps short-term price action. A buy signal from the Moving Average Convergence Divergence (MACD) indicator backs HYPE's bullish case on the 4-hour chart below.

Traders will likely continue to increase exposure as long as the blue MACD line remains above the red signal line. Although the Relative Strength Index (RSI) has retreated from overbought territory to 65 at the time of writing, its stability hints at a potential uptrend continuation. A reversal above 70 would encourage risk-on sentiment, boosting buying pressure and the chances of a bullish breakout.

HYPE/USDT 4-hour chart

Sentiment in the broader cryptocurrency market could impact Hyperliquid's price performance in the coming days and weeks. Hence, there's a need for traders to monitor other factors, such as risk sentiment, inflation, and the regulatory environment, to manage risk effectively.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren