HYPE sees double-digit gains as commodities trading on Hyperliquid surges to new highs

- Hyperliquid's HIP-3 decentralized exchanges have recorded a new high of $790 million in open interest.

- The growth follows a surge in commodities trading amid rising interest in safe-haven assets like Gold and Silver.

- HYPE is up 13% over the past 24 hours after rising above a key trendline and the 20-day EMA.

Hyperliquid's (HYPE) HIP-3 decentralized exchanges recorded a new milestone, with their open interest rising to a new high of $790 million, the platform noted in an X post on Monday. The figure represents over 200% growth in the past month, but it remains a fraction of Hyperliquid's $8 billion open interest across all markets.

Open interest is the total worth of outstanding contracts in a derivatives market.

Launched in October 2025, HIP-3 (Hyperliquid Improvement Proposal 3) enables qualified developers to deploy their own perpetual futures markets on Hyperliquid's HyperCore infrastructure. This framework has unlocked trading for a diverse range of assets beyond traditional cryptocurrencies, including commodities, stocks, and other real-world assets.

"Hyperliquid has quietly achieved an important milestone of becoming the most liquid venue for crypto price discovery in the world," wrote Hyperliquid CEO Jeff Yan in an X post. "With HIP-3 teams leading the way, Hyperliquid has also grown to become the most liquid venue for perps on tradfi assets."

Rising interest in Gold and Silver responsible for growth

The surge in open interest coincides with heightened global economic uncertainty, prompting traders to seek traditional safe-haven assets. Gold and Silver perpetual contracts have seen particularly strong volume as investors seek hedges against inflation and geopolitical risks.

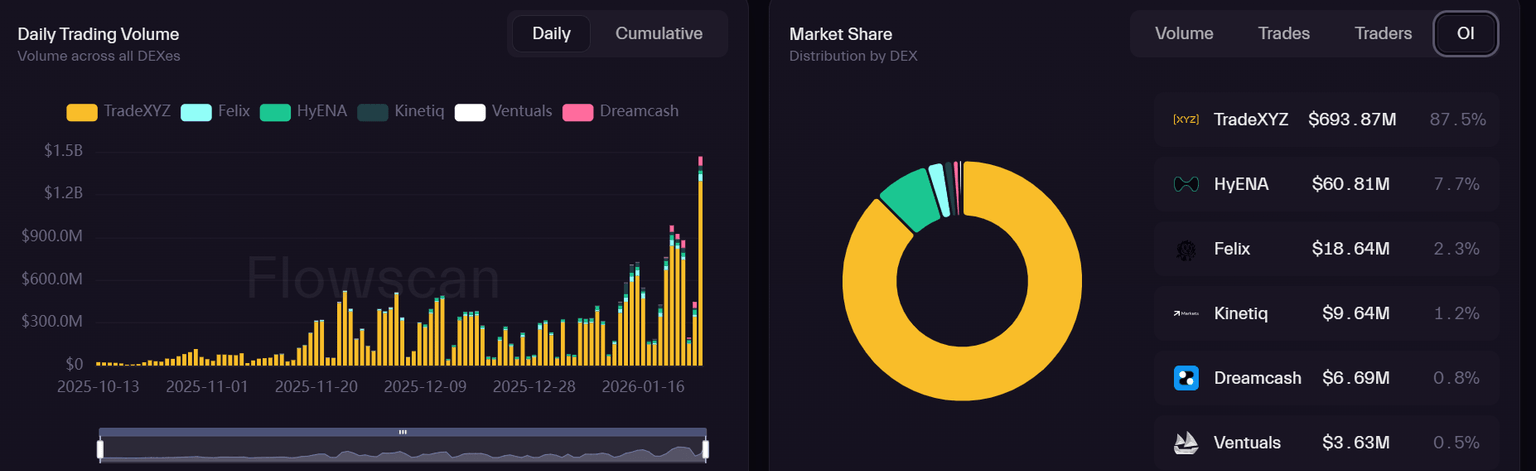

A majority of the open interest and trading volume growth on HIP-3 stems from the platform TradeXYZ, which enables commodities and equities trading. According to Flowscan data, the platform recorded a daily trading volume of $1.29 billion over the past 24 hours, with open interest at $693.8 million at the time of publication.

HYPE clears 20-day EMA and key descending trendline

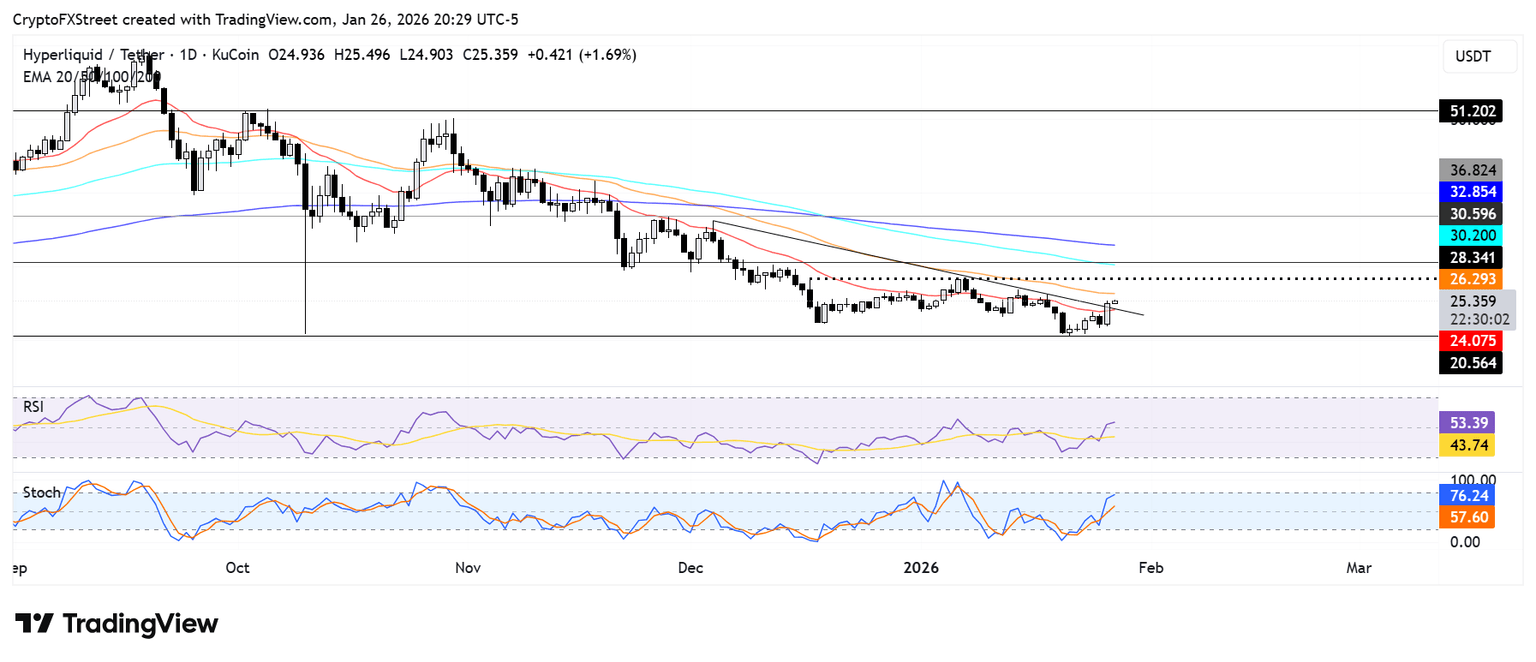

HYPE is up nearly 13% over the past 24 hours, rising above the 20-day Exponential Moving Average (EMA) and a descending trendline extending from December 4.

HYPE could test the resistance at $28 if it flips the 50-day EMA. However, a rejection could see it find support near the 20-day EMA.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are above their neutral levels, indicating a dominant bullish momentum.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi