Huobi Token Price Analysis: HT doomed unless it regains $4

- Huobi Token crashed following the rumors that Huobi's COO is under investigation.

- HT/USDT moves below the critical level, darkens the technical picture for the coin.

Huobi Token had a tough start of the week. The famous Chinese cryptocurrency reporter, Colin Wu, spooled the market players with the speculations that the Chief Operating Officer of Huobi, Zhu Jiawei, was allegedly under investigation.

Breaking: Wu confirmed from multiple sources that Huobi COO Zhu Jiawei is under police investigation. He is the number two player in Huobi. Huobi is the exchange with most Chinese users and the largest Bitcoin stock in the world. Li Lin, the founder of Huobi, is unknown.

However, Zhu Jiawei was not considered a key figure in the company; thus, the trading platform continued operating as usual, despite Zhu Jiawei woes.

Notably, the exchange downplayed the allegations, saying that the rumours about the COO arrests were false. The exchange did not stop the withdrawals and claimed that all customer funds are safe.

Huobi Global Is Operating Normally

We have become aware of rumors within our community about the arrest of a Huobi senior executive by local officials. We can share with confidence that these rumors are false.

— Huobi (@HuobiGlobal) November 2, 2020

However, the harm was already done. Considering that Huobi is one of the most popular cryptocurrency exchanges in China with the largest stock of Bitcoins, the news caused panic on the market and triggered massive Bitcoins outflow. Huobi's native token dropped like a stone, losing over 10% in a matter of hours.

Traders panic and take money from Huobi

At the time of writing, Huobi Token (HT) is changing hands at $3.56. The token has lost over 2% on a day-to-day basis and over 17% on a week-to-week basis. Currently, HT sits at 26th place in the global cryptocurrency market rating, with a current market value of $736 million and an average daily trading volume of $136 million. It is most actively traded on Huobi, Xtheta Global, BitZ, and CoinBene.

Huobi users can spend HT on monthly VIP status plans that provide some privileges, including transaction fee discounts and early access to Huobi events.

Huobi Token hit the local bottom

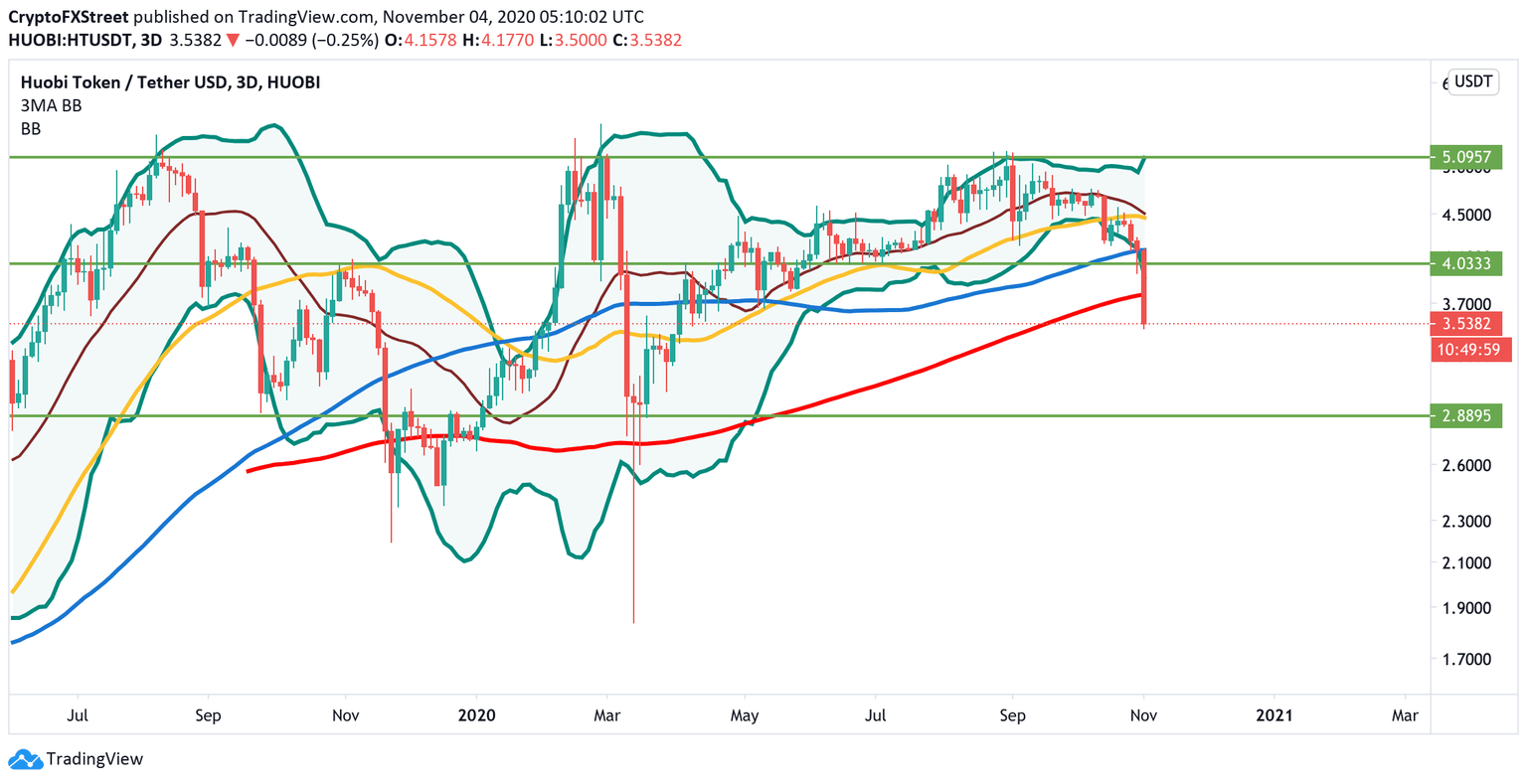

From the technical point of view, HT/USDT retested $3.5, the lowest levels since the beginning of April. The sharp sell-off below the pivotal $4 has increased the bearish pressure and pushed the token's price to the oversold territory on the long-term charts.

Such technical level is reinforced by the lower band of the 3-day Bollinger Band and long-term support that stopped the sell-off on numerous occasions during the summer months. A failure to get back soon will open up the way towards the next critical bearish target of $2.8 that turned into a jumping-off ground for the coin after the March sell-off.

HT/USDT: 3-day chart

Meanwhile, once the recovery starts, HT/USDT bulls will face the local barrier on approach to $3.7 created by EMA200. Once it is out of the way, the upside is likely to gain traction with the next focus on the above-said psychological $4, followed by a combination of EMA50 and the middle line of the Bollinger Band on approach to $4.5. A sustainable move above this area will improve the technical picture and signal that the worst is over for HT/USDT. The next target is created by the long-term resistance of $5.

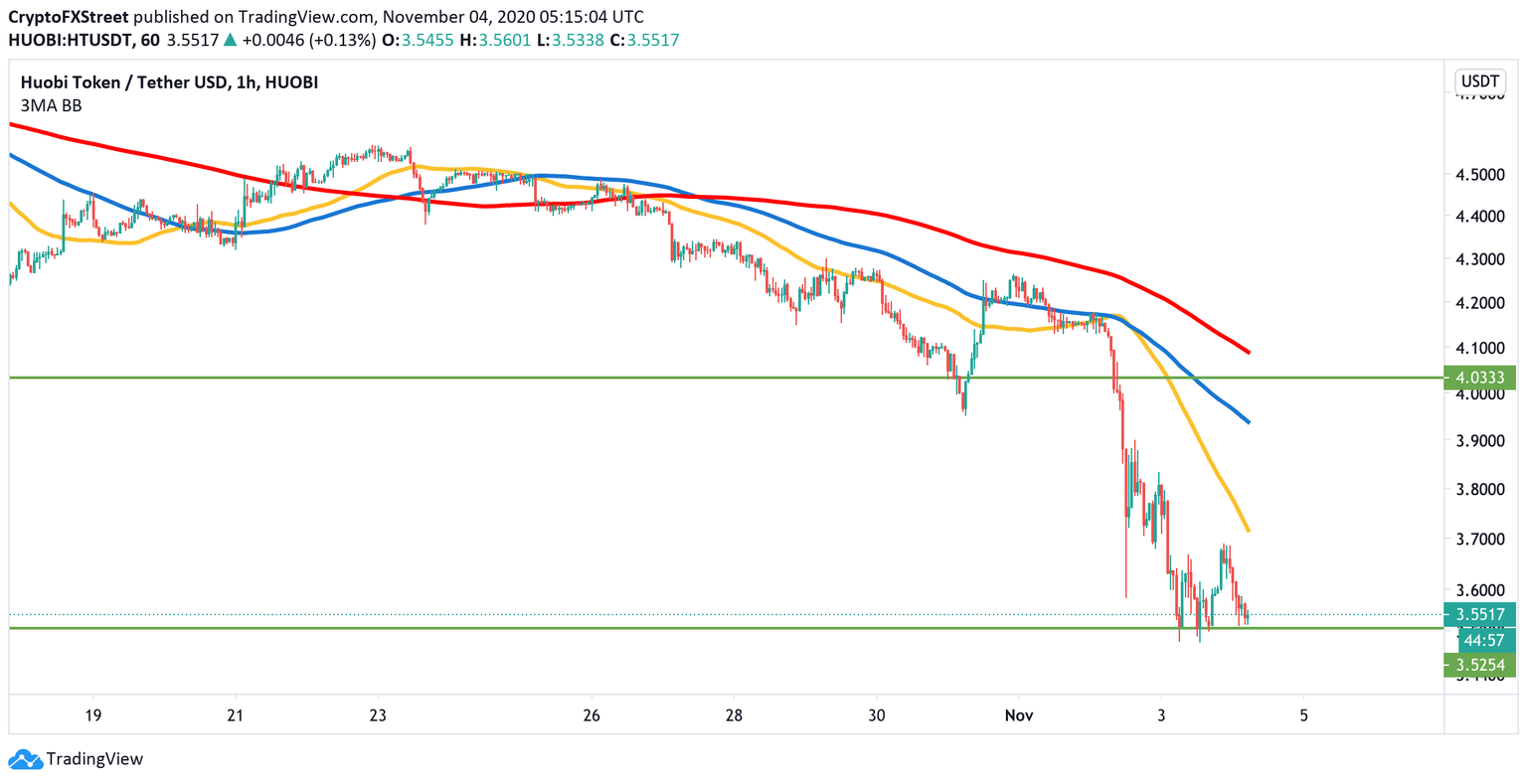

HT/USDT: 1-hour chart

If we zoom in to the intraday charts, HT/USD seems to have bottomed out at $3.5. However, further recovery is limited by 1-hour EMA50 at $3.7, which coincides with the above-mentioned resistance created by EMA200 on the 3-day chart. Once this barrier is cleared, the upside momentum may gain traction with the next focus on 1-hour EMA100 at $3.9, followed by the pivotal $4.

Author

Tanya Abrosimova

Independent Analyst