How will Dogecoin price react to Elon Musk investigating the US SEC?

- Dogecoin price hit $0.25 on Tuesday, plunging 10% in 48 hours.

- The market dip has coincided with regulatory squabbles between Elon Musk-led D.O.G.E and the US SEC.

- Rising trading volumes, a $21.6 million long leverage cluster, and the parabolic technical indicator align for an early DOGE price rebound.

Dogecoin price hit $0.25 on Tuesday, plunging 10% in 48 hours as the market reacted to regulatory squabbles between Elon Musk-led D.O.G.E and the US SEC. Despite the decline, three crucial trading indicators suggest DOGE could be setting up for an early rebound.

How Musk's clash with the US SEC impacts Dogecoin price, three indicators to watch

On Monday, the Elon Musk-led Department of Government Efficiency (D.O.G.E) announced an official investigation into the financial records of the US Securities and Exchange Commission (SEC), sparking intense volatility across crypto markets.

Elon Musk-led Department of Government Efficiency (D.O.G.E) announced an official investigation into US SEC, Feb 18 2025

Dogecoin price action has increasingly aligned with broader political and regulatory narratives. Elon Musk’s influence over the token has intensified, particularly after the Trump administration acknowledged the Dogecoin community during the Republican electoral campaigns.

This connection was further reinforced when Trump officials announced the creation of the D.O.G.E on January 21, positioning Musk at the helm of a federal oversight agency.

The D.O.G.E investigation has escalated tensions, particularly after the agency cited unauthorized use of funds allocated to USAID last week.

While the regulatory battle may not directly impact Dogecoin’s community or network fundamentals, the prolonged legal dispute could delay critical administrative approvals, including the much-anticipated DOGE spot ETF.

Market participants closely tracking regulatory greenlights for altcoin ETFs now weigh the risk of bureaucratic roadblocks.

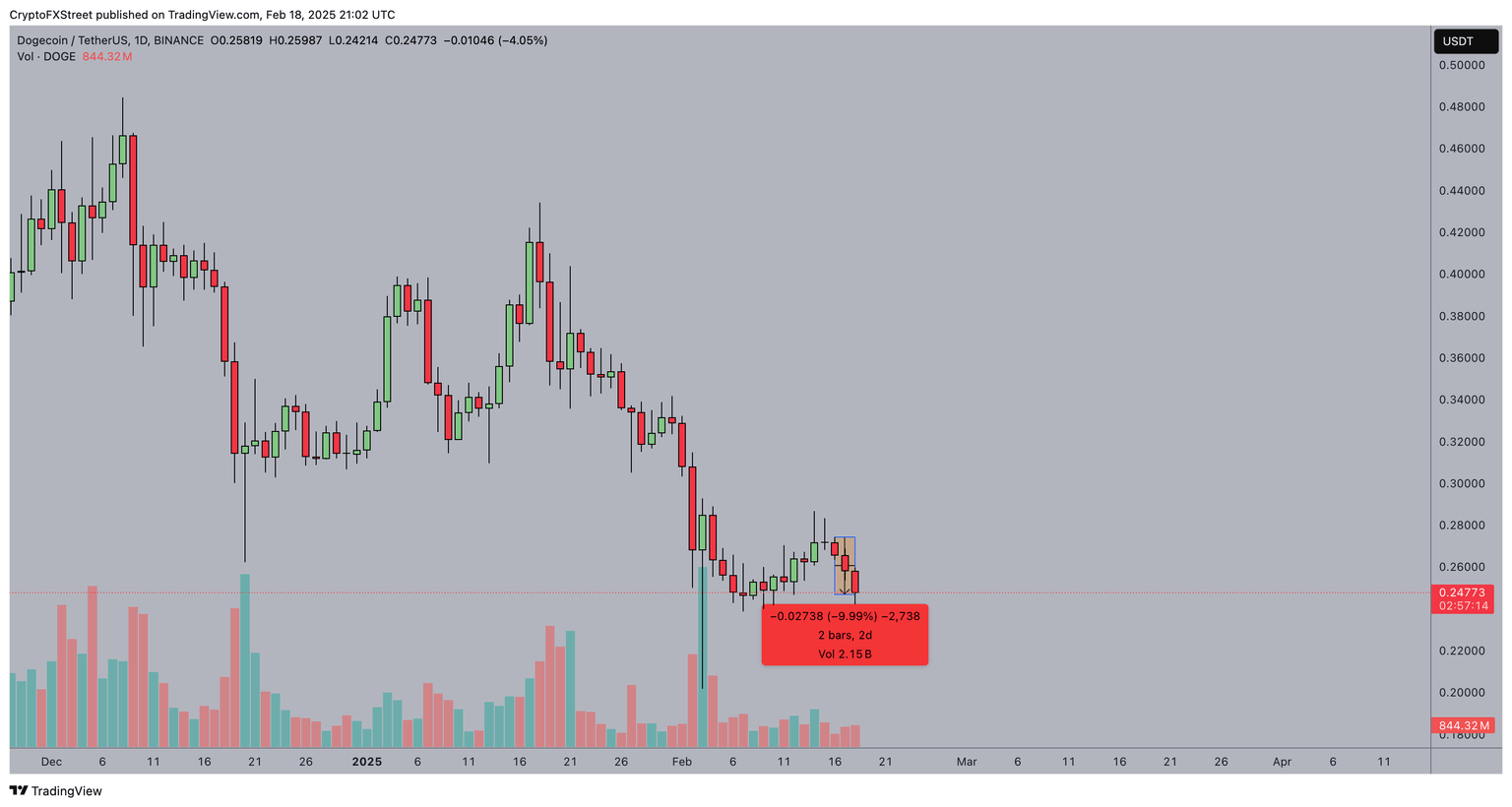

DOGE trading volume signals rising demand after $0.25 breakdown

Last week, Dogecoin received a major boost when the SEC acknowledged the DOGE and XRP spot ETF filings.

However, the rally was short-lived, as profit-taking accelerated once DOGE surpassed $0.30 on February 14. The sell-off deepened following Musk’s announcement that the Department of Government Efficiency had initiated an investigation into the SEC’s financial dealings.

Dogecoin Price Analysis | DOGEUSDT | Feb 18, 2025

The DOGE/USDT daily chart reflects a sharp decline, with Dogecoin breaking below $0.25 for the first time in eight days.

This 10% drop highlights investor nervousness regarding the ongoing regulatory tensions.

However, rising trading volumes suggest that speculative traders are buying the dip.

Historical trends indicate that high-profile events such as Musk’s regulatory battles tend to trigger intense market volatility, attracting short-term swing traders and price speculators.

Should this trend persist, Dogecoin may find strong buy-side momentum in the coming sessions.

Bulls mount $32 million in leverage at $0.24 support level

As evidenced by the 10% downswing in the last 48 hours, the majority of Dogecoin traders have adopted a cautious stance amid the ongoing D.O.G.E probe into the SEC.

However, derivatives trading data suggests that bullish traders are making concerted efforts to defend the $0.24 support level.

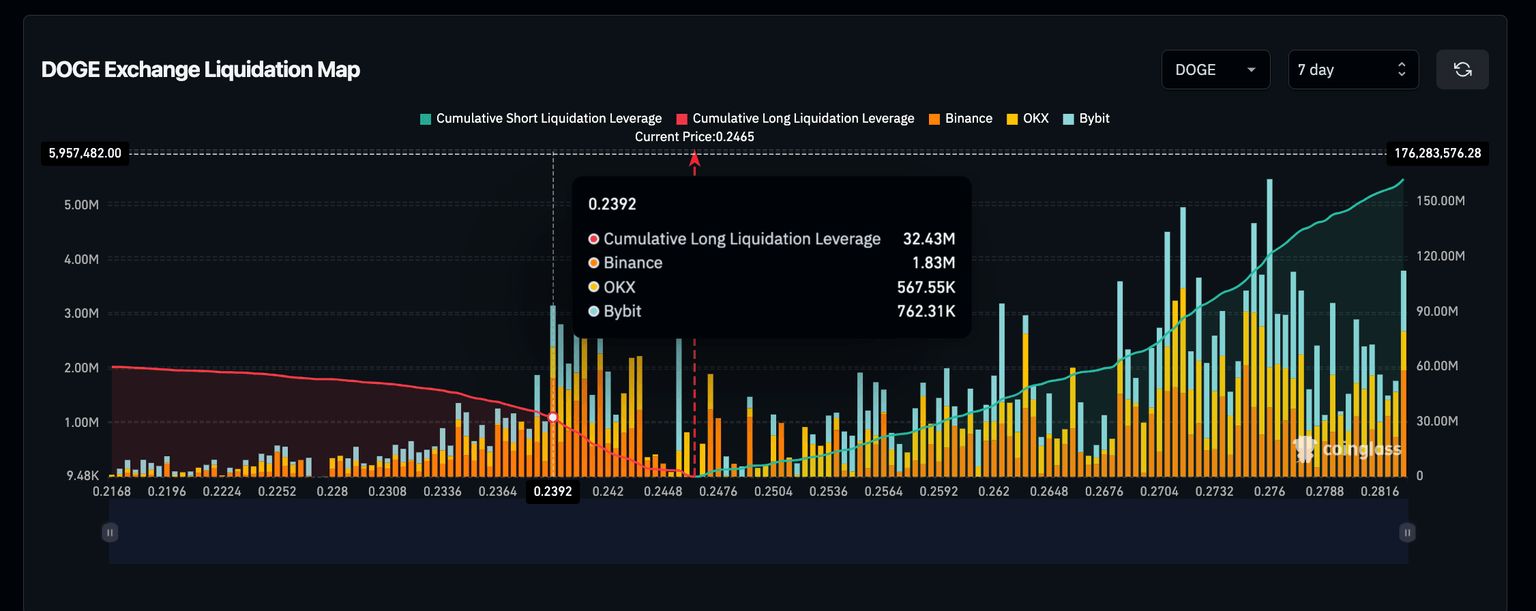

Dogecoin Liquidation Map | Source: Coinglass

The Coinglass liquidation chart, which tracks leveraged DOGE trade positions over the past week, provides key insights into potential support and resistance levels.

A glance at the chart reveals that the majority of leveraged DOGE futures contracts opened recently have been short positions, with total active positions exceeding $151.2 million.

Short trades currently dwarf long positions of $59.9 million, reflecting an 80% skew in favor of bearish sentiment.

However, a closer look at the data reveals a significant $32.4 million leverage cluster at the $0.24 price level, representing over 52% of total long contracts.

This suggests that bullish traders have concentrated efforts around this critical support zone.

If DOGE price breaches this level, traders holding these positions stand to incur significant losses.

Consequently, buy-side support could strengthen in the coming days as traders either reinforce positions or attempt to cover losses.

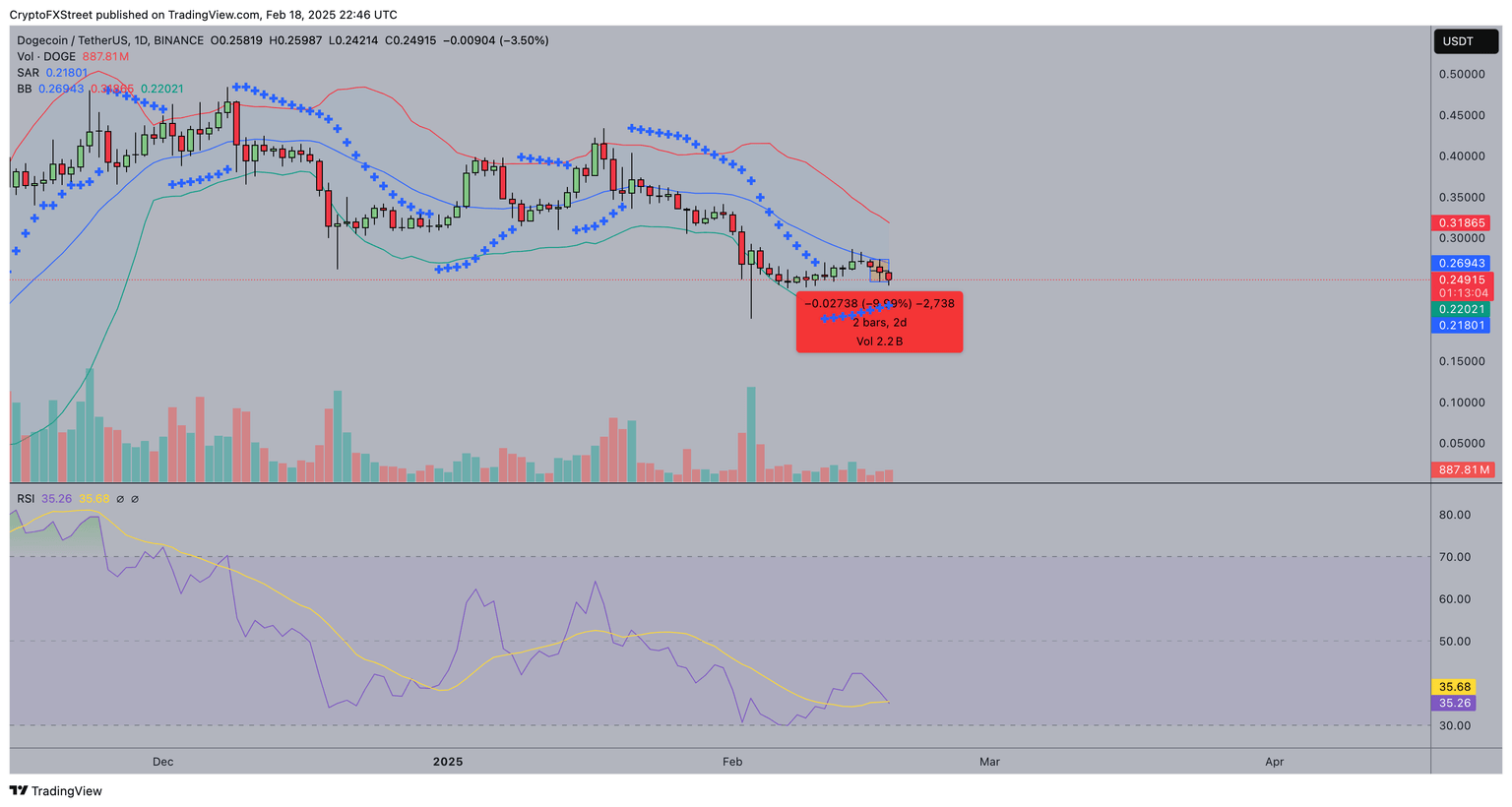

Dogecoin Price Forecast: Bulls to hold $0.24 if market sell-off subsides

With a volatile mix of regulatory uncertainty, growing speculative demand, and leveraged positioning, Dogecoin’s near-term price trajectory remains relatively neutral.

Dogecoin technical indicators also affirm this stance, with the parabolic technical indicator confirming strong support above $0.22 as mid-line Bollinger Band hints at major resistance at the $0.27 20-day SMA.

If rising trading volume and clustered bullish leverage support persist and nullify bearish sentiment from Elon Musk’s squabble with the SEC,

Dogecoin price could be setting up for a prolonged consolidation phase in the middle of the two key support levels, around the $0.25 psychological price level.

The daily chart shows DOGE price trading at $0.25, posting a 3.71% decline, while Bollinger Bands are contracting, signaling lower volatility ahead.

More so, DOGE price is currently hovering near the mid-line support of $0.22, which aligns with the lower Bollinger Band, reinforcing this level as a critical demand zone.

Dogecoin Price Forecast

If bulls maintain control at $0.24, a move toward $0.27, the 20-day simple moving average, remains plausible.

However, bearish signals persist. The Parabolic SAR indicators continue to place resistance above current price levels, suggesting downward momentum is yet to subside. The RSI at 35.11 indicates oversold conditions, hinting at a potential relief bounce.

But if DOGE loses the $0.24 support, sellers could push prices toward the $0.22 lower band, potentially triggering further liquidations and deepening the correction.

While Musk’s clash with the SEC may introduce further turbulence, the underlying technical indicators suggest that DOGE could stage a rebound if bulls successfully defend key support levels.

Investors will be watching closely as market conditions evolve.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.