How much power does Ethereum (ETH) need to get to the $1,500 mark?

The market has turned back to green as all of the top 10 coins are again under bullish influence. The biggest gainer is Bitcoin (BTC), whose rate has rocketed by more than 7%.

Top 10 coins by CoinMarketCap

Meanwhile, the market capitalization index has come back above the $1 trillion mark.

Cryptocurrency market capitalization

The relevant data for Ethereum today

-

Name: Ethereum.

-

Ticker: ETH.

-

Market Cap: $160,836,127,099.

-

Price: $1,405.94.

-

Volume (24h): $45,744,814,623.

-

Change (24h): 5.92%.

The data is relevant at press time.

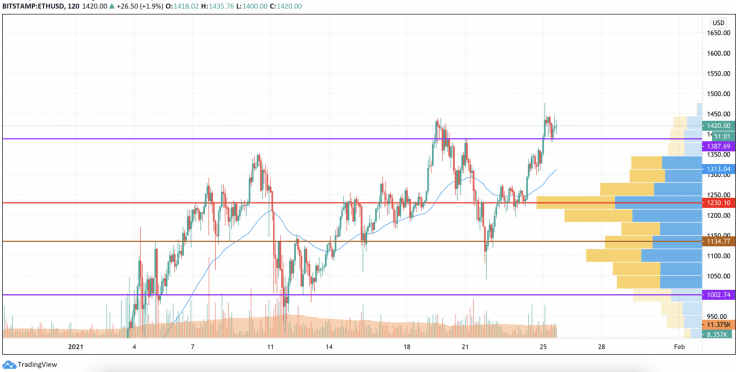

ETH/USD: Can Ethereum keep rising after setting the all-time high?

Last Saturday, the Ethereum (ETH) price consolidated in the area of average prices. On Sunday night, buyers managed to form a bullish impulse, which restored the Ether price to the resistance area of $1,350. The bulls broke through this level tonight, renewing the all-time high at $1,476.

ETH/USD chart by TradingView

Ethereum (ETH) has managed to gain a foothold in the high zone, which means that the bullish run may continue to the area of $1,530. If in the zone of the maximum, the volumes of sales begin to grow, then the price will return to the support of $1,250.

ETH/USD chart by TradingView

On the bigger chart, Ethereum (ETH) might face a correction as the market share of Bitcoin (BTC) is about to rise in the short-term scenario. This will affect the growth of the altcoins market.

At the same time, the second most popular crypto can drop to the closest support at $1,364.

On the weekly time frame, Ethereum (ETH) has firmly fixed above the $1,400 mark; however, there is a high chance of seeing a restest of the mirror level at around $1,300 to gain more liquidity for further growth.

Ethereum is trading at $1,425 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.