How long can Polygon bulls keep up? Is MATIC price a buy now?

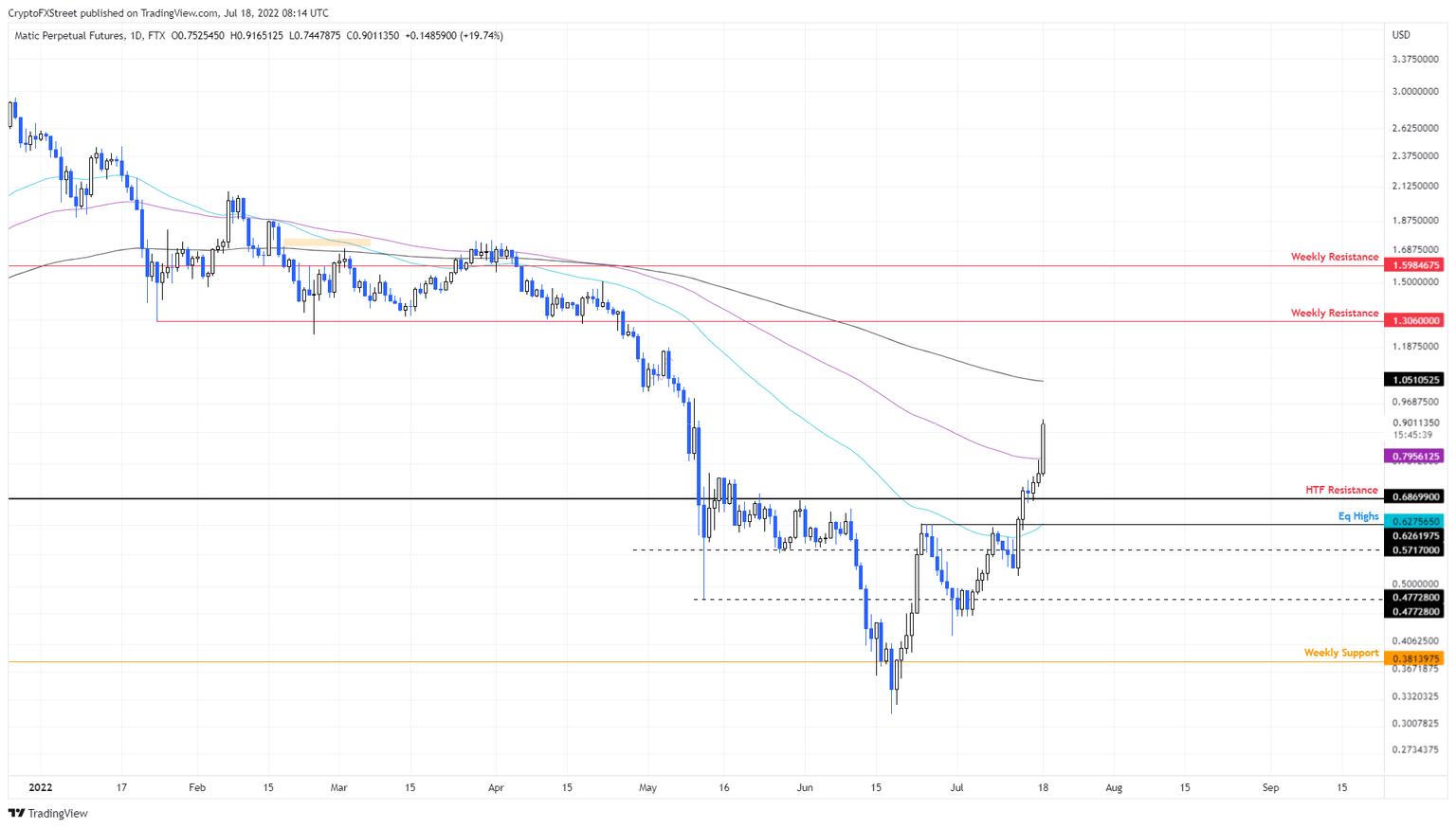

- MATIC price has overcome the 50-day and the 100-day EMA, indicating a full-blown bullish momentum.

- Only two major hurdles stand against Polygon bulls, the 200-day EMA at $1.05 and the weekly resistance barrier at $1.30.

- A daily candlestick close below $0.68 will invalidate the bullish thesis.

MATIC price has been in an uptrend since July 13 and is close to doubling. It is close to facing two significant barriers that risk bringing the move to a halt. A flip of the immediate hurdle will indicate a continuation higher, but a breakdown of a horizontal support level will invalidate the bullish thesis.

MATIC price and its momentum

MATIC price recovery has been uncontested compared to other altcoins. After bouncing 110% between June 18 and June 24, Polygon met a resistance barrier at $0.62. After a brief consolidation, however, this blockade was overcome.

Since July 13, MATIC price has risen another 76% and shows no signs of stopping as it recently sliced through the 100-day Exponential Moving Average (EMA) at $0.79.

If bullish momentum continues to rise, flipping the 200-day EMA at $1.05 into a support level, there is a good chance MATIC price will retest the $1.30 hurdle. In total, this move would constitute a 44% ascent from the current position at $0.90.

The only way to tell if MATIC price will continue to rise is by watching Bitcoin. If BTC price continues to rise and overcomes the 200-week Simple Moving Average (SMA) at $22,559, other altcoins, including Polygon, will likewise continue to rise.

If Bitcoin price crashes, however, other altcoins could face a similar fate and retrace violently as investors start to book profits.

MATIC/USDT 4-hour chart

While MATIC price shows a massively bullish outlook, investors should be aware that trends exhaust. If holders start to book profits, a retracement seems plausible. The bullish thesis will face invalidation if this pullback produces a daily candlestick close below $0.68.

In such a case, MATIC price could revisit the $0.62 and $0.51 support levels.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.