How good are Ethereum's (ETH) chances to keep the growth going against Bitcoin (BTC)?

The new week has begun with a neutral mood on the cryptocurrency market as some coins are in the red zone while others remain in the green.

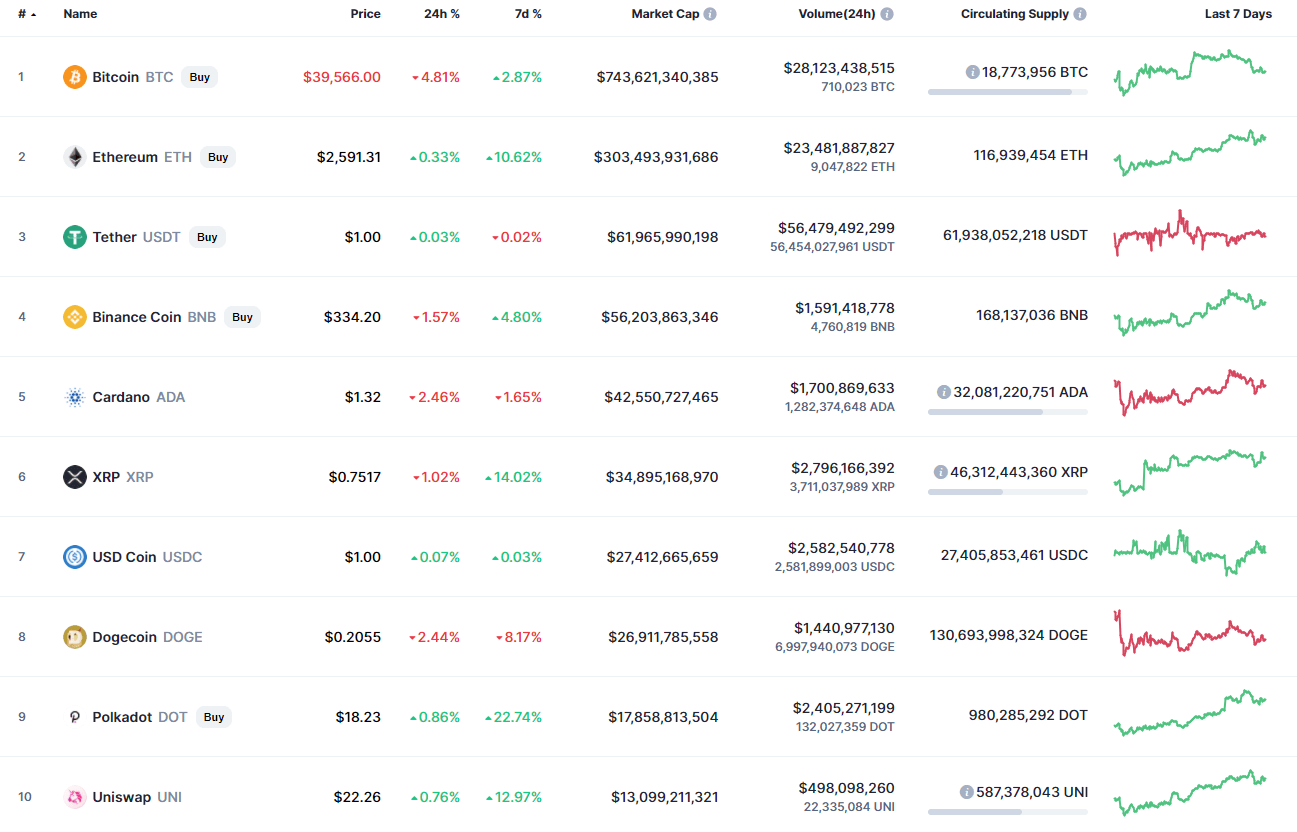

Top coins by CoinMarketCap

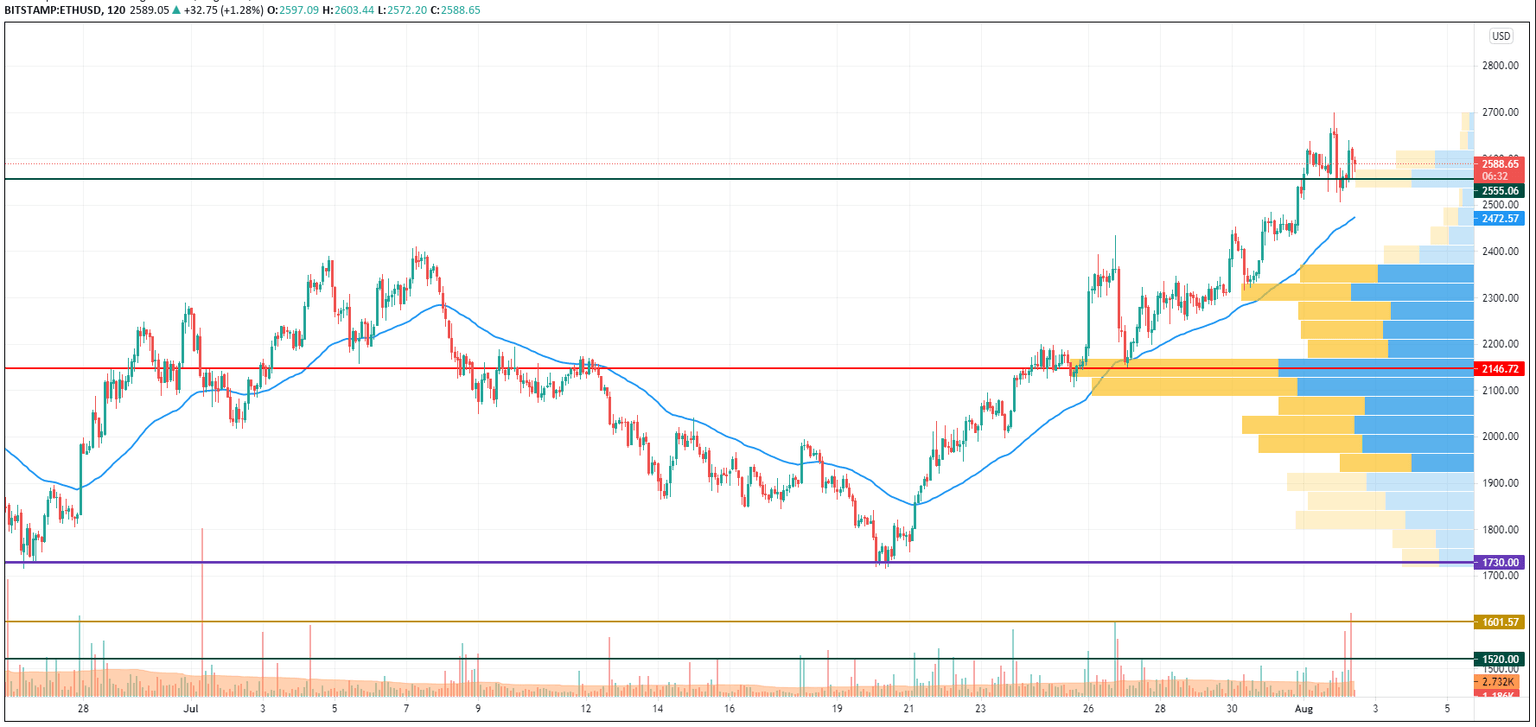

ETH/USD

Last Saturday, buyers were able to pull the ETH/USD pair out of short-term consolidation and break above the $2,500 resistance.

ETH/USD chart by TradingView

On Sunday, the bulls ran to the resistance of $2,700, but no one wanted to buy Ethereum and the price returned to the area of $2,500. The decline has stopped, but the volume of purchases is not increasing.

One may believes that, today, the rollback may continue to the two-hour moving average EMA55.

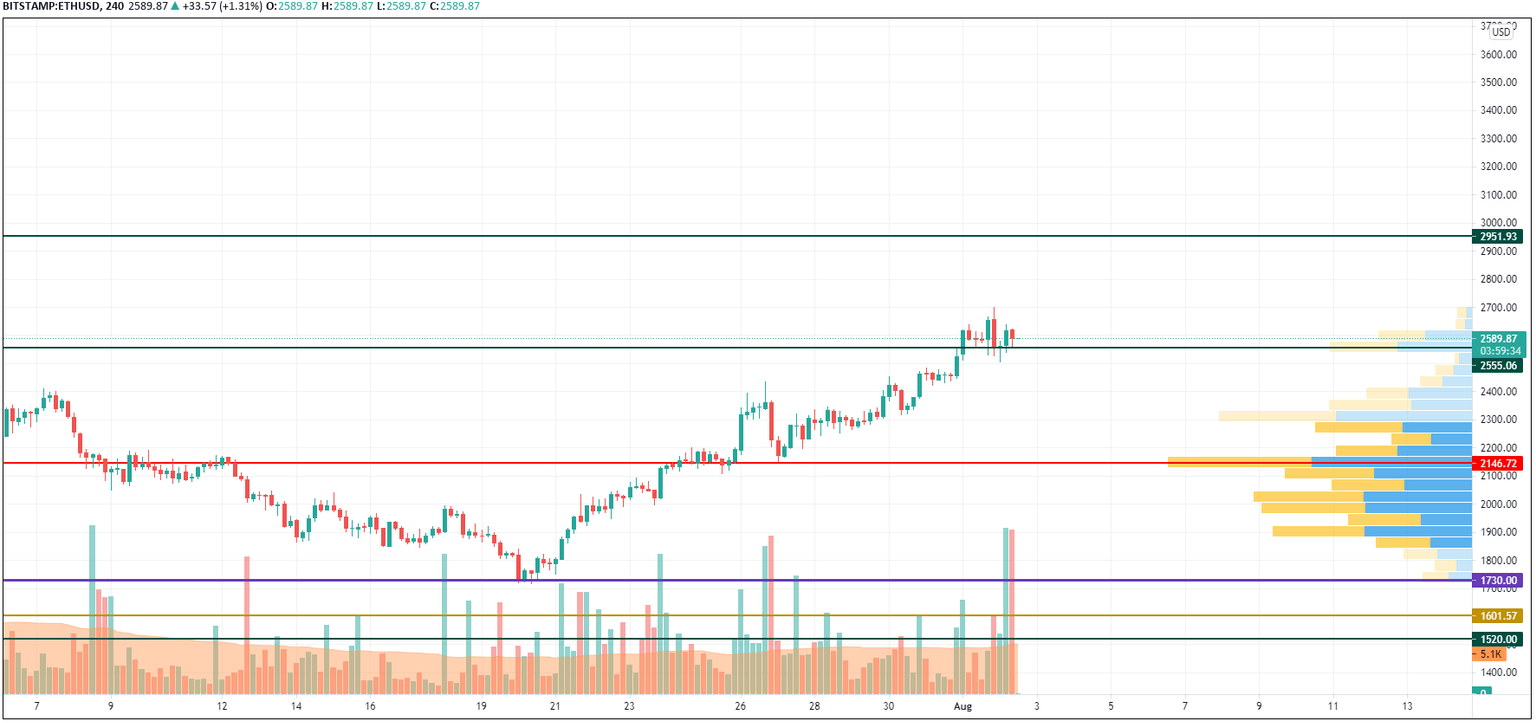

ETH/USD chart by TradingView

On the 4H chart, the leading altcoin is rather bullish than bearish as it has fixed above the vital level of $2,555. There are few chances that it will go below it as sellers have run out of power based on a high trading volume. In this case, the more likely price action is the ongoing rise to the nearest resistance at $2,950.

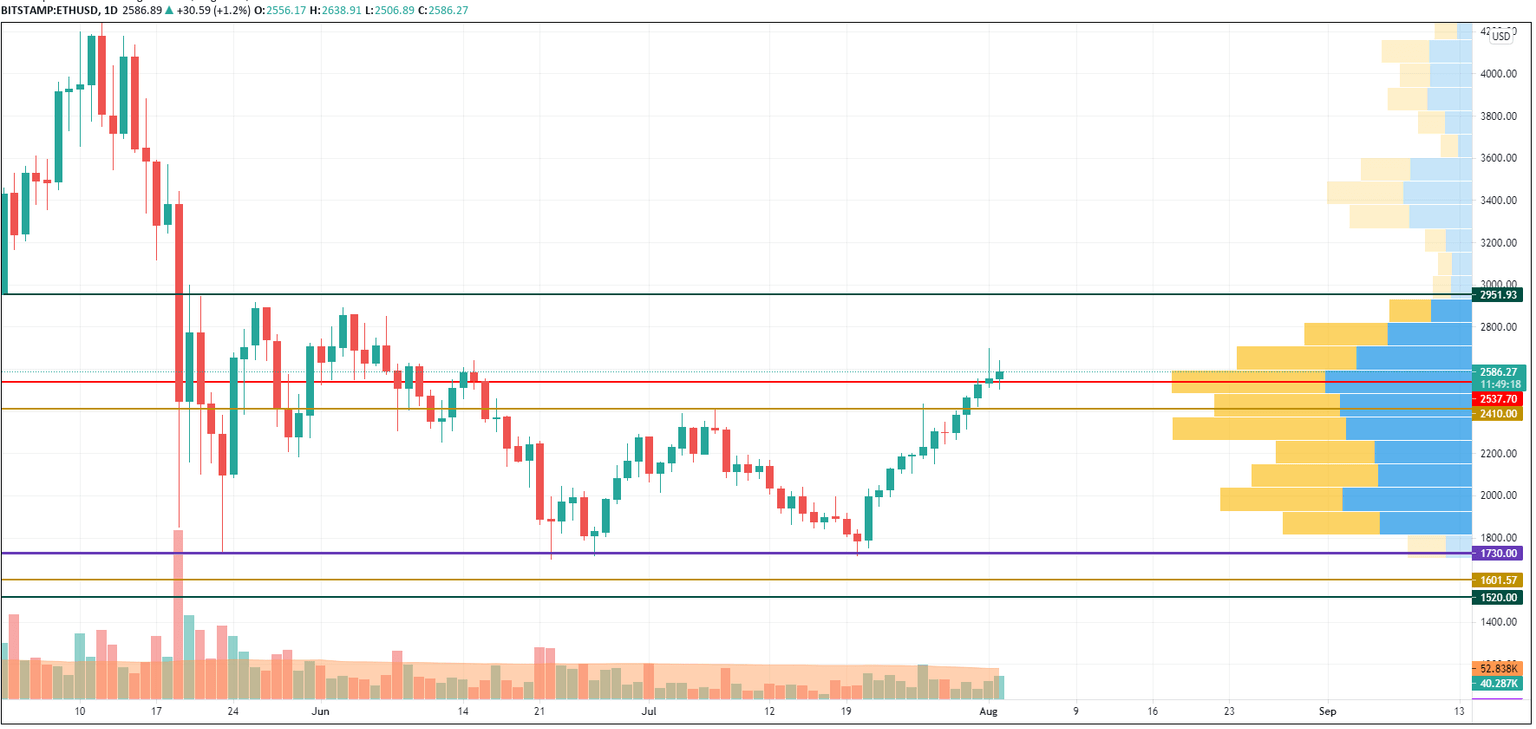

ETH/USD chart by TradingView

On the daily time frame, Ethereum (ETH) is trading in the zone of the most liquidity around $2,500. Even though the mid-term trend remains bullish, buyers need to gain more energy for continued growth. In this regard, the test of the recently formed mirror level may happen within the next few days. One may expect a bounceback from the $2,400 mark.

Ethereum is trading at $2,569 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.