Here's why Cardano price faces an uphill battle to $1.60

- Cardano price shows promise of an uptrend to $1.26 but its path is sprinkled with significant hurdles.

- A decisive daily candlestick close above $1.35 could trigger a move to $1.60.

- A daily candlestick close below $1 will invalidate the bullish thesis for ADA.

Cardano price has worsened its situation over the past two days and is now trading below a significant level. While recovery is bullish, no doubt, its destination is far away and contains hurdles at every step.

Cardano price goes against the wind

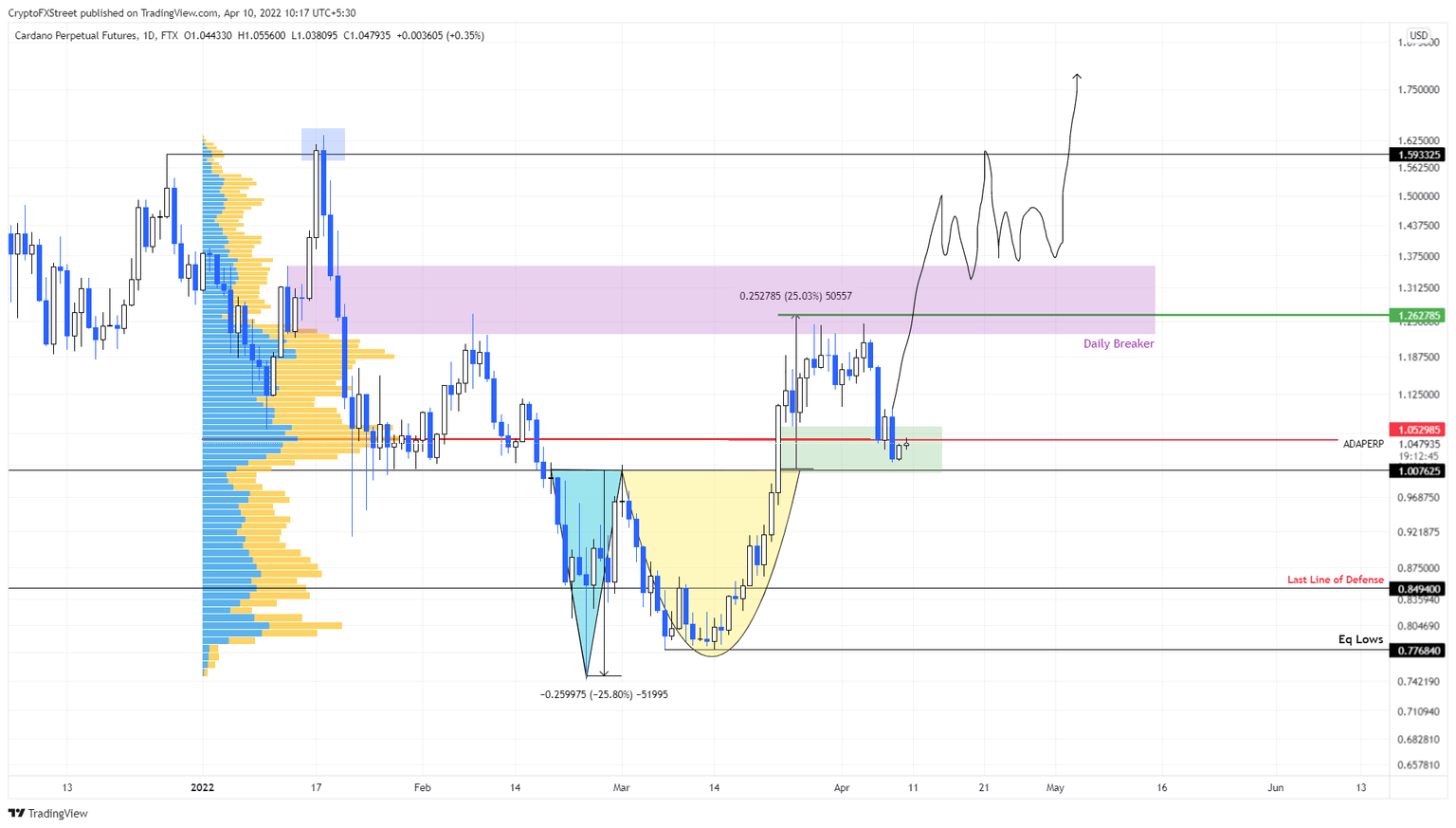

Cardano price action from February 19 to March 23 created a bottom reversal pattern known as Adam and Eve. This technical formation contains a V-shaped valley known as “Adam” followed by a rounded bottom referred to as “Eve”.

A breakout from this pattern indicates a trend change favoring the bulls and forecasts a 25% upswing to $1.26. This target is determined by adding the valley’s depth to the breakout point at $1.

Despite an excellent breakout from the $1 psychological level on March 23, Cardano price failed to tag the forecasted target at $1.26 since it fell short of momentum. Additionally, ADA reversed the trend, retracing to the 2022 volume point of control at $1.05.

Due to the massive volume traded at $1.05, it served as a support for some time, but ADA eventually broke below this and is currently trying to overcome it.

A successful recovery above $1.05 could trigger a run-up to its destination at $1.26. During its second attempt, ADA might try to invalidate the bearish breaker that extends from $1.22 to $1.35 by pushing through it and producing a decisive close above $1.35. However, if the so-called Ethereum-killer can clear the said hurdle, it would open the path for Cardano price to retest the $1.60 hurdle.

ADA/USDT 1-day chart

A daily candlestick close below $1 will produce a lower low and invalidates the Adam and Eve pattern. In such a case, Cardano price could see drowning to 0.85, which is the last life of defense for the smart contract token.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.