Can Cardano price rally to $1.6 after major strategic partnership

- Cardano price looks ready for a 16% ascent after bouncing off the 2022 volume point of control.

- A move beyond the $1.22 to $1.35 breaker will allow ADA to extend the run-up to $1.60.

- A daily candlestick close below $1 will invalidate the bullish thesis for the so-called “Ethereum-killer.”

Cardano price seems to have undone the gains made following its breakout on March 23 as BTC crashed in the last two days. However, this downswing is a blessing in disguise for interested investors as it offers ADA at a discount.

Moreover, Input Output Global’s Project Catalyst seems to have partnered with Ariob, an Africa-focused incubator. The blog detailing this collaboration stated,

This strategic partnership is designed to enhance the growth of projects funded by Project Catalyst, Cardano’s innovation engine, and offers high potential Catalyst start-ups access to venture-building expertise and resources to help develop products that solve real-life challenges in Africa.

Cardano price prepares for a lift-off

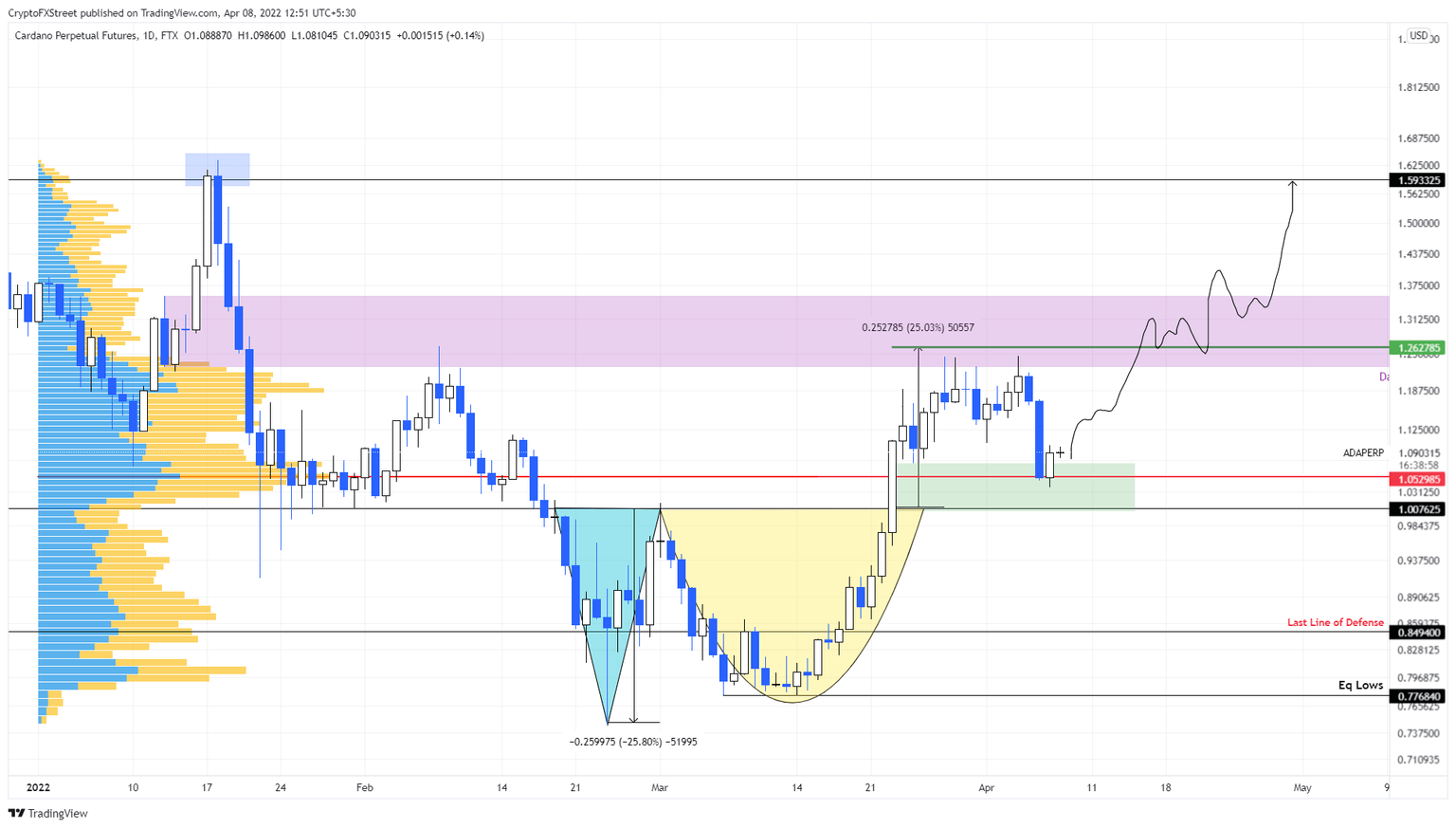

Cardano price set up an Adam and Eve pattern due to its moves from February 19 to March 23. The V-shaped valley is known as “Adam,” which is followed by a rounded bottom formation referred to as “Eve”. This formation is a bottom reversal pattern that forecasts a 25% upswing to $1.26, obtained by adding the depth of the valley to the breakout point at $1.

Although ADA breached the $1 psychological level on March 23, it failed to reach the forecasted target at $1.26. Furthermore, it reversed the trend, allowing ADA to retrace to the volume point of control at $1.05.

This down move is a perfect opportunity for long-term holders to accumulate. Since tagging point of control, ADA has seen quite a bit of buying pressure come in, pushing it up by 5%.

Going forward, market participants can expect Cardano price to eventually reach its destination at $1.26. Interestingly, this target is present inside a bearish breaker that extends from $1.22 to $1.35, suggesting a move above the barrier will be a hard-going, tedious task.

However, clearing the said hurdle could lead to gains that push Cardano price to $1.60.

ADA/USDT 1-day chart

Regardless of the optimism around ADA, a reversal in trend for the big crypto could ruin the perfect setups on altcoins including Cardano. In such a case, a daily candlestick close below $1 will produce a lower low thus invalidating Adam and Eve’s bullish thesis for Cardano price.

This development could further trigger a correction for ADA that tags the $0.85 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.