Helium Price Forecast: Possible breakout from triangle pattern signals bullish outlook

- Helium broadly consolidates this week despite an increase in mobile signups to a new high.

- HNT open interest recovers, reflecting increased traders’ demand in the altcoin.

- The technical outlook puts Helium in a consolidation mode as it nears the apex of a triangle pattern.

Helium (HNT) trades at $4.121 at press time on Tuesday, consolidating in a triangle pattern this week and ignoring the record-high mobile signups over the same period. However, bulls anticipate a potential triangle patternbreakout, fueled by open interest recovery.

Helium nears triangle breakout

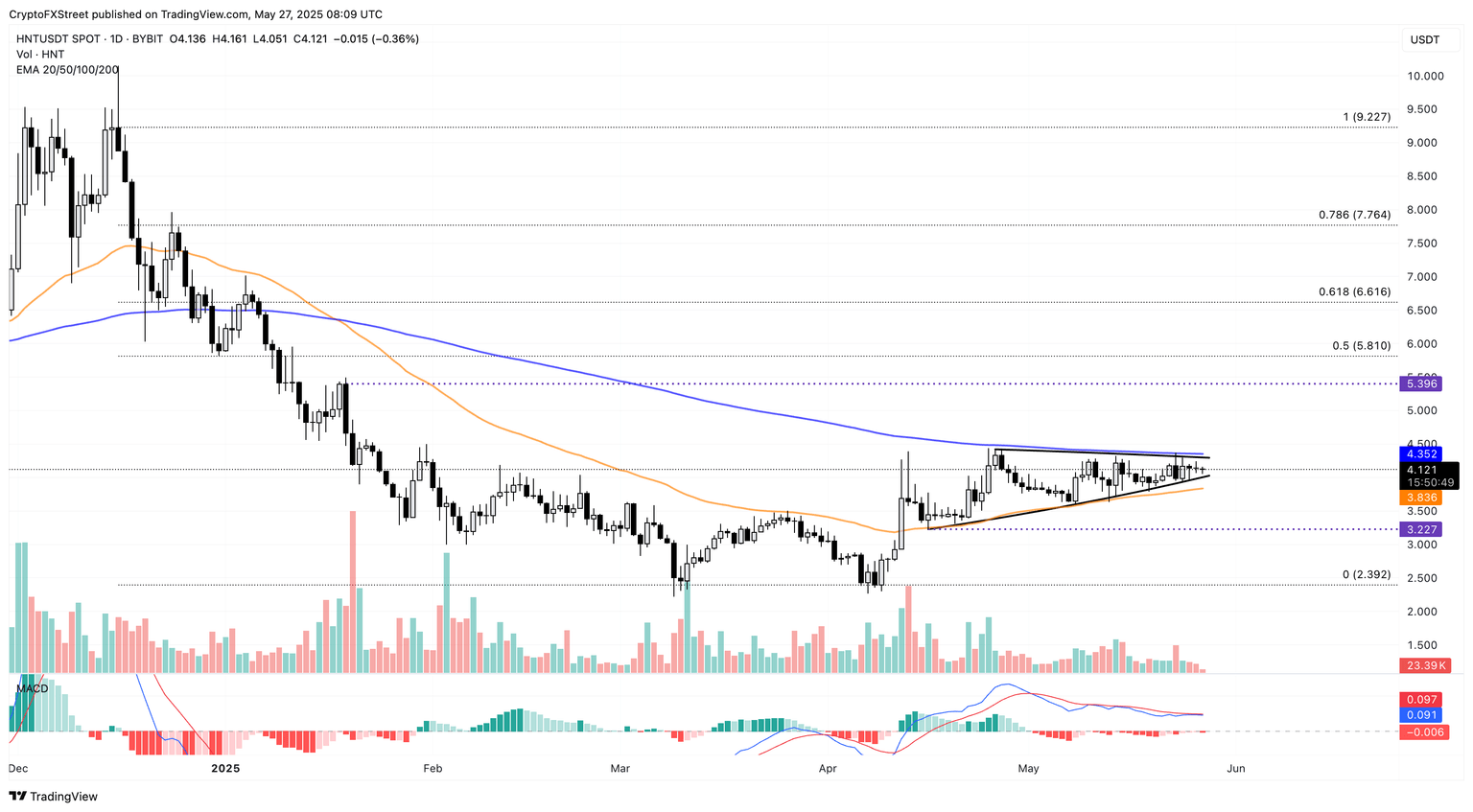

Helium holds above the $4 mark with a mild drop of 0.38% at the time of writing on Tuesday. Since April 16, HNT has consolidated between the 50-day and 200-day Exponential Moving Averages (EMAs).

The converging dynamic moving averages develop a triangle pattern on the daily chart below, with the altcoin nearing the apex. This signals a heightened possibility of a breakout continuation move to prolong the 81% rally recorded between $2.39 on April 9 opening and $4.33 on April 26 closing.

The Moving Average Convergence/Divergence (MACD) indicator and its signal line are on the verge of a bullish crossover, supporting the breakout possibility.

Helium must sustain a daily closing price above the 200-day EMA at $4.35 for a decisive triangle breakout. The breakout target extends to $5.81, aligning with the 50% Fibonacci retracement drawn from $9.22 on December 16 opening to $2.39 on April 8. However, a short-term struggle could be seen at $5.39, a peak formed on January 18.

HNT/USDT daily price chart. Source: Tradingview

On the other hand, a daily closing price under the 50-day EMA at $3.83 could extend the decline to the $3.22 support, highlighted by a low on April 16.

HNT derivatives witness increased bullishness

As Helium nears a triangle breakout, the derivatives market turns optimistic. According to Coinglass, the HNT open interest (OI) has increased to $6.69 million from $5.35 million in a week, suggesting a sharp increase in traders’ activity as it indicates that new money or more money is flowing into the market.

HNT futures open interest. Source: Coinglass

The rising OI-weighted funding rate to 0.0122% reflects a bullish inclination in the traders’ activity.

HNT OI-weighted funding rate. Source: Coinglass

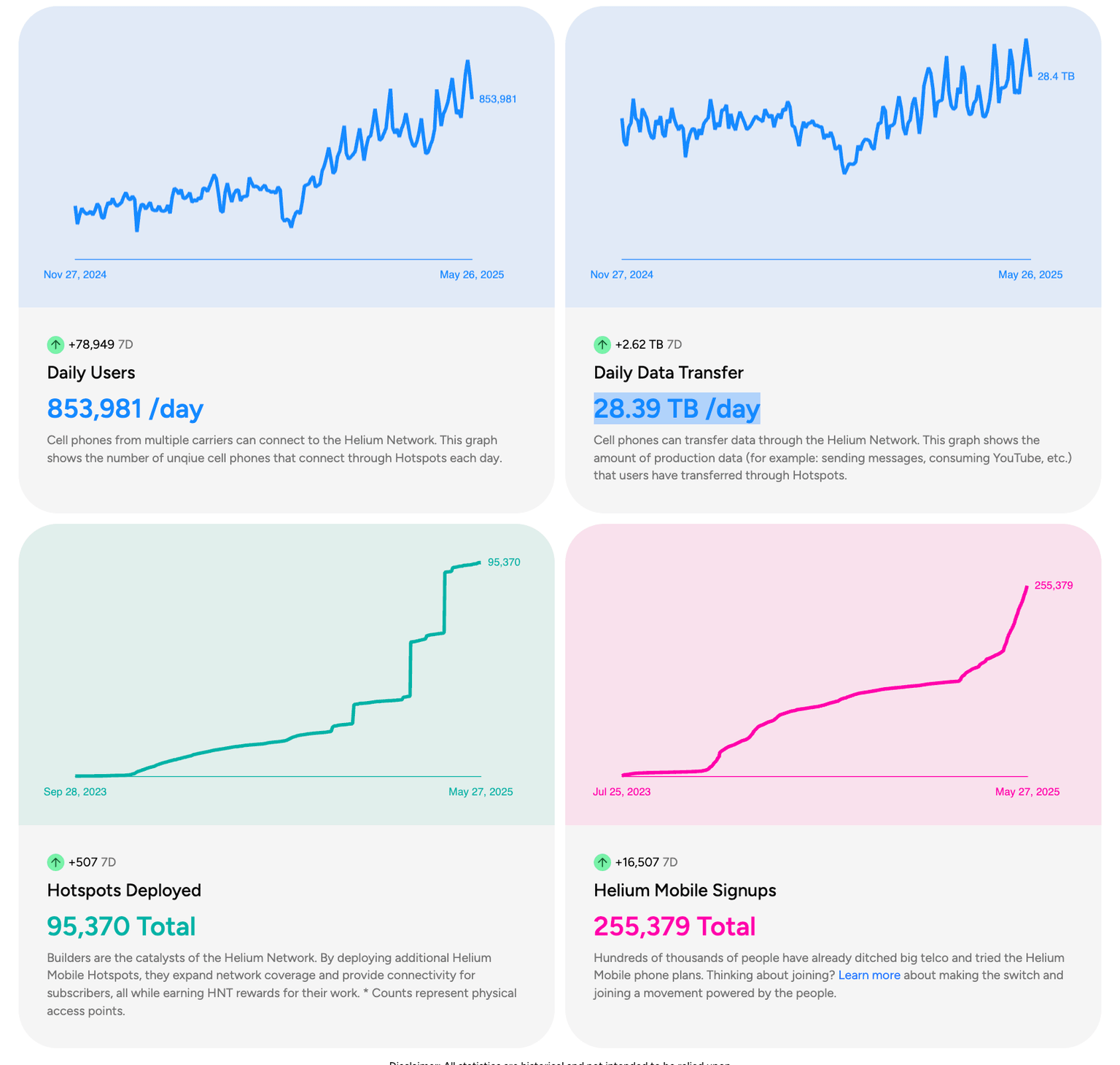

Helium mobile adds 16,507 signups in a week

Helium Mobile offers decentralized wireless carriers with affordable plans and rewards. Over the last week, the mobile signups have surged by 16,507 unique users, driving the total signups to 255,379, a new milestone.

Helium Mobile stats. Source: Helium World

Furthermore, the data from Helium Mobile stats showcase 853,981 daily users on Monday, with 78,9497 users added in the last week. These users hold cell phones connected to multiple carriers and transferred 28.39 TB of data on Monday through the Helium network.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.