Have most of the coins finished their correction before continued growth?

The new weekend has begun with an ongoing rise on the cryptocurrency market as all top 10 coins are in the green zone.

Top 10 coins by CoinMarketCap

BTC/USD

Last Saturday, the Bitcoin (BTC) price consolidated above the two-hour EMA55, and buyers tried to continue the pair's recovery. The trading volumes were below average, and the BTC price could not overcome the resistance in the area of $56,600. By the end of the week, it returned to the moving average EMA55.

BTC/USD chart by TradingView

If the pair holds above the level of average prices, then the recovery might continue to the resistance of $60,000.

If the bears push through the support of the two-hour moving average, then the price will retrace to the orange level of $53,400.

Bitcoin is trading at $58,116 at press time.

ETH/USD

Ethereum (ETH) is trading better than Bitcoin (BTC) as the chief crypto has increased by almost 5%.

ETH/USD chart by TradingView

On the daily chart, Ethereum (ETH) is testing the liquidity zone around $1,800. The selling volume is low at the moment, which means that bulls may get the rate of the altcoin to $1,950 soon.

Ethereum is trading at $1,770 at press time.

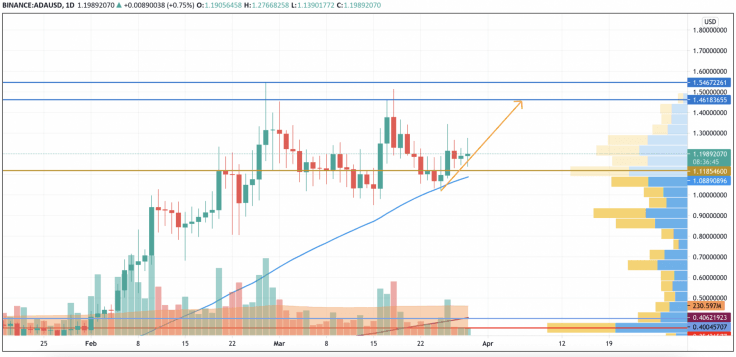

ADA/USD

Cardano (ADA) is also located in the green zone, rising by 1.93% since yesterday.

ADA/USD chart by TradingView

From the technical point of view, Cardano (ADA) is not as bullish as Ethereum (ETH) or Bitcoin (BTC). At the moment, the altcoin is accumulating power for a future rise. If bulls keep trading above the MA 50, the nearest resistance at $1.46 may be attained shortly.

Cardano is trading at $1.20 at press time.

KLAY/USD

KLAY is the top gainer from our list. It has risen by 13.20% over the last 24 hours.

KLAY/USD chart by TradingView

After a test of the $8 mark, the altcoin has begun to accumulate power for ongoing growth. The buying volume is increasing, which means that the rise is about to continue.

KLAY is trading at $3.91 at press time.

UNI/USD

Uniswap (UNI) is not an exception to the rule as the growth of the DeFi token totals 3.20%.

UNI/USD chart by TradingView

On the daily time frame, the asset is located in the sideways trend. At the moment, there are chances of seeing the rise reach the closest vital level at $30.25.

UNI is trading at $28.50 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.