Have coins declined enough to start returning to previous levels?

Neither bulls nor bears are dominating at the moment on the cryptocurrency market.

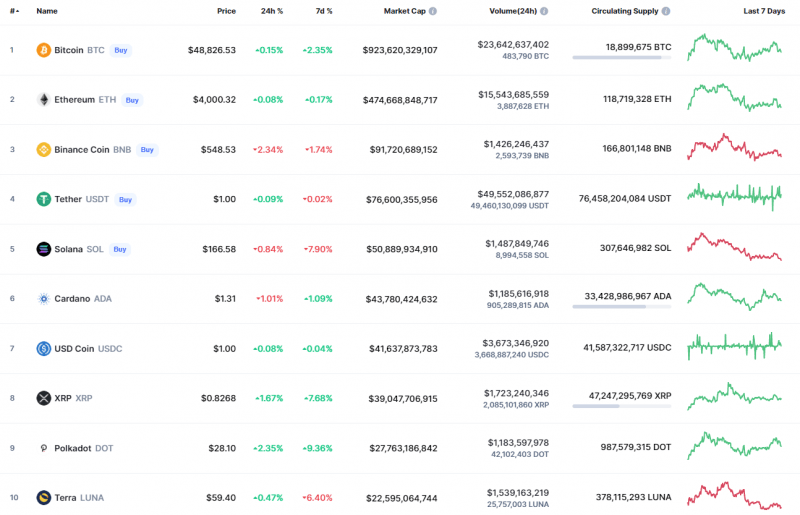

Top coins by CoinMarketCap

BTC/USD

The rate of Bitcoin (BTC) is almost unchanged since yesterday.

BTC/USD chart by TradingView

After the breakout of the purple level at $53,300, Bitcoin (BTC) is located in the wide channel where the nearest support is located at the level of $41,967.

If bulls cannot hold this area, there is a chance to see a sharp drop below the vital zone of $40,000.

Bitcoin is trading at $47,607 at press time.

ETH/USD

Over the weekend, the Ethereum (ETH) price held in a sideways consolidation with support at the psychological level of $4,000. On Sunday evening, buyers made a weak attempt to break above the average price level but failed to gain a foothold above the $4,100 mark.

By the beginning of this week, the price again rolled back to the support area of $4,000.

ETH/USD chart by TradingView

Today, the breakout could be repeated, and if buyers overcome the resistance of the two-hour EMA55, then the Ether price could test the resistance of $4,300.

Ethereum is trading at $3,880 at press time.

XRP/USD

At the end of last week, the XRP price failed to gain a foothold above the two-hour EMA55 level. On the weekend, the local maximum was set around the $0.857 mark, but currently the pair is still below the average price level.

XRP/USD chart by TradingView

If the next attempt by the bulls is more successful, and the XRP price comes back above the EMA55, then the growth can continue to the resistance area of $0.96.

XRP is trading at $0.7955 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.