Have bulls accumulated enough power to maintain the mid-term growth of the top coins?

The new week has started with neutral sentiment in the cryptocurrency market, with some coins coming back to the green zone and others remaining in the red.

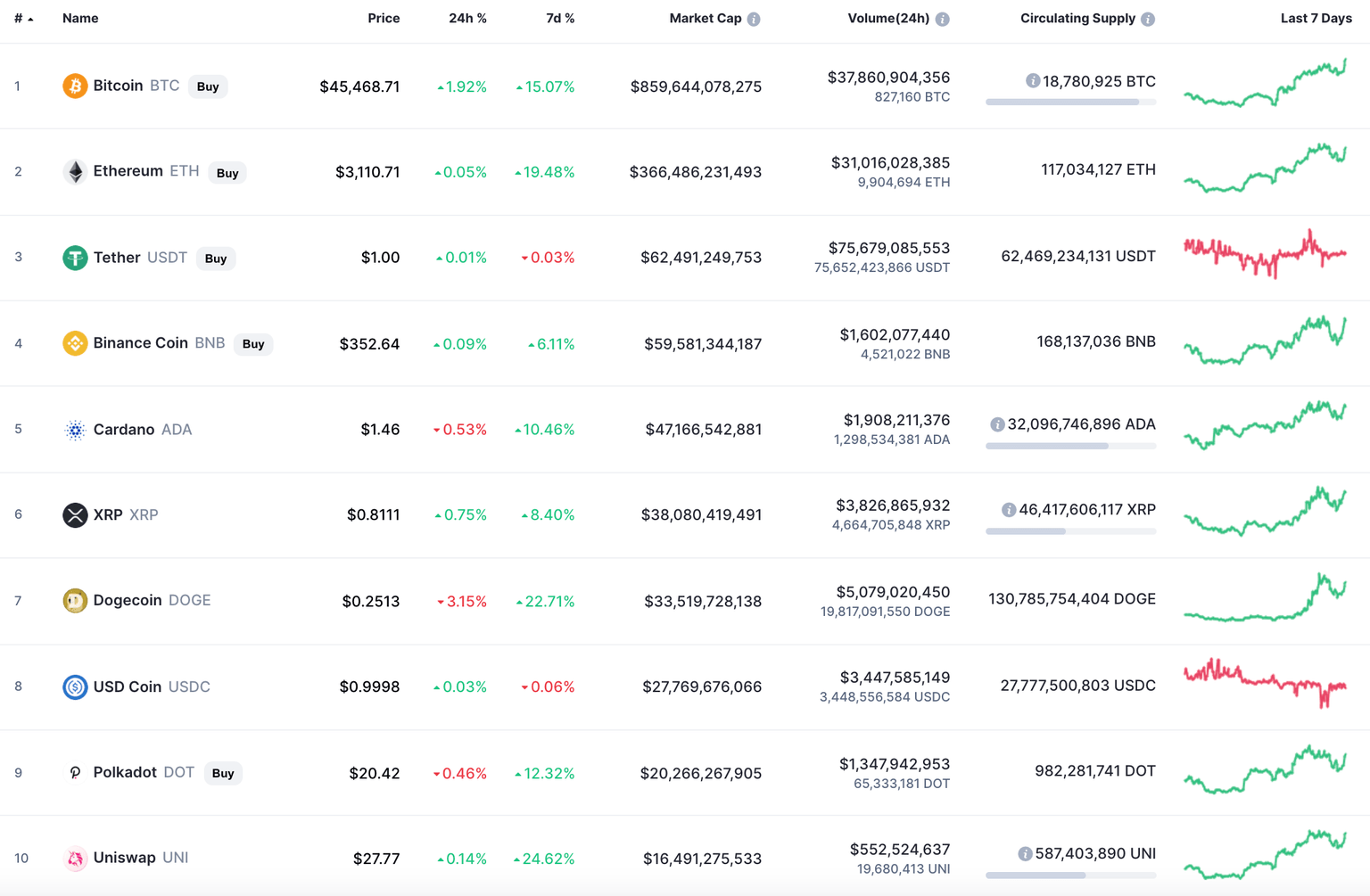

Top coins by CoinMarketCap

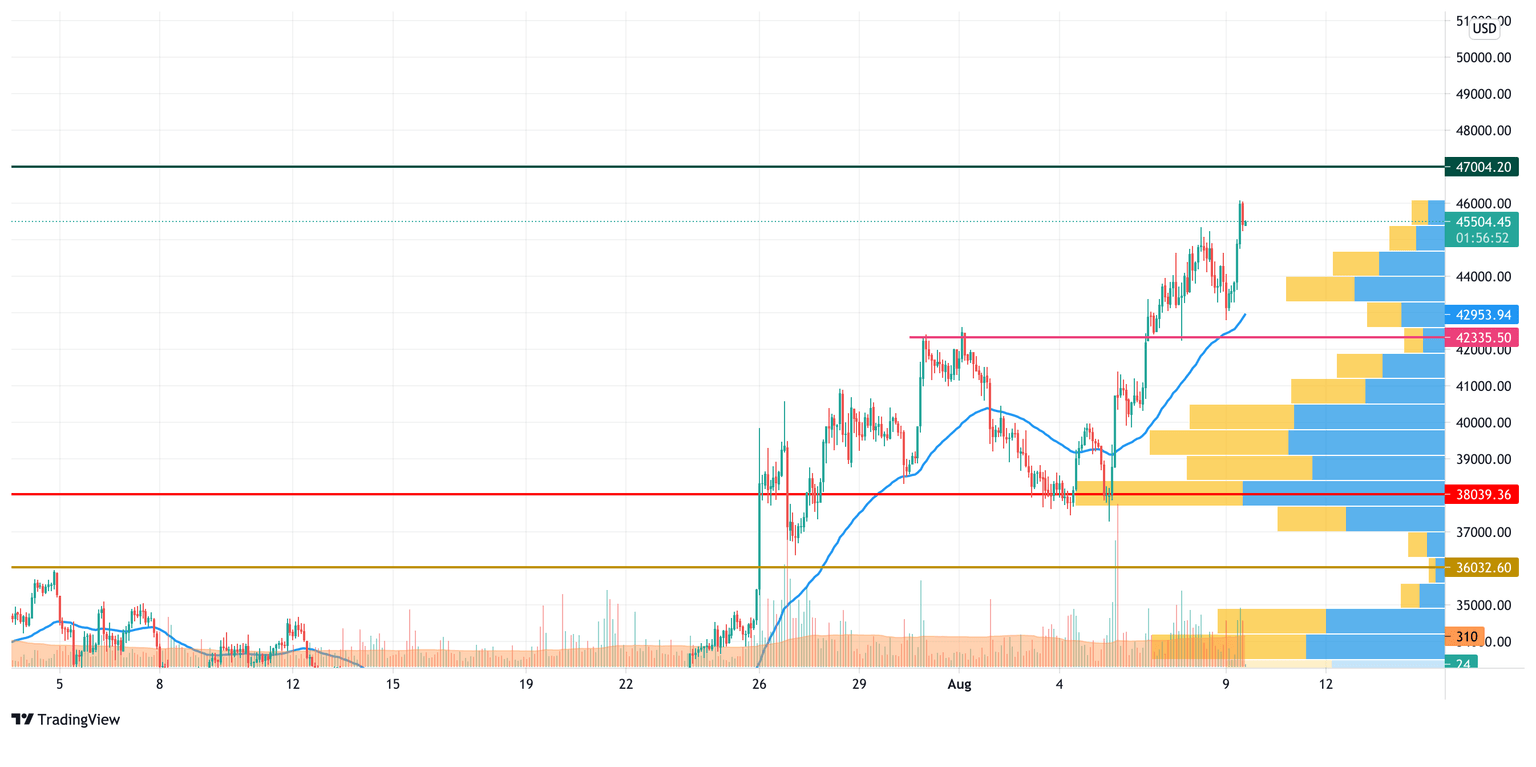

BTC/USD

Over the past weekend, the Bitcoin (BTC) price continued to rise. It marked a monthly high at around $45,355 on Sunday morning.

In the second half of the day, the buying volume decreased. Therefore, until the end of the week, bulls could not test the resistance of $46,000.

BTC/USD chart by TradingView

The pullback turned out to be quite deep and stopped at the level around the $42,800 mark. If buyers are able to continue the bullish momentum today, the pair may test the resistance of $47,000.

Bitcoin is trading at $45,504 at press time.

ETH/USD

Last Saturday, the Ethereum price was able to continue to rise. The bulls broke through the powerful psychological resistance of $3,000, and it once again tested its summer high of $3,190 on Sunday.

ETH/USD chart by TradingView

In the early morning, the price tested the two-hour EMA55, but the pullback has stopped. If this moving average keeps the price from further decline, then the bulls might try to continue the run and overcome the resistance at $3,340.

Ethereum is trading at $3,147 at press time.

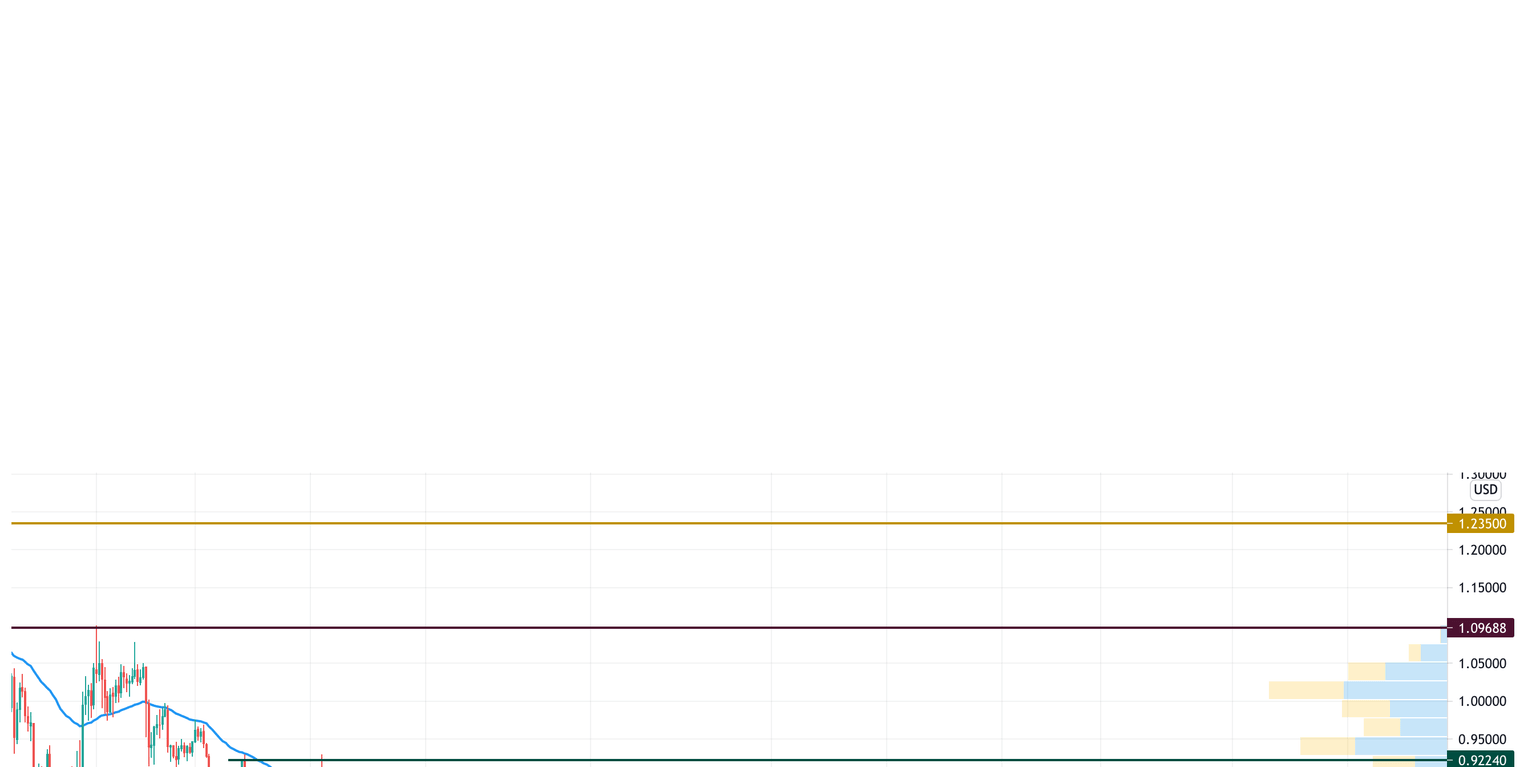

XRP/USD

Over the weekend, the XRP price was able to demonstrate growth and broke through the resistance of $0.80. The Point Of Control (POC) indicator line ($0.869) served as a target for the bulls, but the price was unable to test this level until the end of the week.

XRP/USD chart by TradingView

The growth stopped on the way to the Point Of Control line and the pair rolled back below the level of $0.80. Now, buyers are trying to stop the pullback and resume growth to the resistance at $0.9224.

XRP is trading at $0.82160 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.