GoMining Token breakout trade waits nearby as Bitcoin continues rally this week

- GoMining Token price slides after string of rejections.

- GMT still in rally mode as ascending trend line holds.

- Expect to see a bullish squeeze to the upside with a breakout on the topside soon.

GoMining Tokens (GMT) are set to see some heavy demand arrive this week. GMT is the native Bitcoin mining token for its platform and functions as the link between professional equipment and end-users in Bitcoin. With a clear and present correlation, it is a matter of time before a spinoff tailwind from Bitcoin reaches alternative coins and tokens like GMT with a 60% gain a real possibility.

GMT to enjoy positive spillover from Bitcoin rally

GoMining Tokens are primed for a massive spurt higher as the Bitcoin rally that is currently underway is set to trigger rallies in other asset classes like altcoins and derived tokens. This is good news for GTM, especially since it is a vital token in the conceptual approach of Bitcoin mining. With all eyes on the Bitcoin price performance from the past few days in some volatile markets, GMT is set to enjoy the revived interest and become the next best thing aside from Bitcoin to invest in.

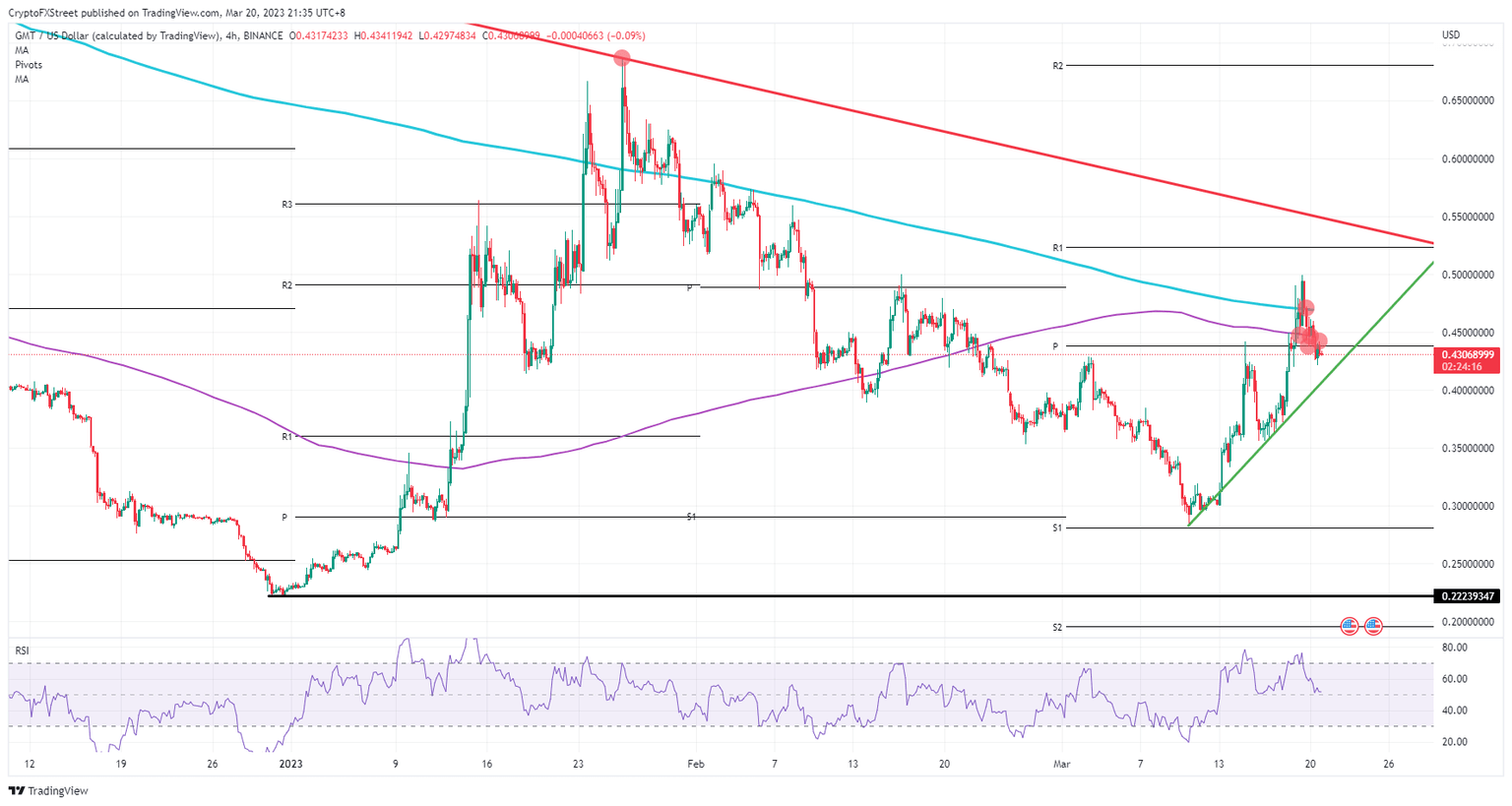

GMT could see support swinging in from the green ascending trend line near $0.42, triggering a bounce higher. Once that has happened, expect to see a spike toward the monthly R1 resistance level at $0.52. Should bulls trade that level well, it can act as a support to trigger a breakout trade toward $0.65 that carries a 60% gain along with it.

GMT/USD 4H-chart

The biggest threat for a breakdown of the green ascending trend line and its rally for GMT comes with its underlying correlation to Bitcoin. If Bitcoin price starts taking, this will have a negative side-effect on GMT. A quick break below $0.40 would even open up a full downward spiral back to $0.30.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.