Goldman Sachs entry into the Bitcoin futures market signals Armageddon

- Bitcoin price coils in a sideways triangular trading range.

- Goldman Sachs rumored to have opened their first BTC futures and options position.

- Invalidation of the bearish downtrend is a break and close above $21,868.

Bitcoin price shows technical reasons to believe in one more decline. Goldman Sachs’ entrance into the crypto market is a strong indication of a big move to come.

Bitcoin price meets Goldman Sachs

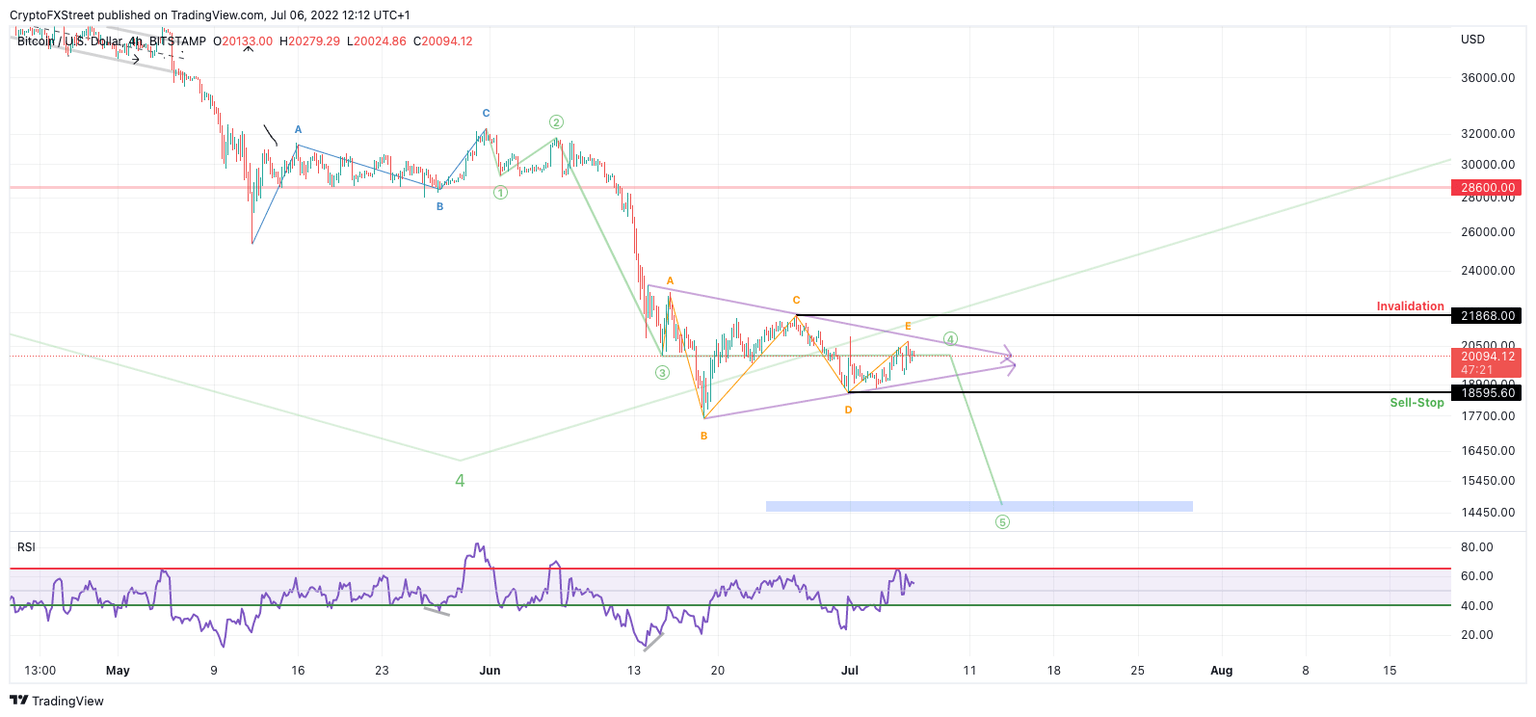

Bitcoin price has investors preparing for a lethal blood bath in the coming days. Since June 15 the BTC price has auctioned off within an erratic trading range producing diminishing returns and diminishing losses with each directional shift. The technicals have now revealed the reasoning behind the peer-to-peer digital currencies madness as a symmetrical triangle is unavoidably prevalent on the 4-hour chart.

Bitcoin price currently trades at $20,087 as the bulls have managed to re-route since the early morning shake-out on June 5. The Relative Strength Index subtly validates the symmetrical triangle’s presence as bullish and bearish divergence is witnessed at key pivotal turning points.

BTC/USDT 4-Hour Chart

On July 5, Crypto analysts @BTC_Archive reported that Goldman Sachs has joined in on the crypto speculation. Apparently, the prestigious investment group has opened their first Bitcoin Futures and Options position during the Asian trading session. At current time, it is uncertain if the immensely funded investment group is a bull or a bear in the market and the company has not issued a follow-up to the hundreds of Twitter users asking the same question.

From a technical standpoint, BTC price does have the potential for an Armageddon-style decline. A break and close below $18,595 could ultimately be the catalyst to awaken sleeping bears in attempts to send the BTC price into $14,300.

Invalidation of the bearish thesis is a definitive break and close above $21,868. If the bulls can breach this level, they could be able to rally as high as $31,000, resulting in a 55% increase from the current BTC price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.