Former Celsius CEO Alex Mashinsky arrested by DoJ and sued by SEC, CFTC and FTC

- The bankrupt crypto lender's Celsius CEO was arrested and charged with fraud by the US Department of Justice, per Bloomberg's report.

- The Securities and Exchange Commission, minutes before the arrest, also sued Mashinsky for Securities fraud.

- This is SEC's third biggest crackdown on the crypto sector this year, following Binance and Coinbase lawsuits.

Celsius, the crypto lender that went bankrupt last year, is making headlines once again. The company's co-founder and former Chief Executive Officer (CEO), Alex Mashinsky, was arrested by US authorities on July 13.

According to a report from Bloomberg, Mashinsky's arrest was the result of an investigation following which, the US Department of Justice (DoJ) charged the disgraced executive with fraud.

Additionally, the executive was also charged with an attempt to manipulate cryptocurrencies. Per the indictment unsealed on Thursday, prosecutors claimed that between 2018 and June 2022, until the company imploded,

"...[Mashinsky] orchestrated a scheme to defraud customers of Celsius Network LLC and its related entities.

Furthermore, the founder has also been sued by three other regulatory agencies minutes before the charges and arrest by the DoJ. The Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC) and the Federal Trade Commission (FTC) all filed lawsuits against the former CEO and Celsius itself.

SEC's third big attack

The lawsuit filed against Celsius and Alex Mashinsky alleged that the company and the founder were misleading investors by promising high returns. This suit made it the SEC's most recent shot at the crypto market, third within this year.

Earlier in Q2, Binance and Coinbase were subjected to lawsuits from the Gary Gensler-led agency, which alleged violation of securities laws. The cases were in addition to the already ongoing Ripple lawsuit, which is expected to come to a conclusion before the end of this year.

Celsius token takes a hit

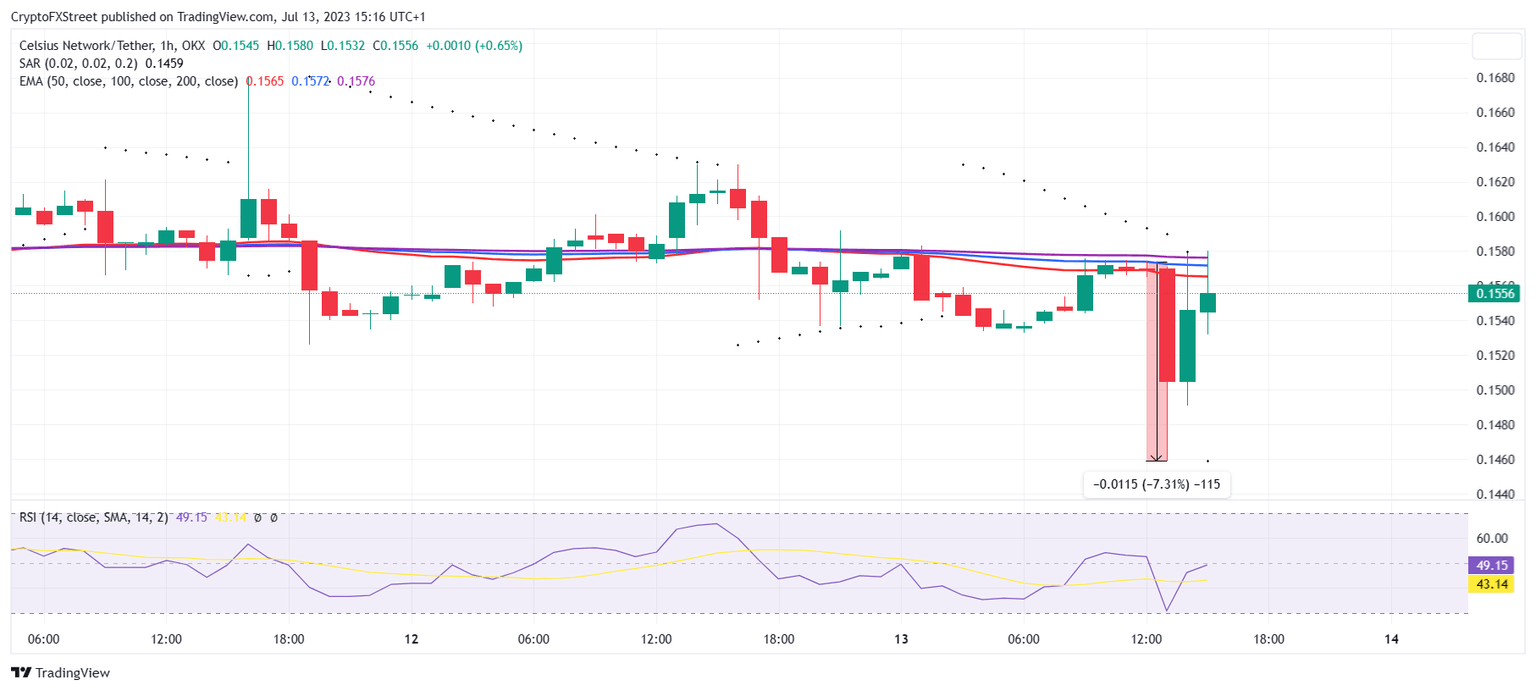

In response to the charges, Celsius token CEL initially observed an almost 8% decline bringing the price of the token down to $0.1459 from $0.1578. This drawdown, however, did not stick for long as, at the time of writing, the cryptocurrency recovered to trade at $0.1556.

CEL/USD 1-hour chart

Official statements from the DoJ, SEC, CFTC and FTC await.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.