Floki Inu price could initiate recovery to April highs on six trillion FLOKI turning profitable

- Floki Inu price is currently trading at $0.000033, facing a key barrier at $0.000035 in the form of a 50-day EMA.

- At the same price level stands a demand wall of almost six trillion FLOKI worth $205 million.

- The MVRV ratio shows FLOKI is in the opportunity zone; investors are likely to hold off selling.

Floki Inu price has been straying away from broader market cues, charting its own path without following cues from Bitcoin or Dogecoin. This fluctuation of price has left a significant portion of the supply in limbo, which, when turned into profits, could potentially push the price up.

Floki Inu price needs to go against the odds

Floki Inu price trading at $0.0000033 is observing rather negative signs at the moment, with the price indicators all signaling a potential decline in price. The Relative Strength Index (RSI) is in the bearish zone, just under the neutral line at 50.0.

At the same time, the Moving Average Convergence Divergence (MACD) is also observing a bearish crossover, with the signal line (red) crossing over the MACD line (blue).

However, Floki Inu price is still standing above the 100-day Exponential Moving Average (EMA), which has been acting as a support level throughout the month. As long as this support level is maintained, FLOKI has the potential to breach the resistance level at $0.000035 coinciding with the 50-day EMA.

FLOKI/USD 1-day chart

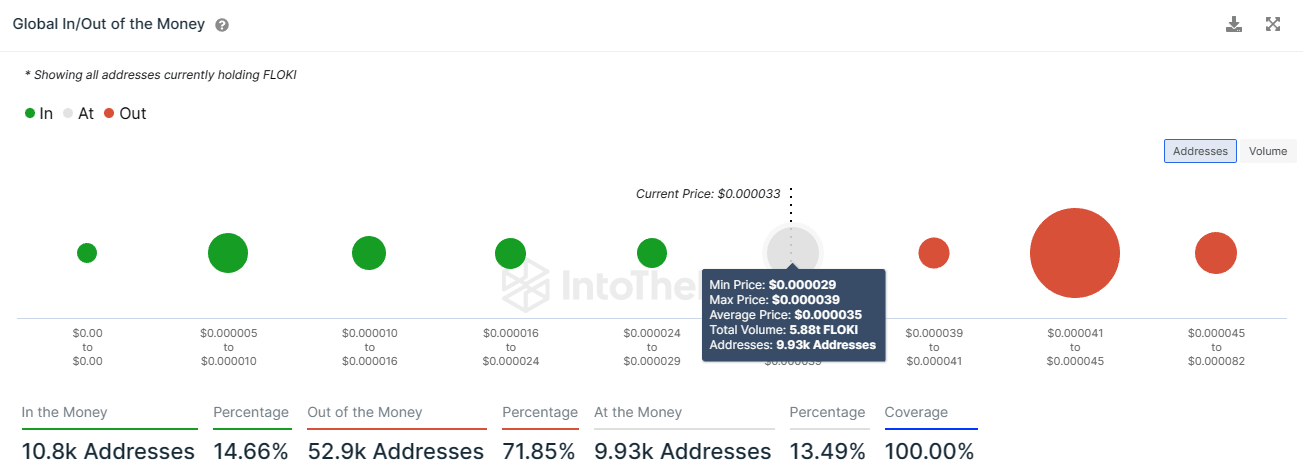

This point also marks the average price at which more than 5.88 trillion FLOKI worth $205 million was purchased. The almost 10,000 addresses that bought these tokens are patiently waiting for the supply to turn profitable.

Floki Inu GIOM

Looking at the Market Value to Realized Value (MVRV) ratio, the meme coin does have the potential to rise to the aforementioned resistance level. This potential is due to the indicator sitting in the opportunity zone, which is marked by the presence of an MVRV ratio below -10%.

This zone has historically been synonymous with recoveries since investors are generally underwater at this time. Thus to prevent losses, they hold on to their assets that act in favor of a price rise.

Floki Inu MVRV ratio

Although once this happens, Floki Inu price could be susceptible to profit-taking and could then take a hit. Until then, the meme coin would have the opportunity to rally back to April 2023 highs of $0.000044.

If this fails to happen and bearish cues intensify even before the demand wall is breached, Floki Inu price could decline to $0.000030 and beyond.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B04.12.34%2C%252018%2520May%2C%25202023%5D-638199638176454862.png&w=1536&q=95)