Floki Inu investors call for another 55% rally as 2 trillion FLOKI stands inches away from profitability

- Floki Inu price noted a near 55% rally on May 5 after the altcoin closed at $0.00004959.

- FLOKI fell back to $0.00003544, however, leaving $71 million of FLOKI underwater after traders got pulled into the bull trap.

- The meme coin is highly driven by Dogecoin and Shiba Inu’s cues rather than broader market developments.

Floki Inu price is one of the most loyal cryptocurrencies in the meme coin sector, since the altcoin’s price is highly correlated to leaders in the altcoin space rather than its own market developments. Thus for investors to identify future opportunities, they might want to watch Ethereum, Dogecoin and Shiba Inu just as closely, as FLOKI tends to run with the pack.

Read more - Shiba Inu price could be on the path to recovery after $2.5 billion SHIB slip into loss

Floki Inu price needs to rally

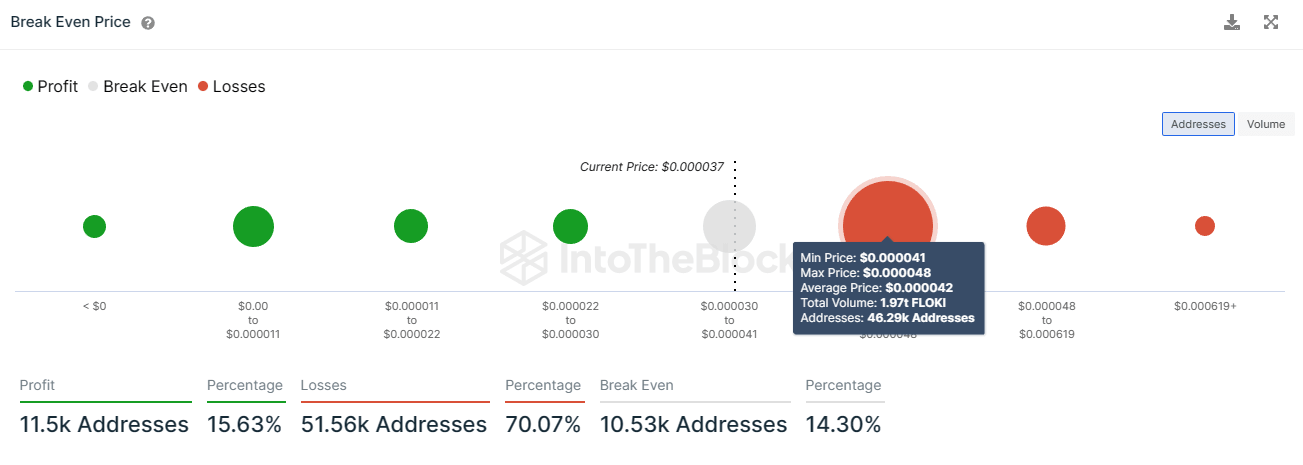

Floki Inu price noted a remarkable rise a few days ago on May 5, when the meme coin shot up to the high of $0.00006160 before coming back down to close at $0.00004959. This marked a 54% rise in 24 hours and left over 46,000 addresses elated.

FLOKI/USD 1-day chart

This is because the altcoin’s rally turned a significant chunk of investors’ assets profitable. However, the good times for investors were short lived: an eventual decline brought them back down to earth with a bang. As a result, a massive demand wall was erected in the $0.00004100 to $0.00004800 range. In this range, more than 1.97 trillion FLOKI, worth over $71 million, were bought at an average price of $0.00004200, as traders got sucked into the rally. Yet all these traders now find themselves underwater.

Floki Inu supply at loss

For this supply to become profitable again, Floki Inu price needs to register another 54% rally. But the possibility of the rally is not dependent on what goes on in the Floki Inu environment but on the actions of the altcoin and meme coin leaders - Ethereum, Dogecoin, and Shiba Inu.

As an example – over the last 24 hours, Floki Inu has been listed on one of Europe’s biggest centralized exchanges, WhiteBIT, as well as on another exchange BitMEX, which enabled derivatives trading for the meme coin. You would have thought these developments would have triggered a rally in the altcoin, right? Wrong, these developments failed to bear any impact on Floki Inu price.

Memecoin season continues

— WhiteBIT (@WhiteBit) May 10, 2023

About: @RealFlokiInu combines fun and utility, offering DeFi features, NFT integration, and a dedicated charity wallet to support animal welfare.

For more information, please visit our blog: https://t.co/odLAO2Y8ec ⬇️ pic.twitter.com/RkqYHiY3aD

Contrast that to the 54% rally of May 5, which took place purely as a result of FLOKI following Ethereum’s lead. The biggest altcoin in the world rallied by 6.37% to almost breach the $2,000 mark (it failed to quite get there).

Dogecoin and Shiba Inu share a 0.74 and 0.80 correlation with Ethereum, which makes them highly likely to rally if ETH rises too.

Ethereum correlation with Dogecoin and Shiba Inu

And since Floki Inu price naturally follows DOGE and SHIB’s lead, FLOKI holders would also be more likely to follow ETH higher too, compared to developments on their own network.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.