Filecoin price crashes by 16% in a single day, FIL set to drop below $5

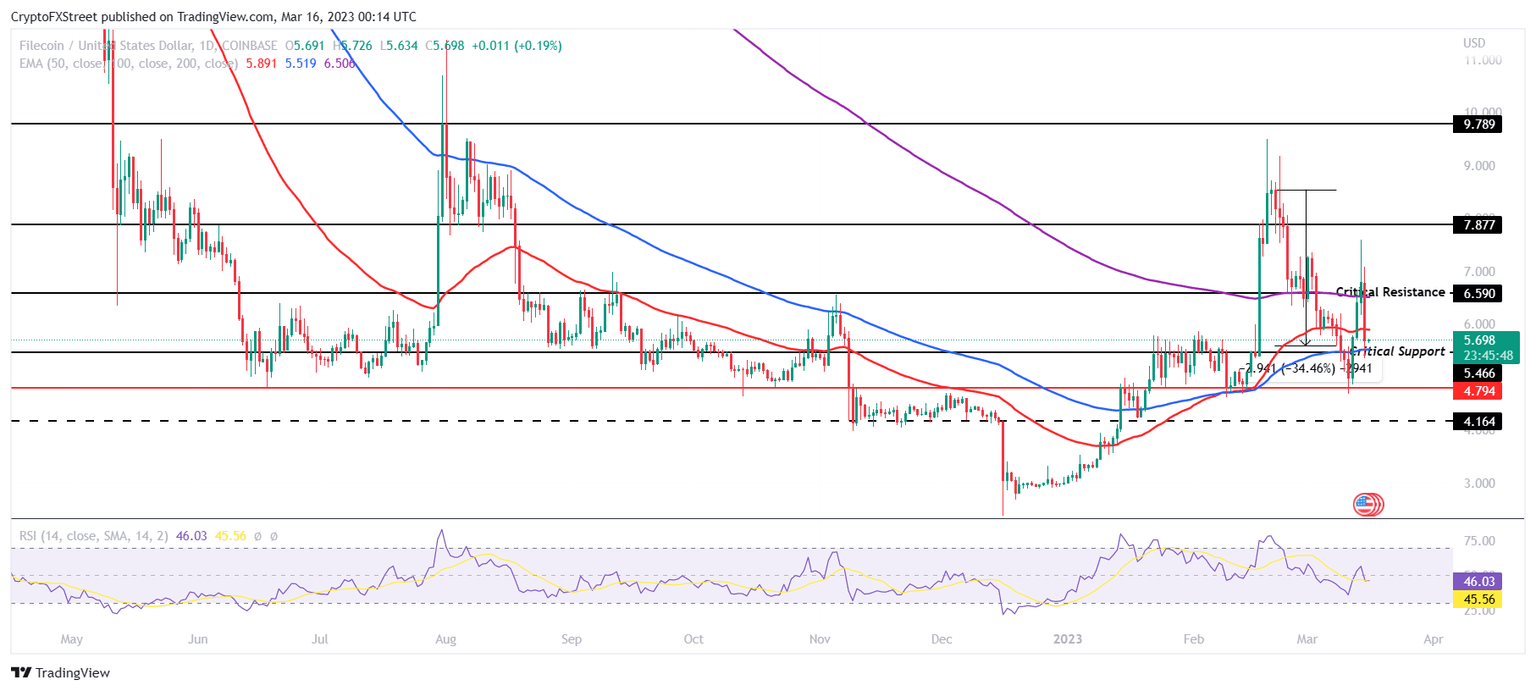

- Filecoin price dipped below the immediate support to trade at $5.68 at the time of writing.

- FIL could dip below $5 if the critical support at $5.46 is lost.

- The altcoin would invalidate the bearish thesis if it climbs back to yesterday’s highs.

Filecoin price bore the brunt of the broader market cues and lost nearly half the increase observed by the asset in the span of a day. If this uncertainty continues, expect a decline below the critical support level and toward a monthly low.

Filecoin price falls to test a key support

Filecoin price declined by more than 16% in the last 24 hours, resulting in the cryptocurrency falling to the critical support level of $5.46. The uncertainty in the financial market due to the banking crisis is also having effects on the altcoin’s price action.

Looking at the chart, the possible course of action for cryptocurrency is a bearish outlook. If the panic continues and FIL slips below the critical support level at $5.46, the altcoin would be at risk of declining by another 15% to fall to a month-long low of $4.79.

But the Relative Strength Index (RSI) here indicates that there is some bullishness present in the momentum. Although the indicator's downtrend around the midline may indicate a potential decline in FIL, it also hints at a possible increase if the middle line at 50 is tested as support.

FIL/USD 1-day chart

In doing so, a recovery could be triggered, and the cryptocurrency could be saved from falling by another 15%. However, in order to invalidate the bearish thesis, the cryptocurrency would need to breach the critical resistance at $5.59 and flip it into a support floor. This would enable the altcoin to rise further and recover the losses noted over the last month and tag $7.87.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.