Fed fuelled interest for crypto hint working on the blockchain

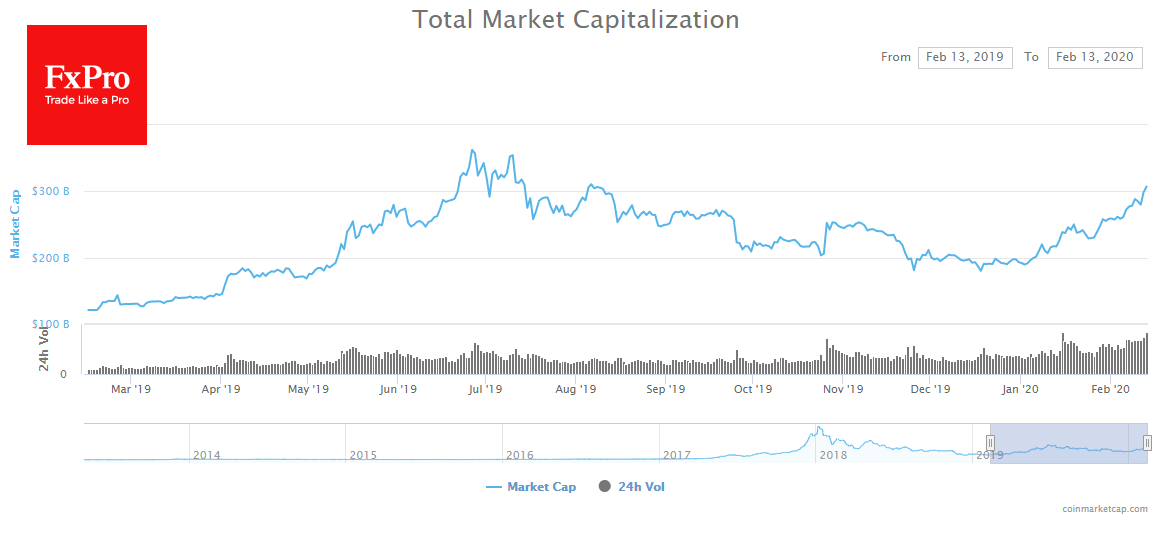

The Bitcoin held above $10,000 for a few days, and that's the good news. The ability to stay above the threshold also supports the demand for altcoins. Thus, Ethereum (ETH) has grown by 30% in the last seven days. Other coins have also been growing steadily in price. Altcoins are growing faster than the benchmark cryptocurrency, which leads to a decline in the BTC domination index, which dropped to 61.7% - the lowest in the last seven months.

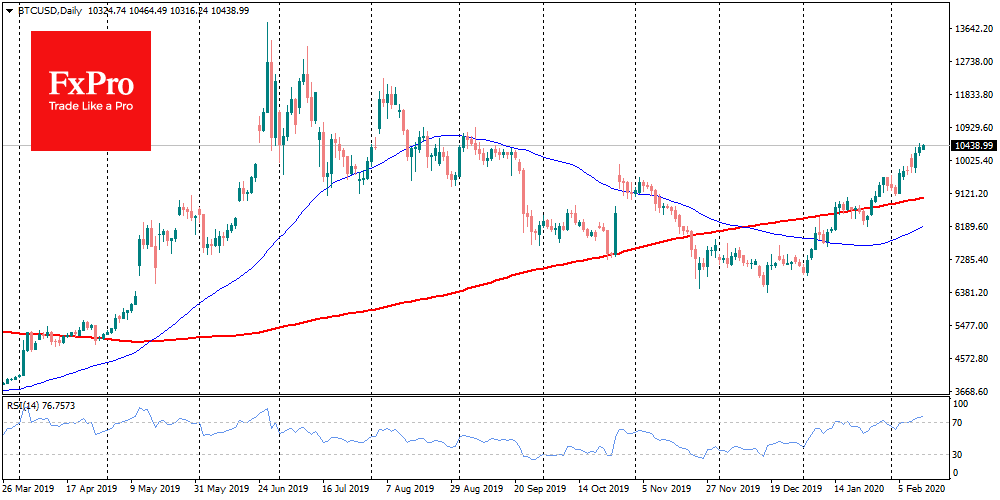

It's interesting to see what contributed to the $500 sharp rebound of the benchmark cryptocurrency.

Crypto community agrees that the main driver was the speech of the Fed governor. Market participants have concluded that the US Federal Reserve perceives cryptocurrencies as a severe threat to the status of the dollar as a global reserve currency. Besides, in Powell's speech, there may have been hints of creating its rival to the Chinese digital yuan, which again would be logical, after the strict steps of regulators against Libra and TON.

However, in the last few hours, we are witnessing that the growth momentum is gradually fading. Also, we still do not see any manifestations of the FOMO syndrome, which is typical for cryptocurrencies, with a jump of tens of per cent, as was the case after the general secretary of the Communist Party of China announced its work at the blockchain project.

The reaction is now more muted while further attempts of bears to push Bitcoin below the threshold could turn into painful profit-taking. This assumption got support by the Crypto Fear & Greed Index, which is currently at "greed" level 65. These are the highs from the August 2019. The RSI is also in the overbought zone. These are symptoms of overheating in the market. Without any external impulses, the cooling might be swift.

In a broad time frame, the intentions of central banks to launch digital analogues of national currencies may become a favourable scenario for existing cryptocurrencies. Participants believe that the spread of the national "crypto" at the system level will increase demand and institutional investors' confidence in the current leaders of the sector.

However, there is another position: central banks and governments are in a hurry to lead the new trend to oust as many competitors as possible from the market. Under this scenario, we will soon get a rules tightening for the conversion of cryptocurrencies into fiat, as this is the primary weapon of central banks in a decentralized environment.

Sadly, the truth is that without the opportunity to use the exchange for traditional money, cryptocurrencies will quickly start to lose their attractiveness.

Author

Team FxPro

FxPro

FxPro is a UK headquartered online broker providing contracts for difference (CFD) on foreign exchange, shares, futures and precious metals primarily to retail clients.