Extreme fear keeps Cronos consolidated even as Crypto.com DeFi wallet integrates with OpenSea

- Crypto.com recently brought new features to its DeFi wallet, focusing on NFTs.

- The Crypto market’s growth has been restricted due to the bearish pressure from the broader market.

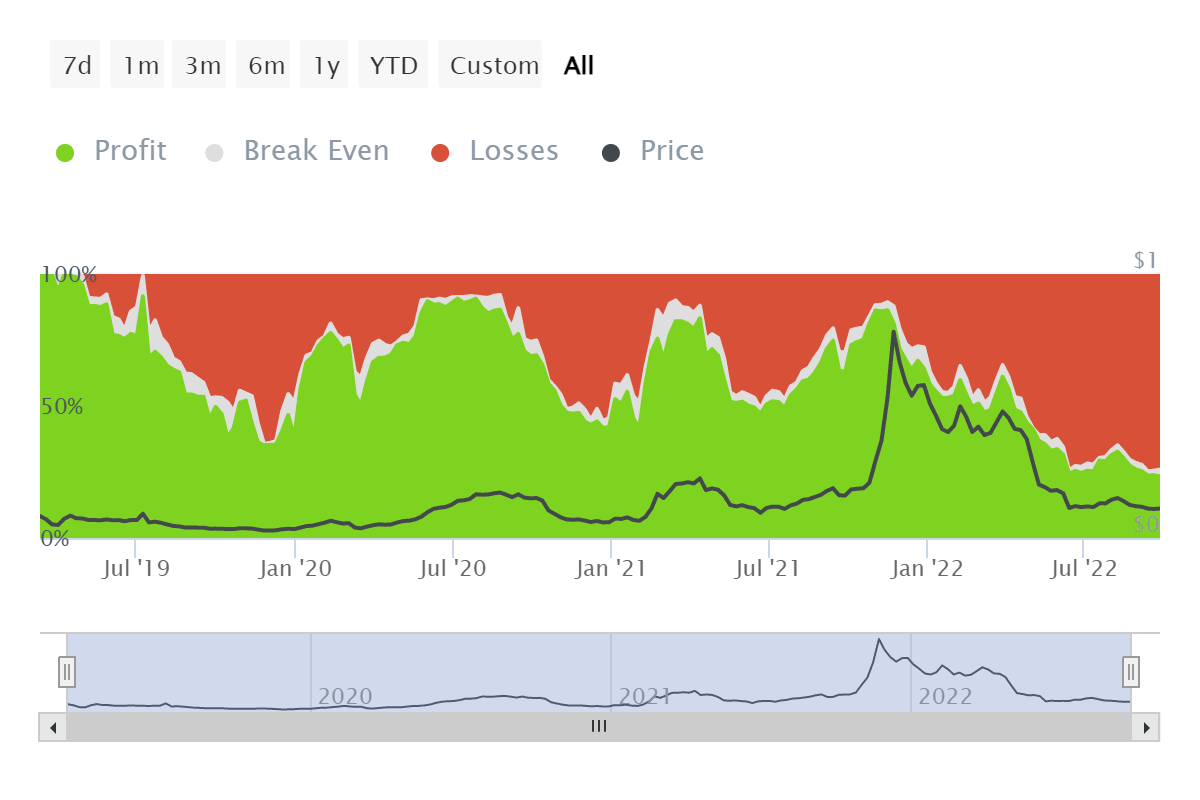

- Cronos holders’ losses have mounted to an all-time high, with more than 74% of investors standing far from profits.

The worsening global market pressure can be seen on the crypto market as the combined value of all cryptocurrencies remains stuck at around $900 billion. While external factors usually end up rescuing tokens during such bearish periods, even those are unsuccessful at the moment.

Crypto.com stands as an example of the same as its token, Cronos, falls to a four-month low.

Cronos price makes no move

Suffering from the same lack of volatility as other cryptocurrencies, Cronos is currently struggling to breach the resistance of $0.132. This level has been tested multiple times over the last four months, which is also the same low CRO’s price is currently at.

The lack of growth can also be attributed to the fact that Cronos is currently not noting enough buying pressure to rally the price. The Relative Strength Index (RSI) around the neutral line verifies the same.

This precariousness of the buying pressure stems from the presence of extreme fear in the market, as observed on the Crypto Fear and Greed Index. The same fear that has been persistent for the last three months continues to anchor the Cronos price.

Profits stray away even as Crypto.com expands

The consequences of the falling prices can be seen in CRO holders’ investments. Since CRO’s all-time high of $0.781, the total investors in profit have reduced from 81.39% to just 23.36%. At the time of writing, over 198k addresses, which amount to 74% of all investors, are suffering losses.

Cronos investors wade in losses

Regardless, Crypto.com is continuing its efforts in consistently developing its network, with new upgrades arriving this week. On September 30, Crypto.com DeFi Wallet integrated Minted Vault, allowing investors to passively earn token rewards.

The wallet is also integrated with the Ethereum NFT marketplace, OpenSea, allowing users to search and buy NFTs without the need to visit the marketplace separately.

Although these efforts do not mean much for the community, it's a step in a positive direction that will have some effect on the price when CRO escapes the bears.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.