Exploring the optimistic side of Solana price as bearish signs wane

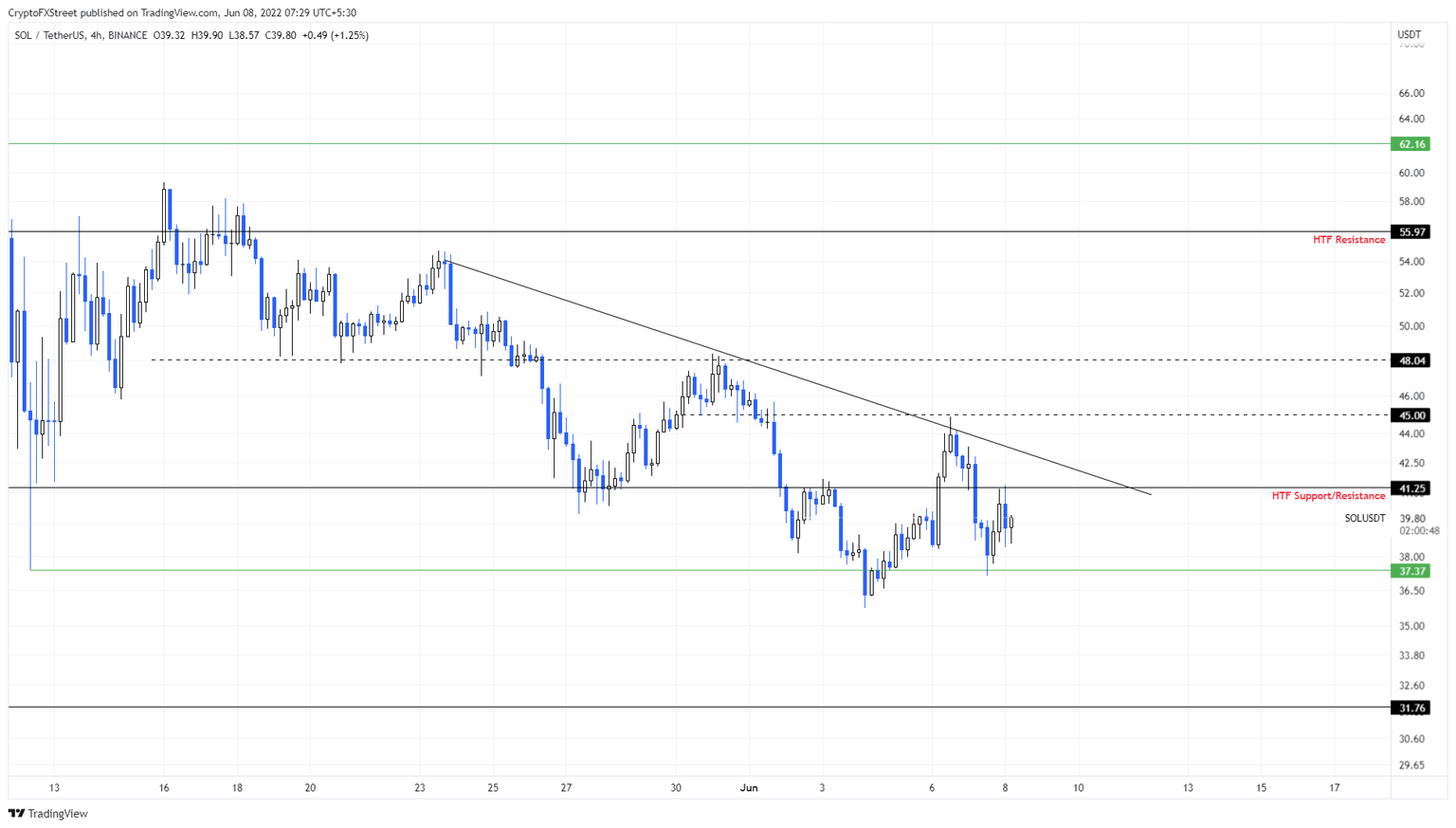

- Solana price is trading between two crucial levels, $37.37 and $41.25, signaling a lack of directional bias.

- SOL could see a bullish outlook develop over the week as it is stabilizing around the $37.37 support level after a constant downtrend.

- A four-hour candlestick close below $37.37 will invalidate the bullish thesis.

Solana price recovery has been less than successful; despite multiple attempts from bulls, SOL has formed lower lows and lower highs, indicating a persistent downtrend. Now, the so-called Ethereum-killer is consolidating between two barriers, attempting to break out.

Solana price remains clueless

Solana price moved from consolidating between the $41.25 support level and the $55.97 resistance barrier for roughly three weeks to being stuck between the $41.25 to $37.37. While this move is clearly bearish, the lows seem to be stabilizing around the $37.37 foothold.

Investors need to be careful as a move above the $41.25 level will breathe hope into the holders’ bags. However, the possibility of an uptrend will arrive after Solana price produces a higher high above $45.

Doing this will allow sidelined buyers to step in, triggering a minor uptrend to $48.04. This move will represent a 22% gain but in a highly optimistic case, SOL might retest the $55.97, bringing the total gain to 40%.

SOL/USDT 4-hour chart

While things are looking sketchy for Solana price, investors need to note that it has been on a downtrend since May 16. After the recovery from the May 12 crash formed a swing high at $59.31, it has been producing lower lows. Now that SOL is stabilizing around $37.37, investors can expect a turnaround for the altcoin.

However, if sellers take control again and flip the $37.37 support level into a resistance barrier on the four-hour chart, it will invalidate the bullish thesis for SOL. This development could see Solana price crash to $31.76 where buyers could attempt a comeback.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.