Ethereum's Vitalik Buterin vows to meet ETH 2.0 deadline as roughly 20% of the goal has been reached

- Ethereum 2.0 staking is behind the schedule with less than 20% of the goal reached.

- Vitalik Buterin reassures the community, promises to slash the minimal deposit if needed.

Currently, the dedicated deposit smart contract contains only 19% of the total amount of ETH required for the developers to start rolling out Beacon Chain, the critical component of Ethereum 2.0. While the launch is preliminarily scheduled for December 1, it may be postponed if the project fails to secure at least 524 288 ETH (over $250 million at the current exchange rate) from 16,384 validators.

ETH holders are anxious

The cryptocurrency community is not satisfied with the progress. Many experts, including Arcane Research, believe that the team won't be able to reach the threshold by December 1.

The experts pointed out that less than two weeks were left before the launch date, but the project still needs to support at least 13,424 staking validators.

Progress of ETH 2.0 staking: Behind schedule!

— Arcane Research (@ArcaneResearch) November 17, 2020

Data from @nansen_ai shows that another 13,424 staking validators are required in the next 2 weeks to trigger the launch of ETH 2.0.

The current growth rate will not be enough, as ~80% of the required validators are still missing. pic.twitter.com/KOSk9gy667

The community members are also hesitant. Moreover, the slow progress deters many of them from joining the network.

It is worth noting that an ETH holder needs to transfer to the deposit smart contract at least 32 ETH (over $15,000), which they won't be able to retrieve or use for an indefinite period. These stakes will be effectively locked until the transition to Ethereum 2.0 is completed, which is expected to happen in two years at the soonest.

A Reddit user recently applied to the Ethereum Foundation with a question:

I want to stake 32 ETH in the Deposit Contract, but I'm worried it won't hit the launch target. How can the EF reassure me that my ETH won't be stuck forever if we never hit the target?

The co-founder of Ethereum, Vitalik Buterin, joined the conversation and tried to elevate the concerns by pointing out that the staking would accelerate, and the target could still be met.

Moreover, the delay won't derail the whole plan as the developers will move on to an alternative scenario. According to Ethereum 2.0 developer Danny Ryan, the genesis block will be triggered seven days after the threshold, whenever it happens.

Also, Buterin said that the minimum deposit might be slashed if needed to attract more validators and speed up the process.

In the very unlikely event that eth2 somehow never progresses past phase 0, I would fully support a state-intervention hard fork to add withdrawal support to the deposit contract so stakers can get their funds back, he added.

Whales are less hesitant that retail users

Meanwhile, the lion's share of staking deposits has come from whales or large institutional investors. For example, Vitalik Buterin transferred 3,200 ETH to the deposit smart contract.

Also, in a recent development, a Dubai investment firm, IBC Group, transferred $10 million worth of ETH to support the Ethereum 2.0. Khurram Shroff, chairman of IBC's board, explained that the company wanted to show its confidence in ETH2 and its dedication to the beacon chain.

Meanwhile, Ethereum Foundation announced its plans to donate to the projects that are ready to participate in ETH 2.0 staking.

ETH is moving within a bullish trend

Meanwhile, ETH/USD continue moving within the bullish trend. The second-largest digital asset retested the psychological $500 on Wednesday amid strong upside momentum across the board.

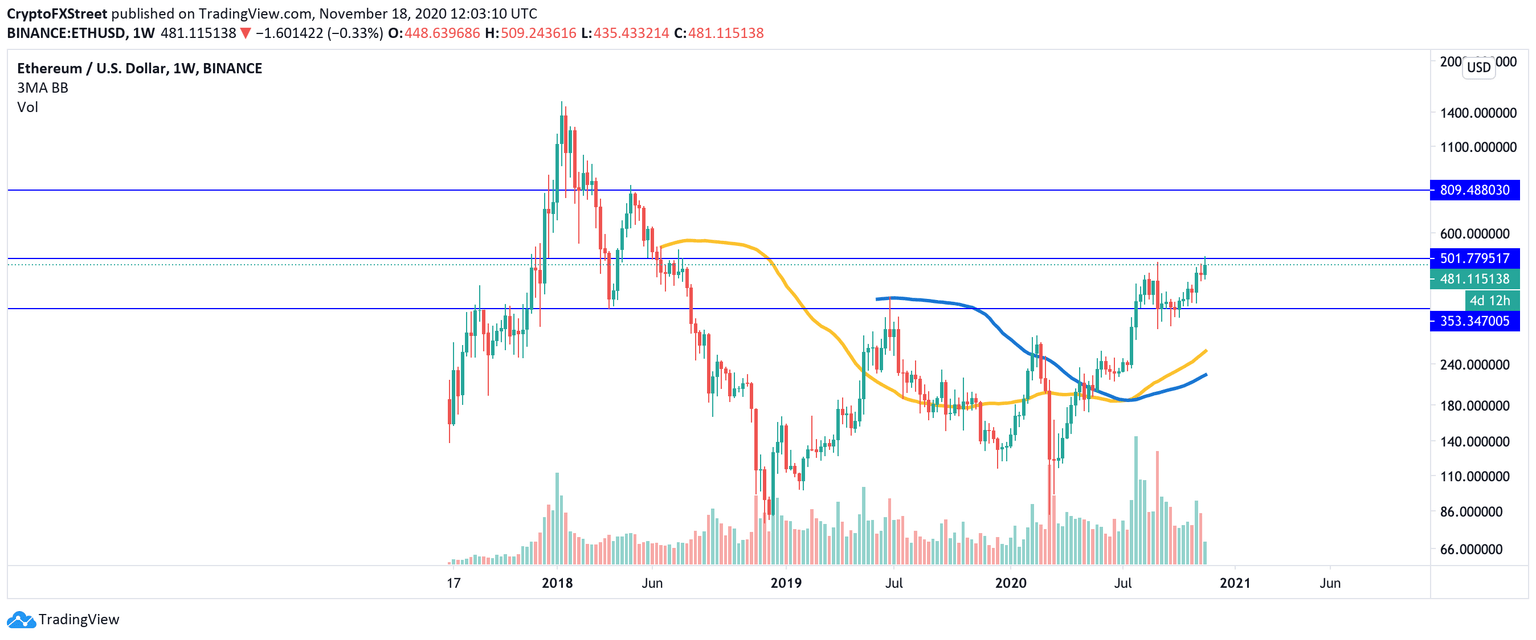

ETH/USD, weekly chart

Once the resistance of $500 is taken out, ETH/USD recovery may gain traction with the next long-term target at $800. This area stopped the recovery attempt in $2018 and triggered a sharp sell-off below $100.

On the downside, the critical support comes at $350. A sustainable move below this area will invalidate the bullish scenario.

Author

Tanya Abrosimova

Independent Analyst