Ethereum’s short-term range forecasts $4,000 but with a warning for eager ETH bulls

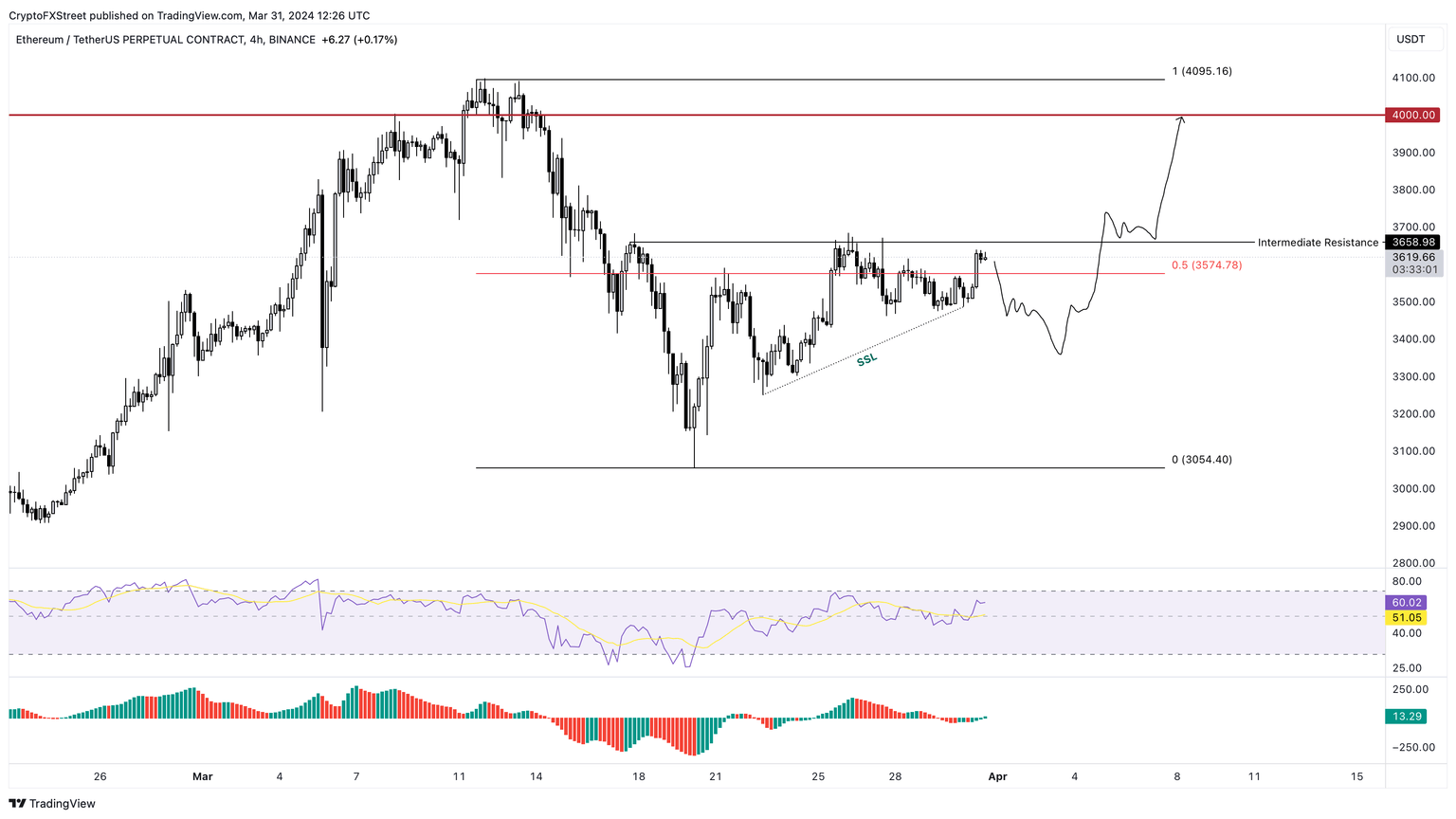

- Ethereum price trades inside the $3,054 to $4,095 range on the four-hour chart.

- A sweep of the sell-side liquidity seems likely before ETH attempts to move $4,000.

- In some cases, ETH could sweep the rang high at $4,095.

Ethereum (ETH) price looks ready for an ascent, at least from a breakout traders’ perspective. But this isn’t always the case as market makers or smart money tends to collect liquidity in the opposite direction first. So, eager ETH bulls need to exercise patience.

Ethereum price likely to trap impatient traders

Ethereum price set up a range, extending from $3,054 to $4,095 during its 25% descent between March 11 and 20. Currently ETH is has triggered a quick ascent above the aforementioned range’s midpoint at $3,574.

While this volatile move might be alluring to trade, investors need to exercise caution. In crypto, the initial breakout is often undone by quick corrections. The aim of such a move is to collect the liquidity below key levels. In this case, ETH has produced higher highs since forming the range low on March 20.

Hence, a breakout above $3,574 and $3,658 is likely to be short-lived, i.e., a correction might ensue soon. A sweep of $3,461 could be a good place to enter longs, provided Bitcoin (BTC) is also done with its short-term liquidity collection. In such a case, ETH is most likely to rally higher, overcome the $3,658 hurdle and eye a retest of the $4,000 psychological level. Resting, $95 above this level is the range high at $4,095, which could also be tagged if the buying pressure is high.

Also read: Crypto traders bet $2.4M on spot Ether ETF approval results

ETH/USDT 4-hour chart

On the contrary, if Bitcoin price fails to recover after short-term liquidity run, it will most likely take altcoins down with it. In such a case, Ethereum price could sweep the range low at $3,054. A flip of the said level into a resistance level would invalidate the bullish thesis for ETH and confirm the resumption of the downtrend.

This development could lead to Ethereum price crashing nearly 2% and tagging the $3,000 psychological level.

Read more: Vitalik Buterin wants rollups to hit stage one decentralization by year-end

(This story was corrected on April 1 at 06:10 GMT to say that the $4,095 level could be revisited if there is high buying pressure, not selling pressure.)

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.