Ethereum price to retest $3,600 as ETH bulls sustain above a crucial barrier

- Ethereum price has flipped the 50-day SMA at $3,060 and held above it.

- A bounce off this barrier is likely to propel ETH by 15% to $3,600.

- A breakdown of the $3,060 support level will invalidate the bullish thesis.

Ethereum price managed to push through a crucial hurdle and flip into a support floor after the second attempt. A resurgence of buying pressure will likely propel ETH to a new local top.

Ethereum price needs bullish momentum

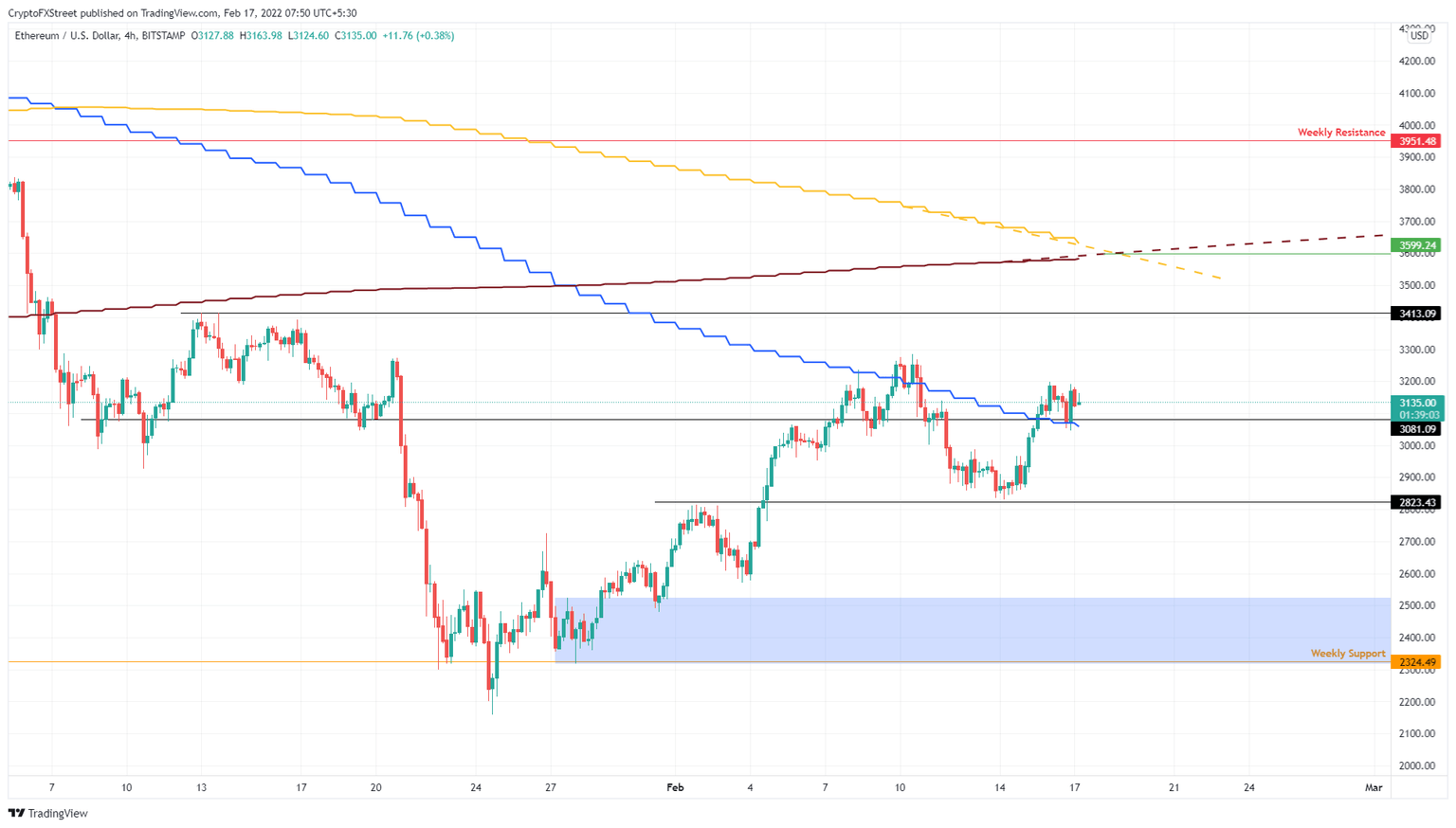

Ethereum price sliced through the 50-day Simple Moving Average (SMA) on February 9 but failed to sustain this uptrend, leading to a correction. The bulls came together during this pullback and bounced off the $2,823 support level, triggering a 12% ascent. This move set a swing high at $3,187.

The second attempt at conquering the 50-day SMA was successful, and ETH currently hovers above this barrier at $3,060. A resurgence of buying pressure is likely to kick-start a 15% rally to $3,600 - a confluence of the 100-day and 200-day SMAs.

In a highly bullish case, Ethereum price could break above this confluence and make its way to the weekly resistance barrier at $3,951. This move would bring the total uptrend to 25%.

ETH/USDT 4-hour chart

The bullish outlook depends on Ethereum price sustaining above the 50-day SMA at $3,060. Therefore, a four-hour candlestick close below this level will suggest that ETH bulls are not willing or unable to push the asset higher.

In this case, investors can expect Ethereum price to slide lower and retest the $2,823 support level. Here, buyers can band together for a third attempt at an uptrend.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.