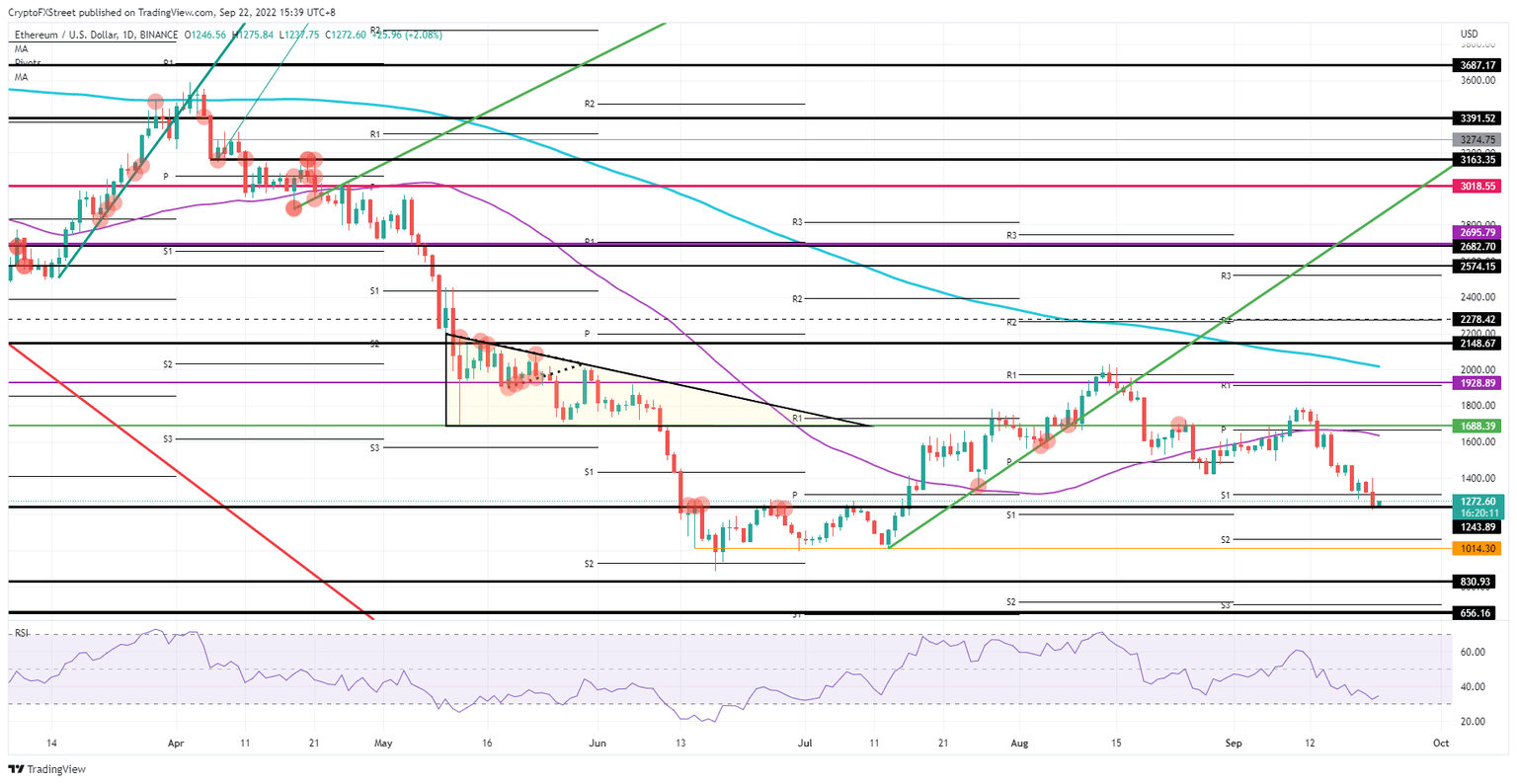

Ethereum price set to slip to $1,000 as five c-banks have their say

- Ethereum price hit a floor of $1,243.89 in the aftermath of the Fed rate decision.

- ETH price could not try and get away from the dollar pressure holding cryptocurrencies in its grasp.

- With five other central banks scheduled to make announcements today, expect to see violent moves in forex and crypto markets.

Ethereum (ETH) price is getting a lesson on central banking 101 on Thursday as over five central banks are set to shed light on the current economic situation and how they see the economy, inflation and their monetary policy evolving. From the looks of it, the day promises to be a bloodbath as several comments from central bankers point to more hawkish and severe interventions as inflation remains sticky. Within Asia, big interventions from the PBoC and the BoJ risk building for a blue-Monday event that could trigger a massive sell-off in the markets should one or other stop its intervention in the market to try and support its currency.

ETH price at risk of being killed in a ‘blue-Monday’ event

Ethereum price is slowly but surely trading lower yet again towards $1,000 as the dust settles over the hawkish message from the Fed. Although the Fed raised rates by the anticipated 75 bps, the underlying message from Chairman Powell was harsh and left no imagination for a soft landing. The US economy will crash and go into recession as it appears to be the only solution to get inflation down, making it time for traders to fasten their seatbelts and get ready for a hard landing.

ETH price currently sees bulls getting pushed against the wall at $1,243.89 and being forced by bears to forfeit their position like a playground bully demanding lunch money from the nerds. Once bulls start capitulating, the sell-side demand will explode and see XRP price hit $1,014.30. That level is likely to be the last line of defence before $1,000; when breaks below it will come into play

ETH/USD Daily chart

Alternatively, a plain and simple bounce off $1,243.89 level would probably see ETH price increase to $1,400. It would mean that bulls are not that easy to push out of their positions, and that sellers will start taking their gains, easing the bearish pressure on price action. Should a daily close print above $1,400, more gains could be up for grabs by Friday and over the weekend towards $1,479, which is the high of September 16.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.