Ethereum price rallies nearly 20% in two days as whale accumulation triggers Crypto Season

- Ethereum price has rallied nearly 20% in two days.

- A massive influx of volume was seen on the Volume Profile Indicator while Whales accumulation of Ethereum tokens hits all-time highs.

- Invalidation of the bullish thesis is a breach below $1450.

Ethereum price stuns the market as an impressive bullrun unfolds. Key levels have been defined to gauge the strength of the bulls.

Ethereum price takes off

Ethereum price has rallied impressively during the final week of October. On October 25, the decentralized smart contract token saw a massive influx of buying pressure. The bullish surge raised the ETH price by 16% in two days. Now the next question is how long will the newfound bull run last?

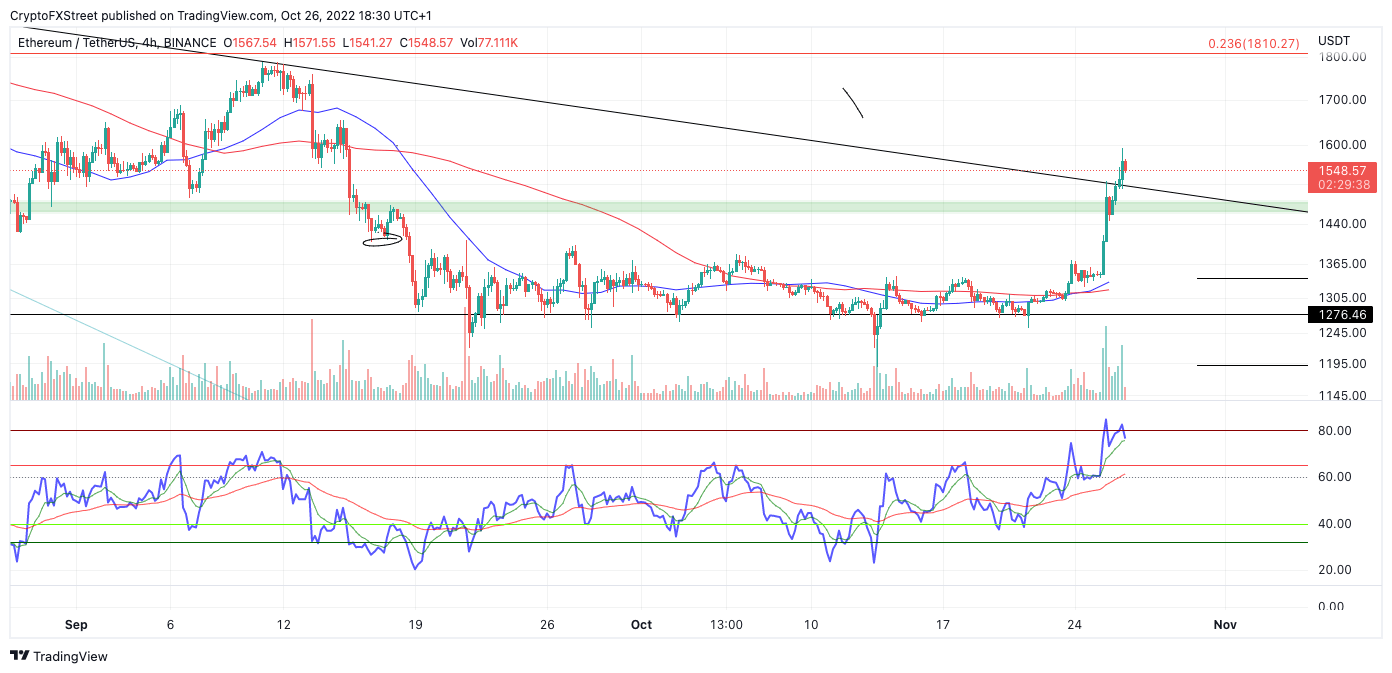

Ethereum price auctions at $1,588. The surging rallies' move was catalyzed by a subtle divergence on the Relative Strength Index between October 13 and 20. On October 23, the bulls breached the 8-day exponential moving average (EMA) and 21-day simple moving average (SMA). By October 24, the 8-day EMA retracement occurred just before the 20% rally commenced.

ETH/USDT 4-Hour Chart

On October 21, FXStreet’s Crypto News Coverage reported a significant accumulation signal that hinted at the imminent bull run. According to Ekta Mourya, $3.5 million ETH was scooped up in a few transactions creating a "14% increase in Ethereum holdings of whales with a billion dollar portfolio. The cumulative holdings of whale wallets hit an all-time high balance of 28.55 million ETH."

Based on the technical and on-chain analysis, the bullish frenzy should not be underestimated. The next bullish targets lie in liquidity zones between $1,600 and $1,680.

The uptrend invalidation level could be below Wednesday's bullish engulfing candle at $1,450. A breach of the candle low could signal a deeper retracement underway. If the invalidation level is tagged, the bears could re-route south, targeting recently broken resistance at $1,400. Such a move would result in a 17% decline from the current Ethereum price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.