Ethereum Price Prediction: ETH/USD poised for lift-off to $750 – Analyst predicts

- Ethereum has an abundance of factors poised to set off on a rally to $750 in the coming months.

- ETH/USD is dealing with low trading activity; a situation that is likely to continue in the near-term.

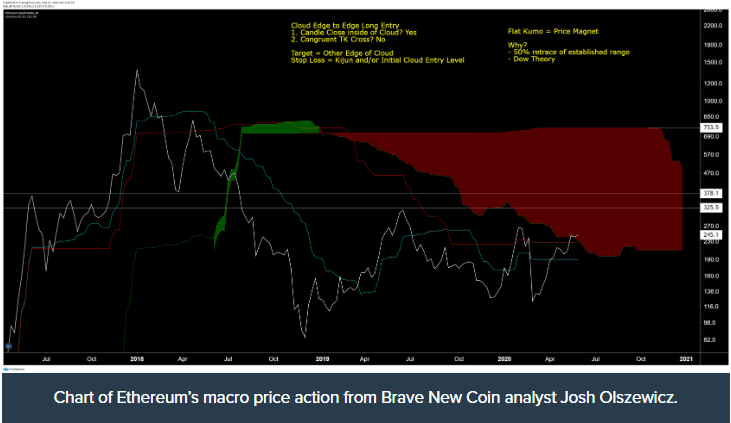

Ethereum price is still trading 80% below its all-time high. Intriguingly, the second-largest cryptocurrency has corrected higher by over 175% from the March lows, triggered by the Coronavirus pandemic. According to Brave New Coin analyst, Josh Olszewicz, Ethereum could be readying for a rally to $750 in the next few months. The analyst made this observation studying ETH/USD one-week chart using the Ichimoku Cloud indicator. Olszewicz wrote:

“One-week Ethereum chart. End to end to $750 triggers within the next few months probably.”

Some of the factors that could support the majestic price action are the upcoming Ethereum 2.0 upgrade. While the use cases of Ethereum have grown significantly over the last couple of years, the upcoming upgrade would be a makeover for the platform. Some of the new features expected include higher transaction capacity, staking within the network, shift to the Proof-of-Work algorithm, and sharding technology.

Ethereum short-term technical picture

From a technical point of view, Ethereum settling above $240 is likely to continue in the near term. On the upside, immediate resistance lies at $245 while the next resistance is expected at $245. The RSI is moving horizontally slightly under the overbought region. This speaks in volumes of the ongoing consolidation. The MACD, on the other hand, clearly shows that the price is in the hands of buyers at the moment. However, with low trading volume, no significant progress can be made to the north. Therefore, investors should start to get accustomed to the drab action mood in the short term.

ETH/USD price chart

%20(29)-637271832662047546.png&w=1536&q=95)

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren