Ethereum Price Prediction: ETH to face rejection and drop to $2,100

- Ethereum price is trying to slice through a significant supply barrier.

- If successful, ETH could rise by 25% toward $3,400.

- However, a rejection from the overhead resistance may lead to a downswing to $2,100.

Ethereum price looks primed to retrace as the overhead resistance seems to have the strength to trigger a rejection.

Ethereum price might retrace

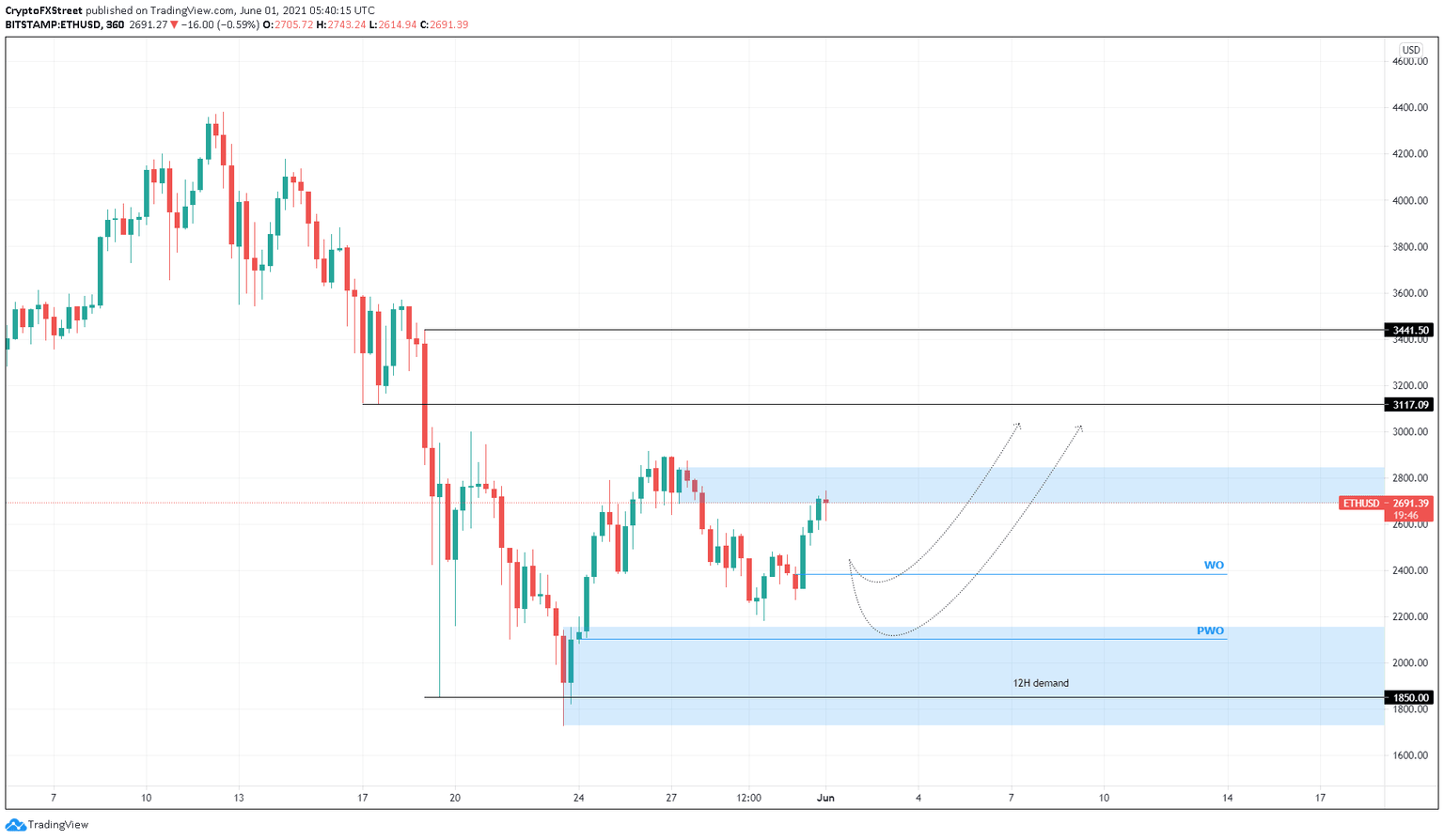

Ethereum price is currently struggling with a supply zone that extends from $2,689 to $2,843.

A rejection at this resistance barrier will push Ethereum price down to the weekly open at $2,383, representing an 11% downswing. If the buyers fail to defend this level, ETH will slide to the immediate support at $2,101, which coincides with the previous week’s opening price.

Investors could then expect Ethereum price to reverse here and surge by 25% to the supply zone’s lower trend line at $2,689.

ETH/USD 6-hour chart

However, if the May 19 swing low at $1,850 is breached, the short-term bullish outlook would be invalidated. In that case, a spike in selling pressure will trigger a consolidation for Ethereum price where it could slide to the immediate support level at $1,730.

Author

FXStreet Team

FXStreet