Ethereum Price Prediction: ETH primed for $3,000 after ephemeral consolidation

- Ethereum price has been on a tear over the last week, as it undid the crash, and is on its way to new highs.

- ETH is now consolidating around the local top at $2,450, anticipating a 15% move to $3,000.

- A breakdown of the support at $2,400 would invalidate the bullish outlook and might invoke a pullback to $2,320.

Ethereum price is hovering a few ticks away from its all-time high as it consolidates, hoping to gather steam before its upswing.

Ethereum price might enter discovery mode shortly

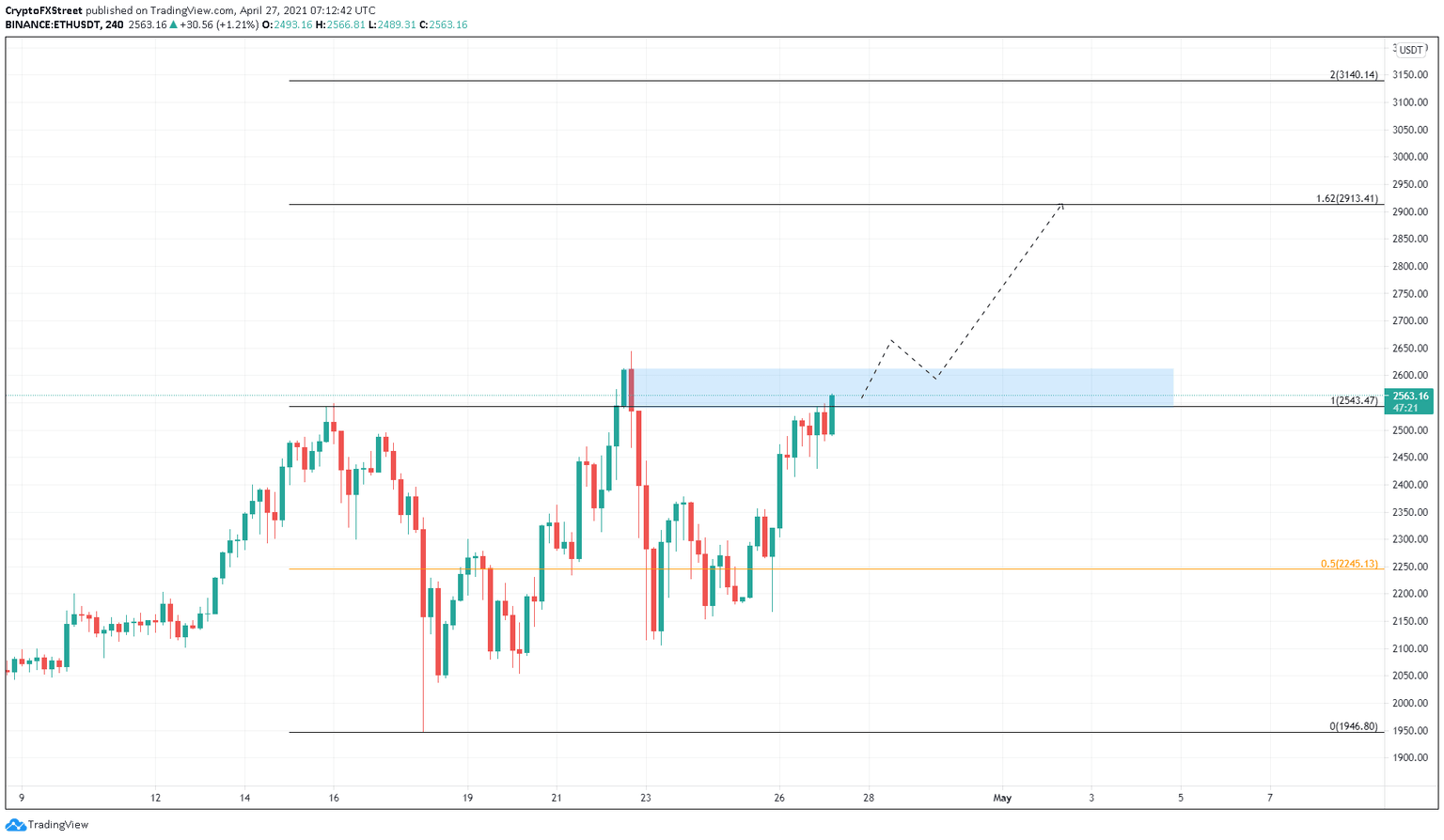

Ethereum price has surged nearly 22% since its crash on April 23. Now, ETH consolidates in a tight range around the recent swing high at $2,450, building up steam before it blasts off to record levels at $3,000.

A potential spike in buying pressure that produces a decisive 4-hour candlestick close above the demand zone’s upper barrier at $2,612 will signal the presence of strong buying pressure.

In such a case, investors can expect the smart contract token to surge roughly 12% to a significant psychological level – $3,000.

ETH/USDT 4-hour chart

Supporting this optimistic scenario for Ethereum price is IntoTheBlock’s Global In/Out of the Money (GIOM) model, which shows no resistance ahead.

Conversely, the presence of a cluster of stable demand barriers adds a tailwind to the upward trajectory portrayed above.

Roughly 2.92 million addresses that purchased 22.11 million ETH around $2,206 will dampen the short-term bearish pressure as investors here might add more to their holdings.

ETH GIOM chart

On the contrary, if investors fail to defend the $2,400 level, a bearish outlook will be triggered. Such a scenario will cause Ethereum price to slide to $2,350 and $2,265 in dire situations.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.