Ethereum Price Prediction: ETH could be on the verge of an imminent breakout above $400

- Ethereum is trading at $388, right above a crucial resistance level at $385.

- Many ETH fundamentals are currently bullish and will help the digital asset.

A few hours ago, we posted an article about Ethereum and its vital fundamental metrics. ETH was trading at around $380, right below a significant resistance level at $385, which has broken now.

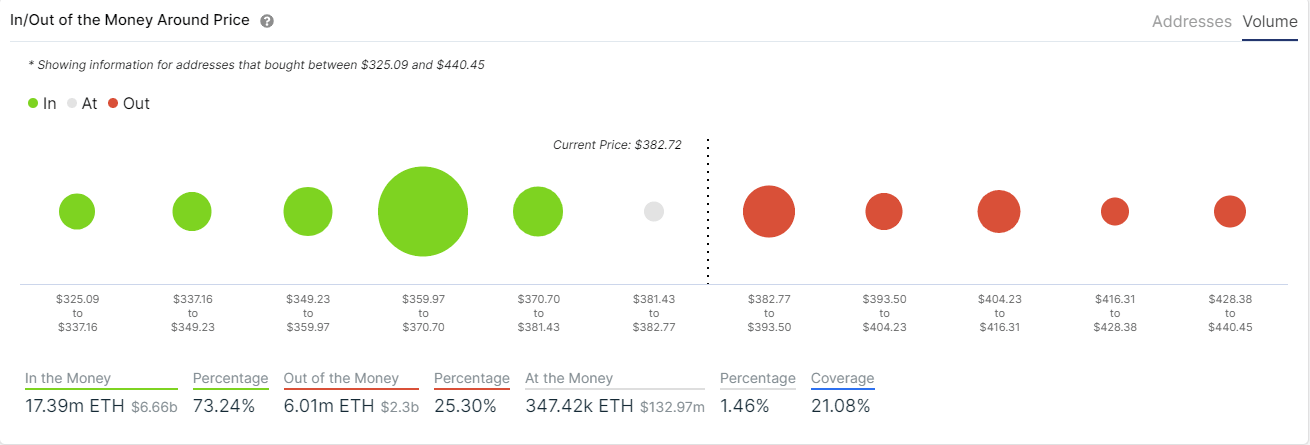

Ethereum's In and Out of the Money data

Source: IntoTheBlock

The next critical resistance point is $390, but the IOMAP chart clearly shows there is practically no resistance even until $433.

ETH/USD daily chart

The smart contracts giant is close to breaking out of the triangle pattern but will also run into the 50-MA resistance level at $390.7 and the high of $390.43. The amount of resistance above $390 is still reasonably low since we reported it, which means bulls have a clear way into $400 and above.

ETH/USD 4-hour chart

Ethereum seems to breaking out as well after cracking the $385 level; however, there is still some resistance ahead at $390. This resistance level is also close to the 200-MA at $391.94. It’s certainly not surprising seeing Ethereum move up as the number of whales has been increasing since September 10, as we saw this morning.

On the other hand, a clear rejection from $390, forming a double top could be the spark that bears need to take the lead and push Ethereum back to $355.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637359644917123040.png&w=1536&q=95)

-637359645061821703.png&w=1536&q=95)