Ethereum Price Prediction: ETH bulls aim for $580 to reverse the downtrend

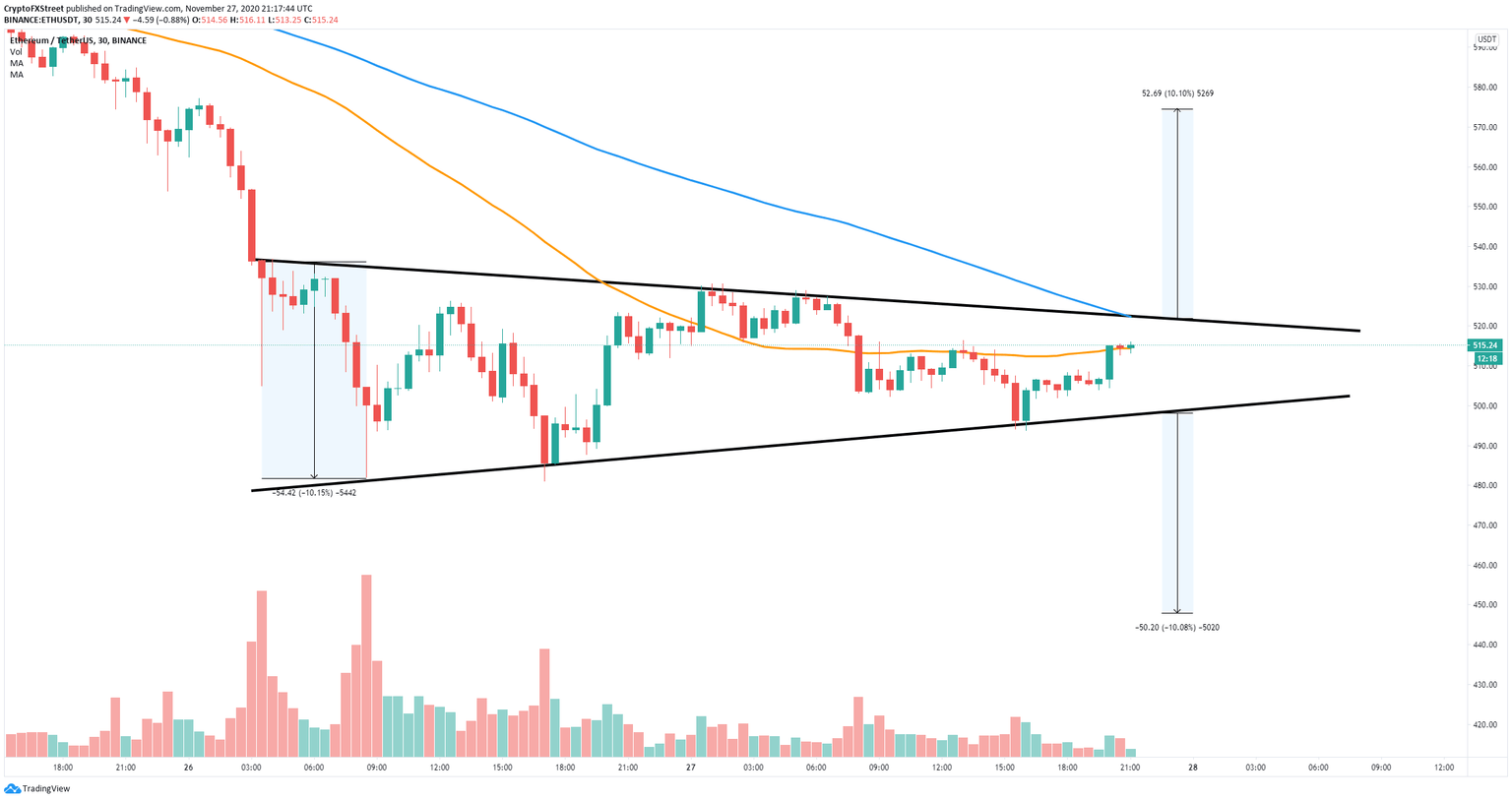

- Ethereum price is currently contained inside a symmetrical triangle pattern formed on the 30-minutes chart.

- The entire cryptocurrency market aims to bounce back up after wiping more than $90 billion in the past 48 hours.

Ethereum managed to reach a new 2020-high at $623 thanks to the upcoming Eth2 upgrade and the bullishness of the market. Unfortunately, the digital asset suffered a 22% correction down to $481, but it’s trying to bounce back up.

Ethereum price needs to crack this critical resistance level to climb towards $580.

On the 30-minutes chart, ETH has formed a symmetrical triangle pattern and the current price of $515 seems to be favoring the bulls. Ethereum price just climbed above the 50-SMA, turning it into a support level for the first time since November 27.

ETH/USD 30-minutes chart

The upper boundary of the pattern at $522 coincides with the 100-SMA which adds more strength to the resistance level. A breakout above that point would quickly drive Ethereum price towards $580 with a 10% move.

On the other hand, if bulls fail to defend the 50-SMA support level, Ethereum price could dip to the lower boundary of the symmetrical triangle pattern at $500, which is also a strong psychological support level. A breakdown below this point would push ETH towards $450.

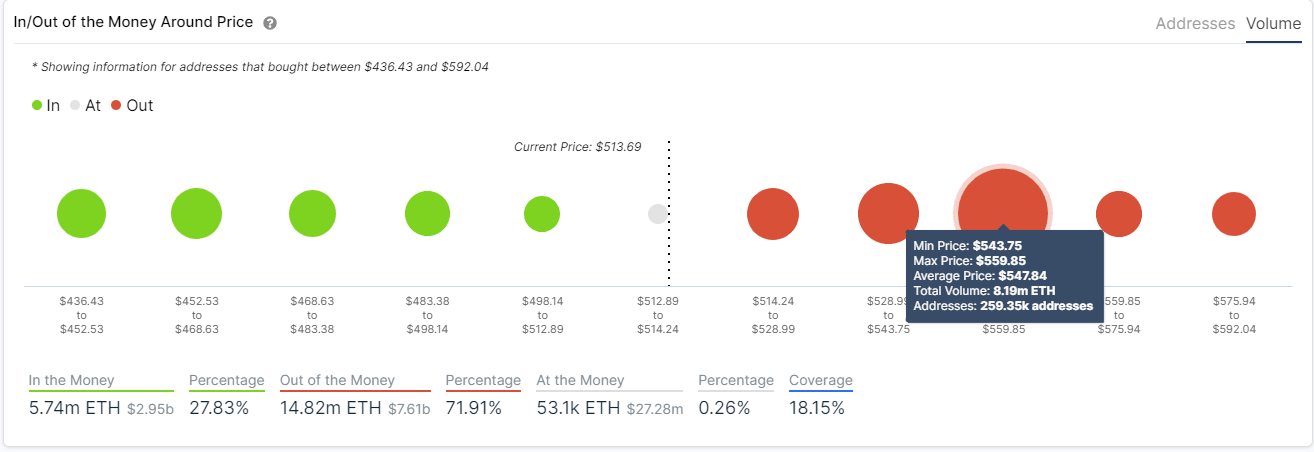

ETH IOMAP chart

The In/Out of the Money Around Price chart shows very little support on the way down without any significant range until $452, which seems to confirm the bearish outlook mentioned above. To the upside, there is a strong resistance area between $543 and $559 which adds some selling pressure to Ethereum.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.