Ethereum Price Prediction: ETH aims for $3,000 but has to conquer this level first

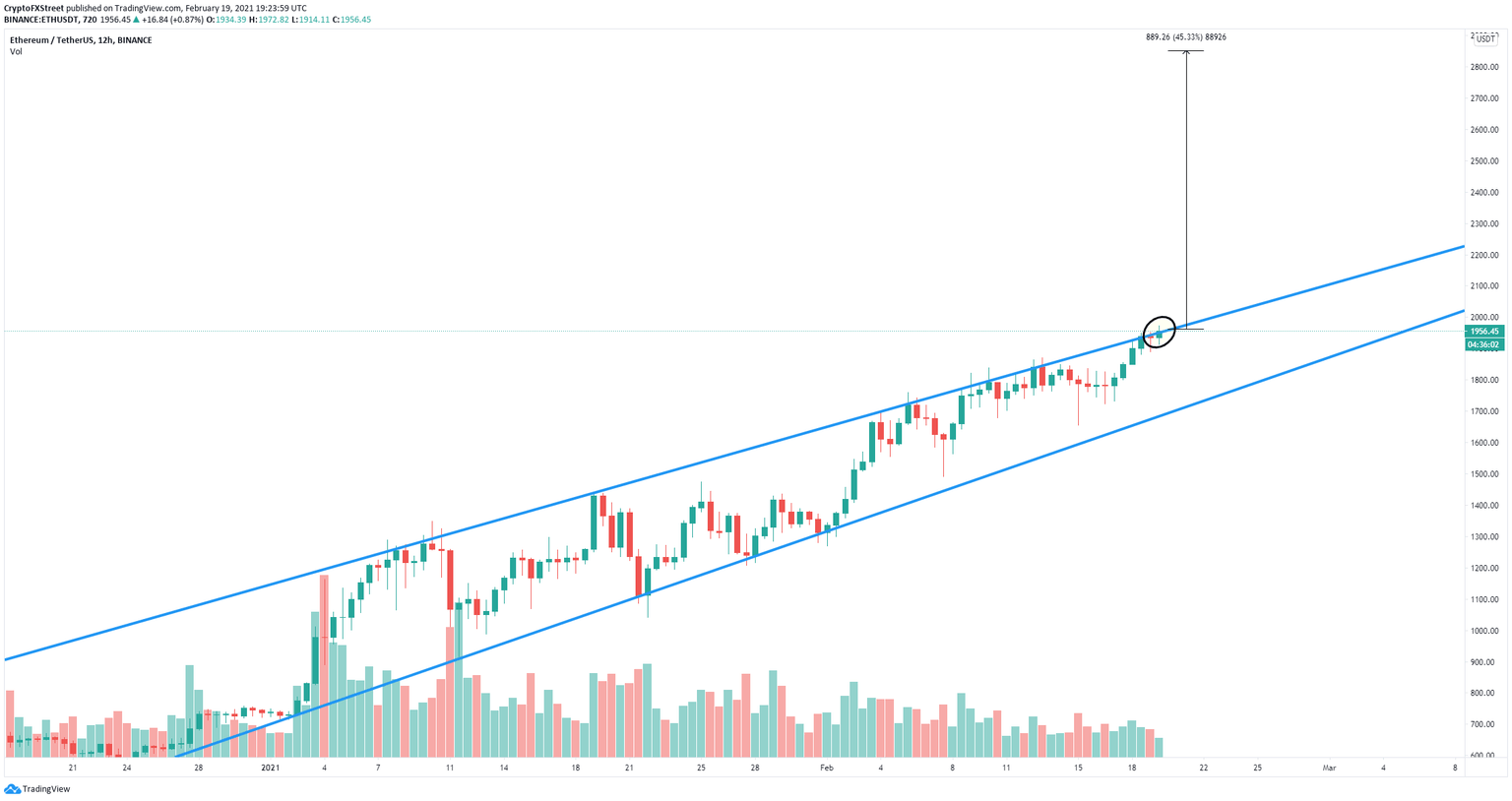

- Ethereum price remains trading inside a long-term ascending wedge pattern.

- A 12-hour candlestick close above the key resistance trendline would be a clear breakout.

- ETH aims to hit $3,000 in the long-term as it nears $2,000 for now.

Ethereum price is close to $2,000 for the first time ever as Bitcoin price just surpassed $55,000. The digital asset is still underperforming compared to most cryptocurrencies, but there is still hope for the bulls if they can conquer a critical resistance level.

Ethereum price needs a candlestick close above a critical level

On the 12-hour chart, Ethereum has established an ascending wedge pattern and has been rejected from the upper trendline several times in the past two months.

ETH/USD 12-hour chart

A 12-hour candlestick close above this resistance trendline would confirm a breakout that would take Ehereum towards $3,000 after a 45% move calculated using the height of the pattern as a reference.

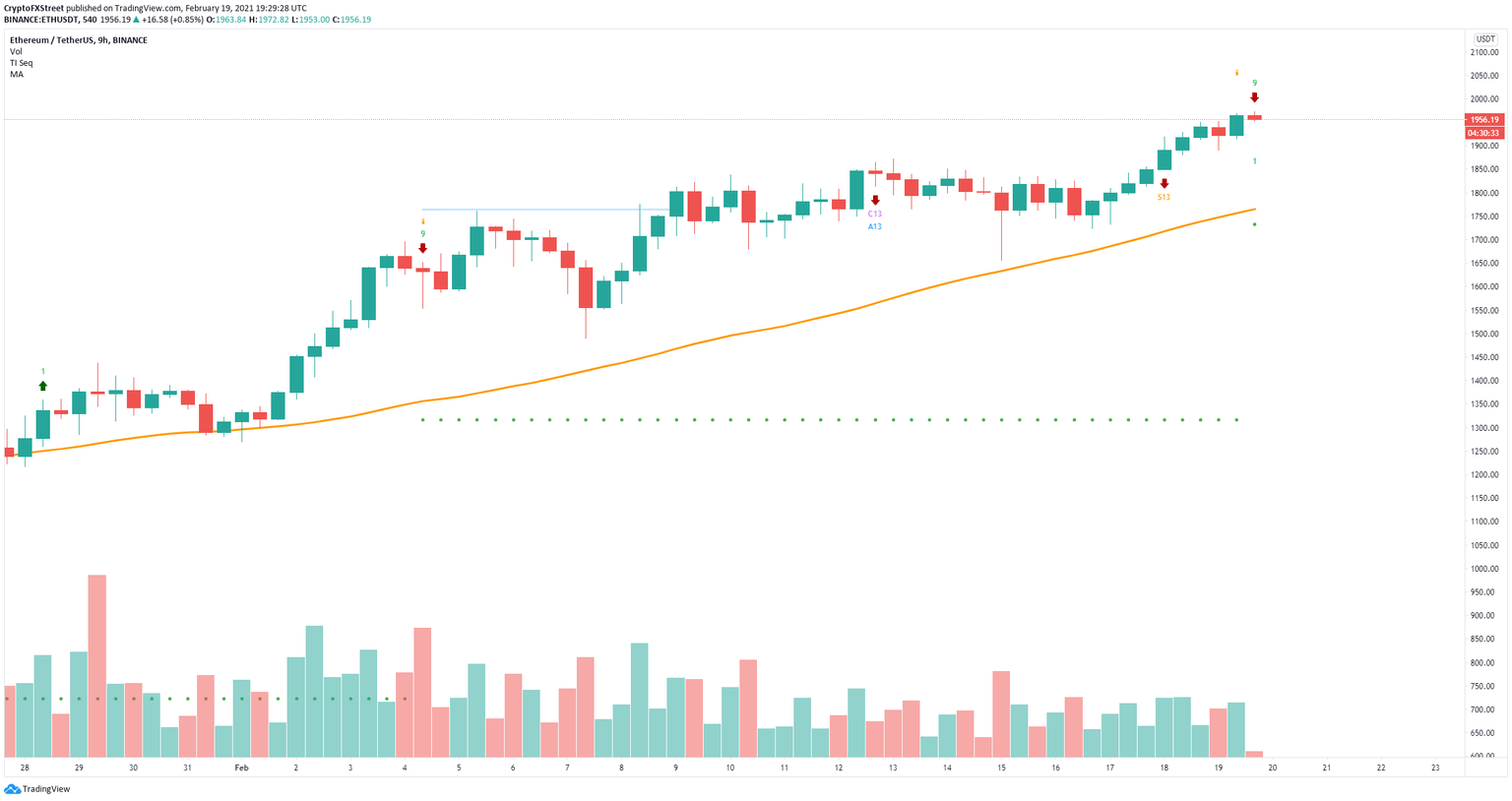

ETH/USD 9-hour chart

However, on the 9-hour chart, the TD Sequential indicator has just presented a sell signal which has been reliable in the past. The next potential support level in case of a sell-off is located at $1,774, which more or less coincides with the lower trendline support of the ascending wedge pattern.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.