Ethereum price must hold this critical point to reach $2,300

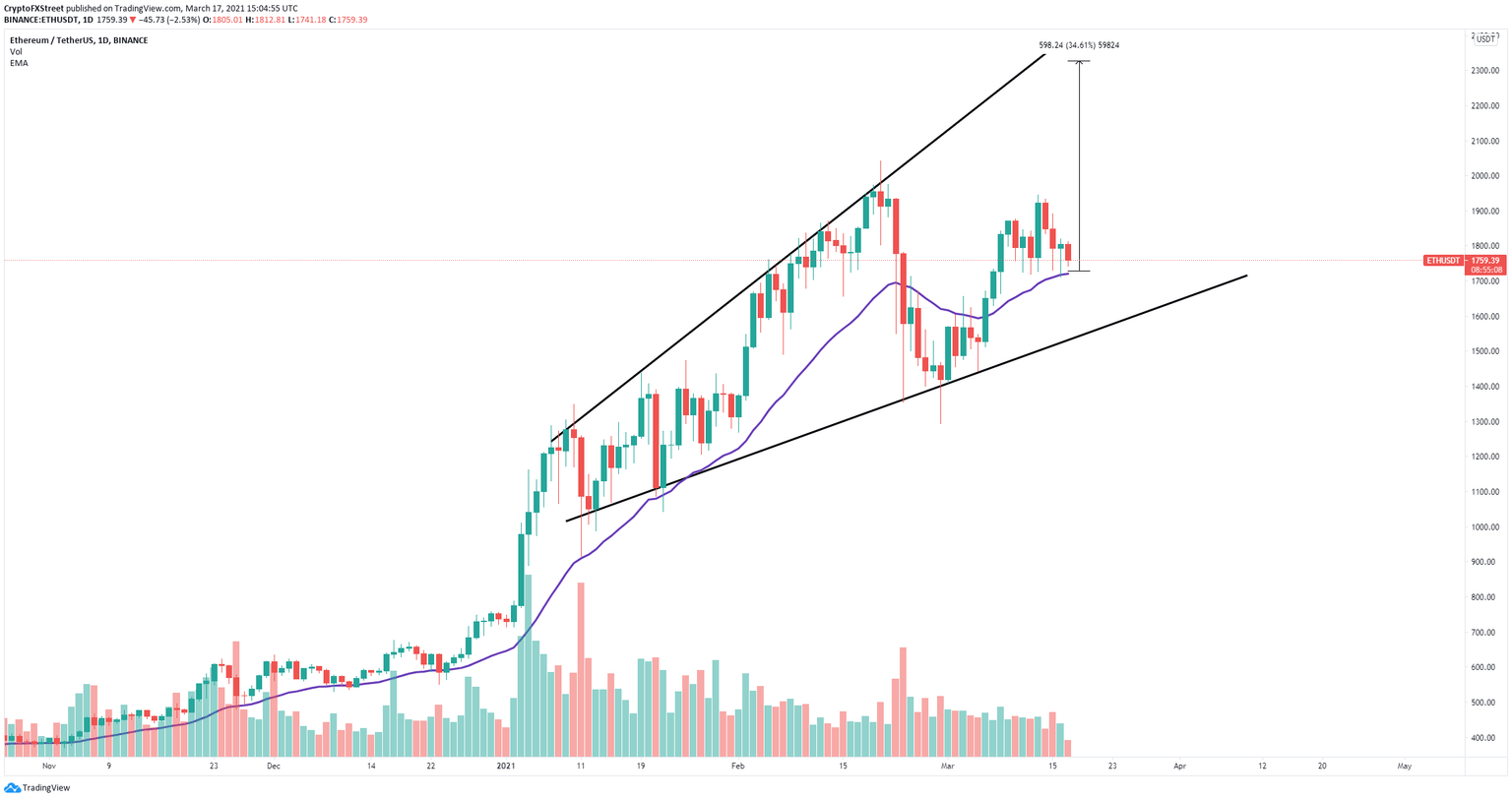

- Ethereum price is trading inside an ascending broadening wedge pattern on the daily chart.

- The digital asset must hold a critical support level for a breakout towards $2,300.

- Ethereum miners have managed to crack Nvidia's mining protection unlocking its full power.

Ethereum faces weak resistance ahead of $1,800 but must stay above a crucial support level first. Meanwhile, Ethereum miners are extremely happy for the high gas fees but also because they have managed to unlock the full power of the new Nvidia RTX 3060 graphics cards.

Ethereum miners beat Nvidia

The new Nvidia RTC 3060 graphic card was released last month. The company purposely limited its mining performance by 50%. However, it seems that miners have managed to bypass this limitation, unlocking its full performance power.

The idea behind the 50% power reduction was to steer cryptocurrency miners away from purchasing all the cards annihilating the stock. Unfortunately for Nvidia, Ethereum miners managed to bypass this restriction using a beta driver.

A developer driver inadvertently included code used for internal development which removes the hash rate limiter on RTX 3060 in some configurations

Ethereum price aiming for new highs if it can stay above this key level

On the daily chart, Ethereum has been trading inside a broadening wedge pattern since the beginning of 2021. The 26-EMA served as a crucial support level for the most part and bulls are trying to hold it again.

ETH/USD daily chart

A rebound from the 26-EMA at $1,700 has the potential to push Ethereum price towards the last high of $1,944. A breakout above this point would drive the smart-contracts giant to an all-time high of $2,300.

On the other hand, a breakdown below the key support level of $1,700 would quickly push Ethereum price down to the lower trendline of the pattern at $1,550.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.