Ethereum Price Forecast: ETH risks drop to $3,500 amid Ethereum Foundation's deposit into DeFi protocol Morpho

Ethereum price today: $3,990

- The Ethereum Foundation deploys 2,400 ETH and $6 million worth of stablecoins into DeFi lending protocol Morpho.

- The move follows its treasury policy update to pursue yield generation opportunities via Ethereum-aligned protocols.

- ETH risks a further decline to $3,470 if it loses a key rising trendline support.

Ethereum (ETH) declines by 3% on Wednesday despite the Ethereum Foundation's (EF) announcement that it will deposit millions of dollars worth of ETH into the DeFi lending protocol Morpho.

Ethereum Foundation expands DeFi operation by lending on Morpho

The Ethereum Foundation announced that it is deploying 2,400 ETH, valued at about $9.3 million, and $6 million worth of stablecoins into the decentralized finance (DeFi) lending protocol Morpho.

The EF said the funds will be deposited into Morpho's yield-bearing vaults as it doubles down on its recent treasury policy, which emphasized leveraging DeFi protocols aligned with Ethereum's values when engaging in yield generation opportunities.

"Morpho is a pioneer in permissionless DeFi protocols and consistently demonstrates a commitment to Free/Libre Open Source Software (FLOSS) principles," the EF wrote in a Wednesday X post. "FLOSS licenses ensure that builders are free to fork and build on existing protocols, making the DeFi ecosystem more resilient and permissionless."

The EF is the non-profit that manages research and protocol updates for the Ethereum blockchain.

Following a series of community backlash against its routine sales of ETH to fund operations, the Foundation began deploying funds into key DeFi platforms earlier in the year. In February, it injected millions of dollars worth of ETH into lending protocols, including Aave, Spark and Compound.

Based on prices at the time of publication, the EF holds about $823 million worth of ETH assets in its treasury, according to data from crypto intelligence platform Arkham.

Ethereum Price Forecast: ETH loses $4,100 support, tests key rising trendline

Ethereum experienced $124.7 million in futures liquidations over the past 24 hours, led by $77.1 million in long liquidations, per Coinglass data.

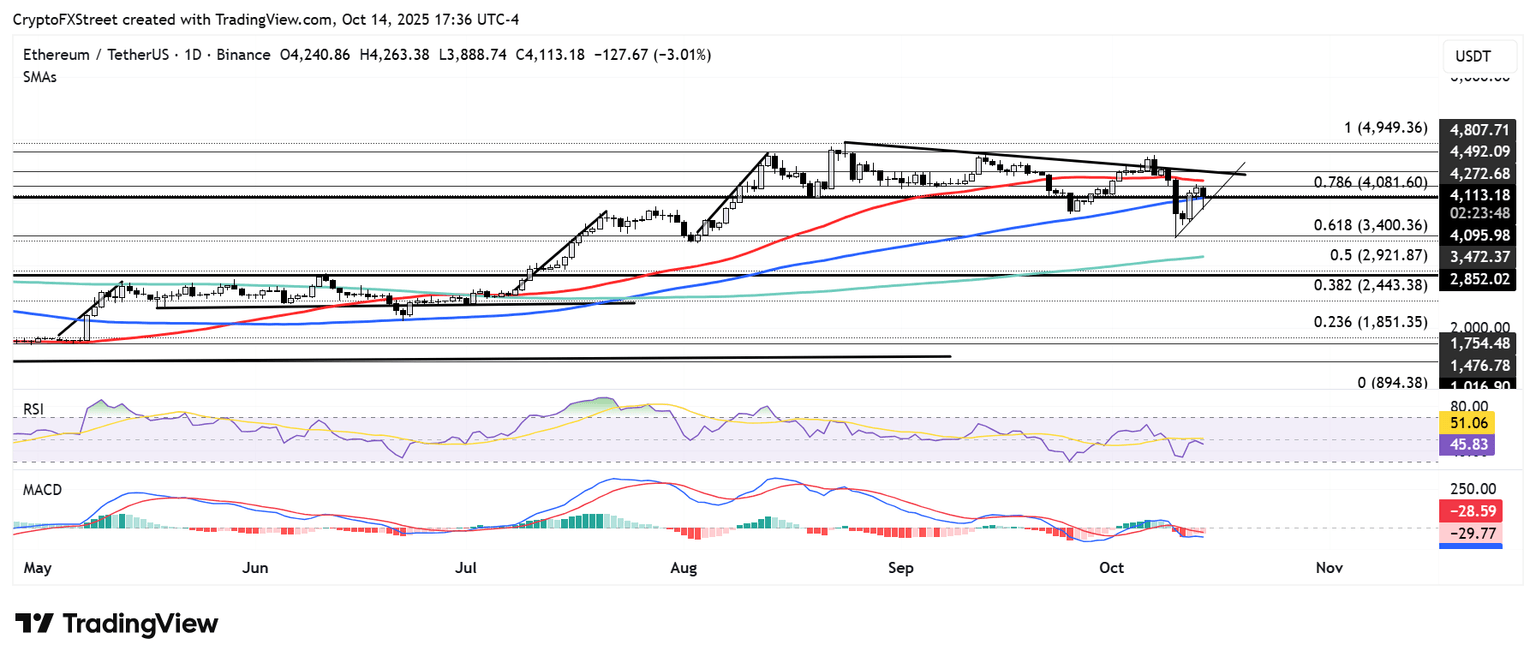

ETH declined below the $4,100 support level and is testing the rising trendline extending from October 10. A breach of this level could send ETH to find support near $3,470.

ETH/USDT daily chart

On the upside, ETH faces resistance at the $4,270 level, strengthened by the 50-day Simple Moving Average (SMA).

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) histogram remain below their neutral levels, indicating a dominant bearish momentum.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi