Ethereum Price Forecast: ETH plunges 8% amid strong accumulation from BitMine and Bitcoin whales

Ethereum price today: $4,400

- BitMine bought over 190,000 ETH last week, boosting its Ethereum treasury to over $8 billion.

- A key Bitcoin whale dumped $2.5 billion worth of BTC to purchase ETH across the spot and derivatives markets.

- ETH could decline to $4,100 if it fails to hold $4,500 level and 14-day EMA support.

Ethereum (ETH) fell by 8% on Monday as BitMine (BMNR) and Bitcoin (BTC) whales increased their accumulation of the leading altcoin.

BitMine and Bitcoin whales spearhead ETH accumulation

Ethereum treasury firm BitMine Immersion extended its lead as the largest corporate treasury of the top altcoin after acquiring 190,500 ETH last week, per a statement on Monday.

As a result, the company claims its total holdings have surpassed $8.8 billion, comprising 1.7 million ETH, 192 BTC and $562 million in cash.

"We continue to believe Ethereum is one of the biggest macro trades over the next 10-15 years," said BitMine board Chairman and Fundstrat's CIO Thomas Lee.

The Nevada-based firm also revealed that its crypto and cash net asset value (NAV) per share has increased by over 70% to $39.84 in the past month.

BitMine pivoted toward an ETH treasury in June, backed by Thomas Lee, Peter Thiel's Founders Fund, ARK Invest and Galaxy Digital.

In addition to strong accumulation from BitMine, several Bitcoin whales are also rotating to ETH, according to on-chain smart money wallet tracker Lookonchain.

Over the past week, a Bitcoin whale with 100,784 BTC worth about $11.4 billion trimmed his holdings by 22,769 BTC worth $2.59 billion and purchased 472,920 ETH worth $2.22 billion, combined with a 135,265 ETH long position on decentralized exchange Hyperliquid.

"He has closed 95,053 $ETH($450M) longs at $4,735 avg for a profit of $33M+, then bought 23,575 ETH ($108M) spot," wrote Lookonchain in a Monday X post.

Glassnode analysts highlighted in a report last week that such increased rotation toward ETH and altcoins aligns with the historical late stage of a crypto bull cycle.

A similar trend is evident in BTC dominance, which has declined from 60% to 57%.

"While still above the sub-50% levels of the 2021 altcoin season, positioning is feeding talk that whales expect ETH to outperform," wrote QCP analysts in a note to investors on Monday. "If staking ETFs for ETH win approval later this year, that narrative would gain further support."

Ethereum Price Forecast: ETH plunges after tagging $4,900

Ethereum saw $277 million in futures liquidations in the past 24 hours, comprising $242 million and $35 million in long and short liquidations, according to Coinglass data.

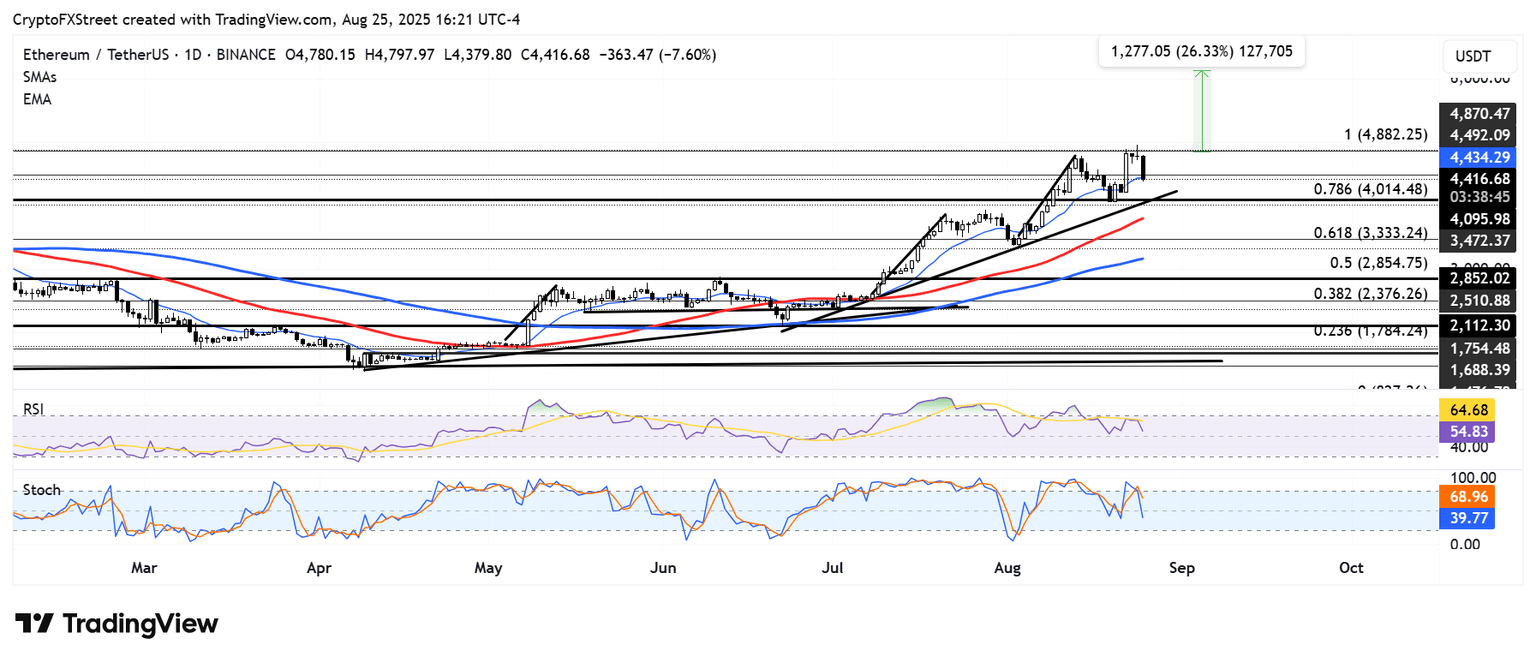

After hitting a new all-time high of $4,956, per Binance data, ETH has seen an 8% decline over the past 24 hours and is testing the support at $4,500. This level is strengthened by the 14-day Exponential Moving Average (EMA). A sustained decline below $4,500 could send ETH toward the support range at $4,100-$4,000, near the 78.6% Fibonacci Retracement level.

ETH/USDT daily chart

On the upside, ETH has to sustain a firm close above $5,000 to validate another bullish pennant. Such a move could push ETH toward $6,000 — a target obtained by measuring the height of the pennant's pole and projecting it upward from a potential breakout level.

The Relative Strength Index (RSI) is trending downward after failing to cross above its moving average line. Meanwhile, the Stochastic Oscillator (Stoch) has moved below its neutral level, indicating a rapidly declining bullish momentum.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi