Ethereum Price Forecast: ETH outperforms top cryptocurrencies, sees $1.1 billion in stablecoin inflows

Ethereum price today: $2,700

- Ethereum outperformed Solana and other blockchains in weekly stablecoin flows with $1.1 billion in net inflows.

- Ethereum ETFs have raked in 145,000 ETH halfway into February — 7x their total net inflows in January.

- Ethereum suffered its sixth rejection near $2,850 in the past two weeks despite signs of recovery in technical indicators.

Ethereum (ETH) is up 1% on Monday, stretching its weekly gains to nearly 3%, while other top blockchains experience losses. The top altcoin's recent outperformance can be attributed to rising stablecoin inflows and investment from institutional investors through ETH exchange-traded funds (ETFs).

Why Ethereum outperformed Bitcoin and Solana last week

Ethereum outperformed other Layer 1 and Layer 2 blockchain networks in terms of stablecoin inflow in the past week, according to crypto analytics provider Lookonchain.

While Solana, Avalanche, TON and Optimism witnessed stablecoin outflows of $772 million, $152.5 million, $100 million and $85.7 million, respectively, Ethereum posted inflows of $1.1 billion.

The stablecoin flows indicate that investors may be rotating capital from other blockchain networks into the Ethereum ecosystem. If the trend continues, Ethereum's native currency, Ether (ETH), could outperform that of other blockchain networks.

ETH's weekly performance of a 3% gain compared to losses seen in SOL, AVAX and TON provides a glimpse into the implications of its stablecoin inflow growth.

ETH has also shown strength over Bitcoin, which experienced a price loss of 2% in the past week. This could be due to increased inflows into US spot Ethereum ETFs.

According to Glassnode, ETH ETFs have seen net inflows of nearly 145,000 ETH just halfway into February — about 7x their entire net inflows in January. However, Bitcoin ETF flows have struggled so far in February with net outflows of 2,214 BTC.

James Toledano, Chief Operating Officer at Unity Wallet provided more insight into ETH's price growth in a note to FXStreet:

"Only a few hours ago Eth had a 4% surge, noting that it is settling down again [...] and it could possibly be attributed to a few factors. There’s been a significant withdrawal of approximately 900,000 ETH valued at around $2.4B from exchanges in the past ten days. This could be an indicator of reduced selling pressure and increased investor confidence. Also major investors have acquired around 280,000 ETH, totaling approximately $760M, further signaling a great deal of bullish sentiment."

Ethereum Price Forecast: $2,817 barrier holds strong

Ethereum experienced $61.8 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of long and short liquidations accounted for $23.4 million and $38.4 million.

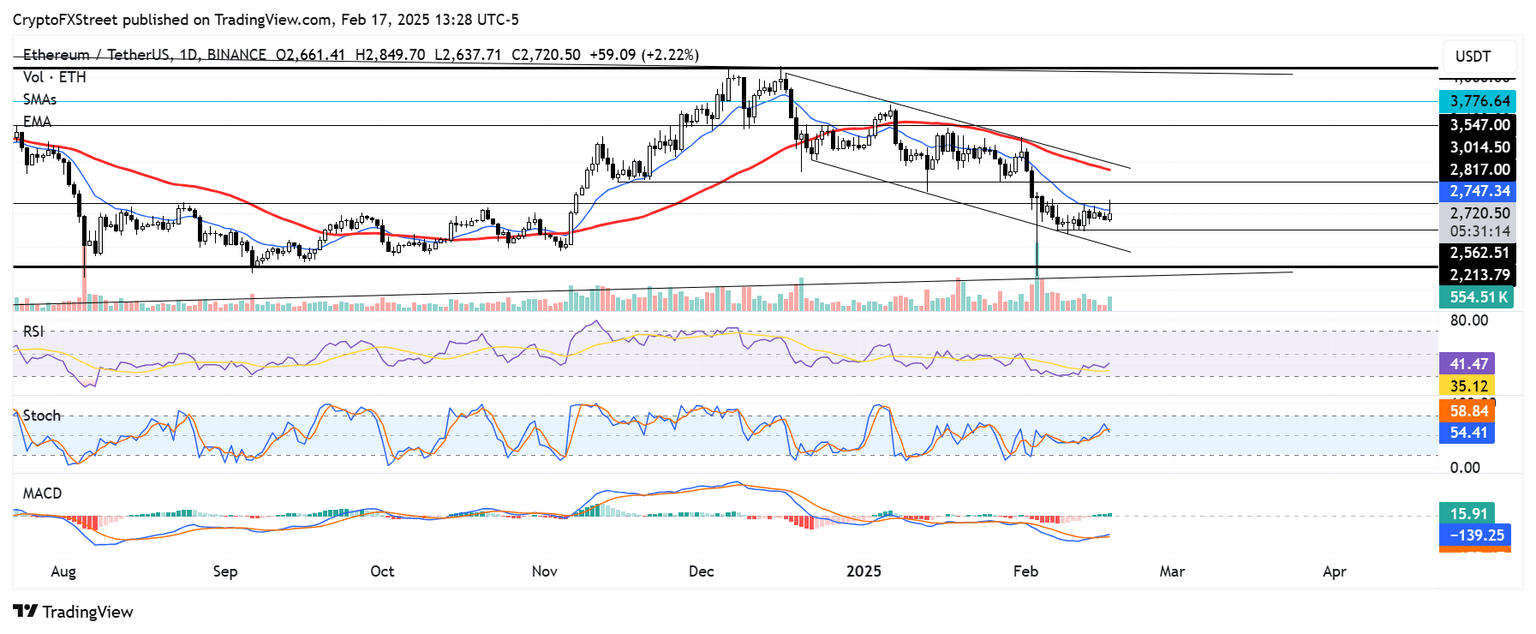

ETH retested the resistance around $2,800 to $2,900 for the sixth time in the past two weeks. A rejection at this level will mark the continuation of a trend where ETH has been consolidating between $2,500 and $2,850.

ETH/USDT daily chart

However, if ETH sees a firm move above $2,817 and establishes it as a support, it could rally to test the upper boundary line of a descending channel. A breakout above the descending channel resistance could send ETH to tackle the $4,100 key level, which has been a critical resistance in the past year.

On the downside, ETH could find support near $2,550 if it experiences a decline.

The Relative Strength Index (RSI) is aiming to test its neutral level. Meanwhile, the Stochastic Oscillator (Stoch) and Moving Average Convergence Divergence (MACD) histograms are slightly above their neutral levels, indicating a gradual rise in bullish momentum.

A firm daily candlestick close below $2,200 will invalidate the thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi