Ethereum Price Forecast: ETH could establish a support at $2,800 amid whale and ETF selling

- Whale addresses with a balance of 10K-100K ETH have shed 150K ETH from their collective holdings.

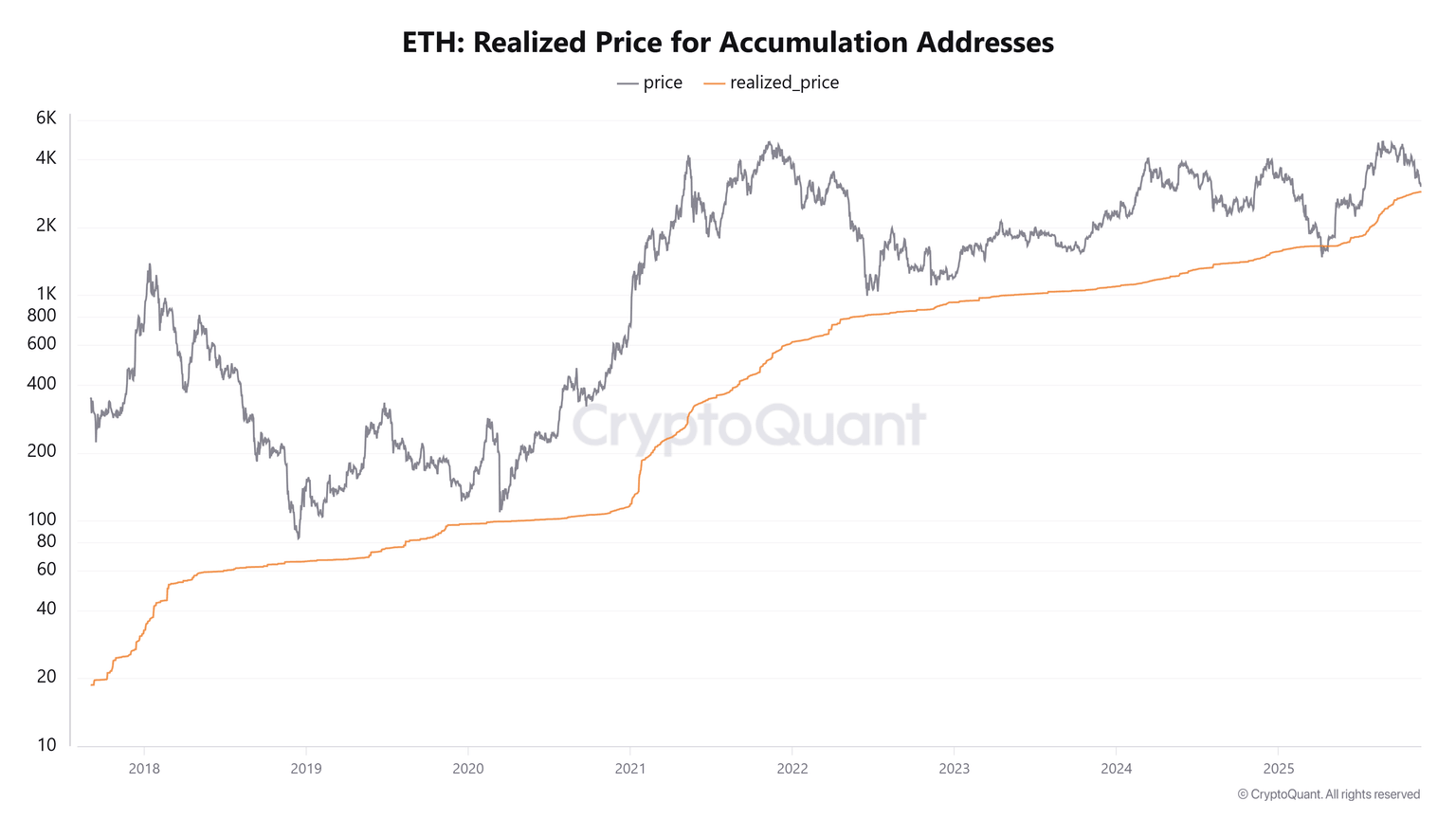

- ETH could see a recovery if it follows historical patterns to bounce off the cost basis of accumulation addresses.

- ETH found support near $2,850 after seeing a rejection around the $3,100 resistance.

Ethereum whales, addresses with a balance of 10K-100K ETH, have begun to show signs of weakness following the sustained market decline, according to CryptoQuant data. These wallets have reduced their collective balance by more than 150K ETH over the past four days.

The distribution comes as ETH's price has been hovering around their realized price or cost basis of $2,900, potentially prompting selling activity to cut losses or break even.

-1763615424474-1763615424475.png&w=1536&q=95)

A sustained price decline below their average buying price could accelerate the selling pressure. On the flip side, these whales could step in to defend prices from below their cost basis.

Accumulation addresses could help initiate recovery

A key level to watch is the cost basis of accumulation addresses or wallets with no record of selling activity, which is at $2,860. Historically, ETH has always seen a recovery whenever its price approaches their cost basis, as evidenced in the chart below. A similar occurrence in the current market landscape could see the top altcoin establish a strong support base around $2,800.

Additionally, ETH's Network Realized Profit/Loss metric shows that investors booked over $1 billion in losses in the past week, per Santiment data. This shows that the majority of selling pressure has come from investors trying to cut losses.

Meanwhile, Ethereum exchange-traded funds (ETFs) on Wednesday extended their outflow streak to seven consecutive days worth over $1 billion, per FarSide data.

Ethereum Price Forecast: ETH finds support around $2,850

Ethereum led crypto liquidations, recording $215 million in total with long liquidations reaching $186 million over the past 24 hours, according to Coinglass data.

ETH bounced near the $2,850 support after a rejection at the $3,100 resistance. The top altcoin is looking to make another attempt above the resistance.

A rise above $3,100 could push ETH toward $3,470, but it has to clear the 20-day Exponential Moving Average (EMA) on the way up. On the downside, a move below $2,850 could push ETH toward the $2,380 support level.

The Relative Strength Index (RSI) is below its neutral level, while the Stochastic Oscillator (Stoch) is close to its oversold region. This indicates a dominant bearish momentum.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi