Ethereum price could validate a 12% selloff before relief rally

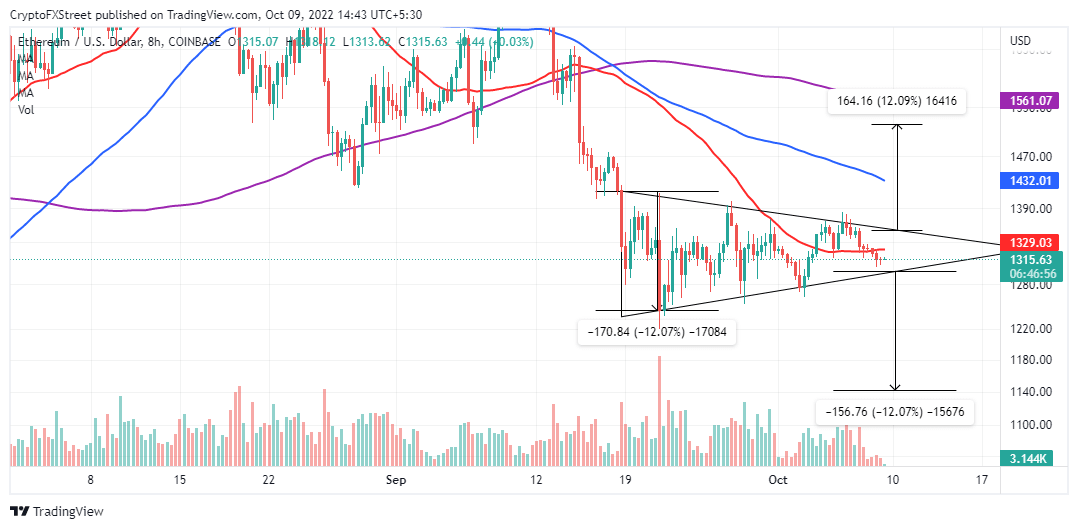

- Ethereum price is grinding toward a potential symmetrical triangle breakout.

- Hope for a bullish breakout from the triangle may be snuffed out by intense seller congestion at $1,334.

- Ethereum price relief rally is at the mercy of investors holding 1,000 and more tokens.

Ethereum price is sitting in limbo amid extended market indecision. Although the flagship smart contracts token tagged $1,384 this week, the momentum behind it faltered, leaving bears untethered. ETH is testing support at $1,300 on Sunday ahead of a potential southbound move.

Ethereum price vaporizes weekly gains

Ethereum price has consolidated around its $1,300 pivotal level in the last almost three weeks. As the token reached hit a series of lower highs and higher lows, a symmetrical pattern surfaced. This technical pattern forecasts a 12% move either up or down.

With the 50-day SMA (Simple Moving Average) capping movement to the upside, Ethereum price will likely break out below the triangle. It is worth mentioning that consolidation within the apex could carry on in the upcoming sessions – calling on traders to exercise restraint.

In other words, waiting for ETH price to crack the rising trend line support is advisable before activating sell orders. Ethereum price might drop to $1,140 as soon as movement below the triangle validates.

ETH/USD four-hour chart

Conversely, Ethereum could move north to $1,521 if a northbound breakout occurs. Symmetrical triangles do not have a bullish or bearish bias, which means recovery cannot be ruled out.

Despite the bulls’ desire to pull Ethereum price out of the pit and up the ladder beyond $1,500, large-volume holders keep snuffing out the ignited spark. On-chain data from Glassnode reveals that addresses with 1,000 and more ETH tokens had continued to sustain a downtrend since they peaked at 6,516 on September 15 – when Ethereum released the Merge software upgrade.

Now, investors in this cohort have roughly 6,316 addresses, and the pressure seems far from reducing. This implies chances of recovery will continue to thin as long as whales offload their bags. It also shows that investors prefer their money elsewhere and not in Ethereum.

Ethereum Number of Addresses with Balance ≥ 1k

The IOMAP by IntoTheBlock shines a light on a couple of strong resistance zones likely to keep sabotaging movement to the upside. The first – $1,334 represents 1.65 million addresses that purchased 5.6 million tokens, while the second – $1,370 hosts roughly 360,000 addresses with 5.5 million ETH.

Ethereum IOMAP model

Trading above these two supply areas will be daunting for the bulls. Hence, Ethereum price might complete the 12% triangle breakout to $1,140 before easing into another uptrend.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-638009054389197224.png&w=1536&q=95)

-638009054333304645.png&w=1536&q=95)