Ethereum price could rise further as supply on exchanges nears all-time low

- Ethereum supply on exchanges is close to its all-time low of 8.05%, lending support to ETH price gains.

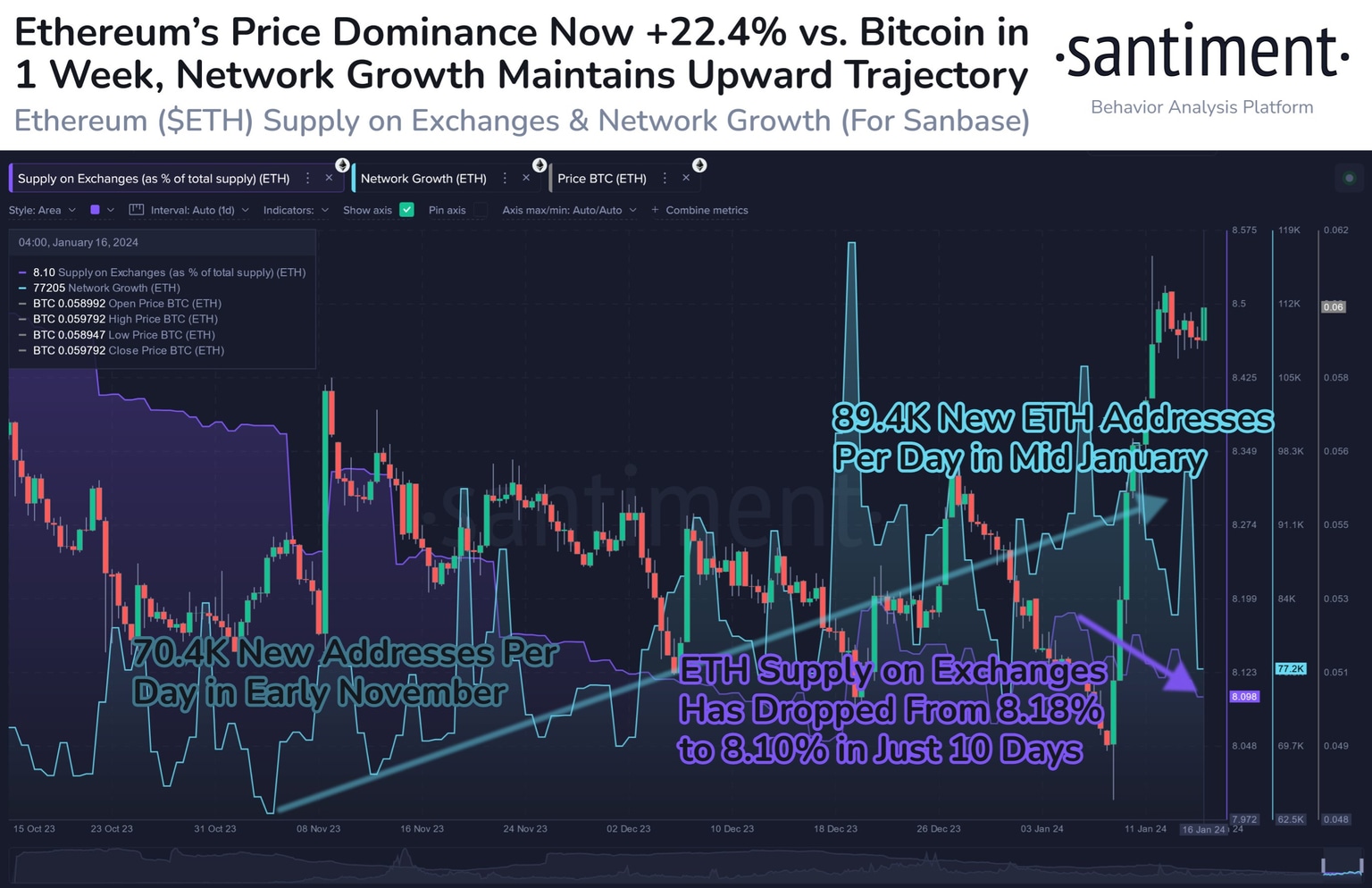

- The altcoin’s dominance surge against Bitcoin pushes ETH/BTC nearly 18.00% higher in the past week.

- Ethereum added over 89,400 ETH addresses per day in the past week, according to Santiment data.

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, noted a consistent increase in the number of new addresses created per day and a consistent decline in its supply on exchanges. In the past week, data from crypto intelligence tracker Santiment shows nearly 90,000 new addresses were added per day to Ether.

At the time of writing, the Ethereum/Bitcoin ratio is up nearly 18.00% in the past week.

Also read: Bitcoin records largest transaction of 2024, $665.3 million BTC transferred on Tuesday

Ethereum bullish on-chain activity supports price gains

Ethereum’s recent on-chain activity suggests the altcoin could see further gains. In the past few weeks, Ethereum added over 89,400 wallets to its chain on avearge every day, as seen in the Santiment chart below. Data from the on-chain tracker reveals that 96,300 new ETH wallets were created on Tuesday.

Ethereum price dominance and supply on exchanges. Source: Santiment

The creation of new wallets on a chain is a sign of its relevance among market participants, signaling that demand for the cryptocurrency is likely on the rise. Santiment data shows that Ethereum’s price has surged against Bitcoin, with ETH price up nearly 18.00% in the past week.

Moreover, Ethereum supply on exchanges has hit a near all-time low at 8.06%, as seen in the chart below. ETH supply dropped from 8.97% in July 2023, and it hit a bottom of 8.05% in December 2023.

Typically, a decline in exchange supply supports ETH price gains.

ETH supply on exchanges. Source: Santiment

At the time of writing, ETH is trading at 0.059 against BTC. ETH/BTC climbed nearly 18.00% in the past week and 12.23% in the past month. Ethereum price is $2,545.70 on Binance.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B15.37.43%2C%252017%2520Jan%2C%25202024%5D-638410870563021047.png&w=1536&q=95)