Ethereum Price Analysis: How ETH/USD survived the carnage in a rising channel?

- Ethereum bulls hold dearly the rising channel support, in anticipation of recovery towards $300.

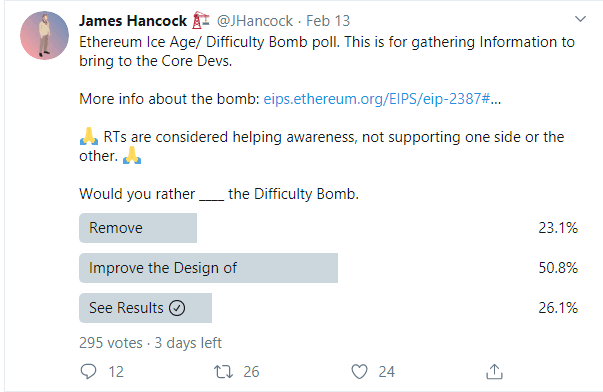

- Hancock, a developer contributing to the development of ETH proposes the elimination of the ‘difficulty bomb’

Ethereum price is teetering at $252 amid increased selling activity. The downward action that dominated the crypto market the entire weekend session did not spare Ether. It is the same action still in play on Monday towards the end of the Asian session. ETH/USD has lost over 2.5% in value on the day while the bears’ grip could potentially increase.

Ethereum price technical analysis

Looking back at ETH/USD price performance over the last couple of months, we can easily tell that the crypto has been in a bullish phase. Attempts made to end the bullish action have been thwarted with Ethereum bouncing off the channel support on several accounts. The channel resistance has also made it difficult for rapid price action to the north.

Meanwhile, the weekend support at $240 has to stay intact if Ethereum bulls have a fighting chance to advance above $300. The short term support at $250 needs to stand tall as well. However, technical analysis shows that the bears are largely in control. For instance, the RSI is not only under the average but also still pointing south. If the trend spills over into the European session, there is a possibility of the support $240 being shuttered as Ether spirals towards $300.

Recovery is needed above $260, which could encourage more bulls to enter the market and push ETH/USD above $270. The 50 SMA provides immediate support at $250 above the 100 SMA at $225.

ETH/USD 4-hour chart

-637175079909981335.png&w=1536&q=95)

The controversial Ethereum difficulty bomb

The Ethereum blockchain contains a code that is supposed to increase the time spent in mining one Ether block., otherwise called, the ‘Ethereum difficulty bomb.’ The bomb is from time to time delayed, however, James Hancock, a developer who contributes to the development of the Ethereum network, in his latest published research proposes an Ethereum Improvement Proposal (EIP 2125). The research shows a process through which the difficulty bomb could be eliminated entirely. He proposes a fix which he calls the Difficulty Freeze. Hancock explains:

Under the Difficulty Freeze, it is more likely that issuance would increase; however, clients are motivated to prevent this and keep clients syncing effectively. This means it is much less likely to occur.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren