Ethereum Price Analysis: ETH bulls are gearing up for fresh record to above $1,477

- ETH/USD stays in an uptrend even as immediate resistance line test buyers.

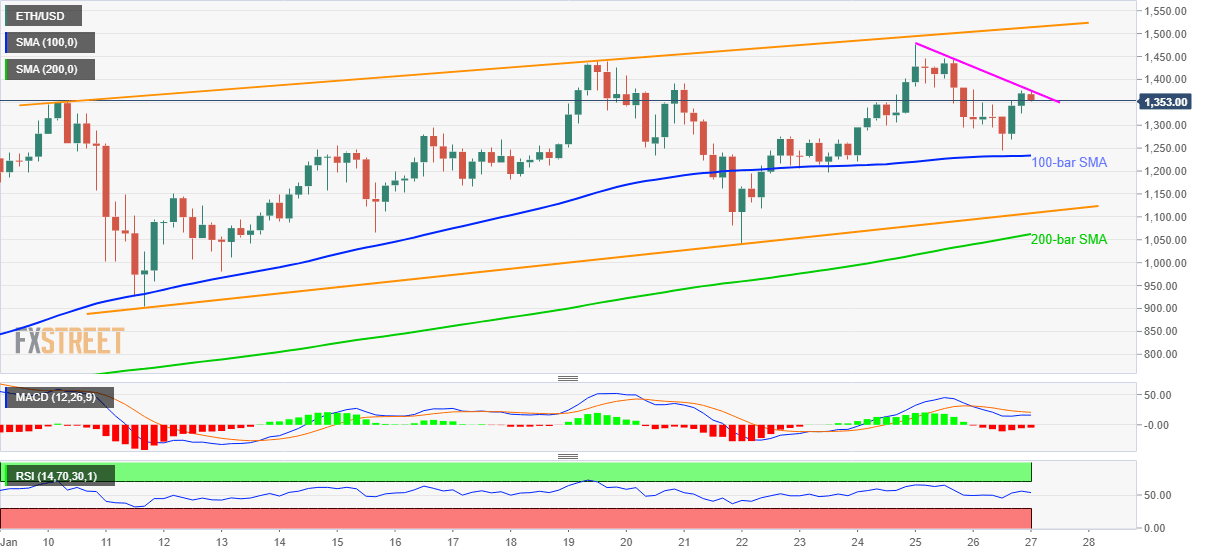

- Upward sloping trend channel from January 10, upbeat oscillators favor the bulls.

- 200-bar SMA adds to the downside filters, channel’s resistance can probe buyers.

ETH/USD buyers battle the weekly resistance line, currently around $1,357, amid the initial trading on Wednesday. Even so, a two-week-old rising channel and strong RSI, not to forget the receding strength of the bearish MACD, suggest further upside of the quote.

However, the weekly falling trend line, at $1,378 now, guards the quote’s immediate upside, a break of which will escalate the north-run towards the recently flashed all-time high of $1,477.

Should RSI conditions stay away from the overbought area while targeting the record top, ETH/USD bulls can eye for the $1,500 threshold. Though, the upper line of the stated channel near $1,513, may challenge any extra north-run.

Meanwhile, repeated failures to cross the immediate resistance line can drag the quote towards a 100-bar SMA retest, currently around $1,234.

In a case where the profit-booking moves break $1,234, the lower line of the channel and 200-bar SMA, respectively around $1,110 and $1,067, will be the key to watch.

To sum up, Ethereum is destined to please the bulls, as portrayed by the rising channel, but short-term pullback can’t be ruled.

ETH/USD four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.