Ethereum Market Update: ETH transaction fees retreat from the all-time high

- Ethereum bulls are inspired as ETH/USD settles above $400.00.

- The long-term indicators imply that the coin may continue moving to the north.

Ethereum (ETH) jumped above psychological $400.00 to trade at $407.00 by press time. The second-largest digital asset with the current market capitalization of $45.5 billion has gained over 4% since the start of the day amid strong bullish momentum caused mainly by a combination of technical factors.

Ethereum's on-chain data

Ethereum's transaction fees dropped by 80% from the recent high, according to the data compiled by the research company Santiment.

Ethereum transaction fees (in USD) dropped almost 80% from their all-time high today. This brings them back to levels last seen in mid-July. This is a nice opportunity for significantly cheaper on-chain operations today.

The lower fees may signal that the network is less clogged, however, the user activity on Ethereum blockchain is still high. Thus, the number of daily transactions has been stable since the beginning of August, while the average transaction volume settled above 4 million ETH.

ETH/USD: The technical picture

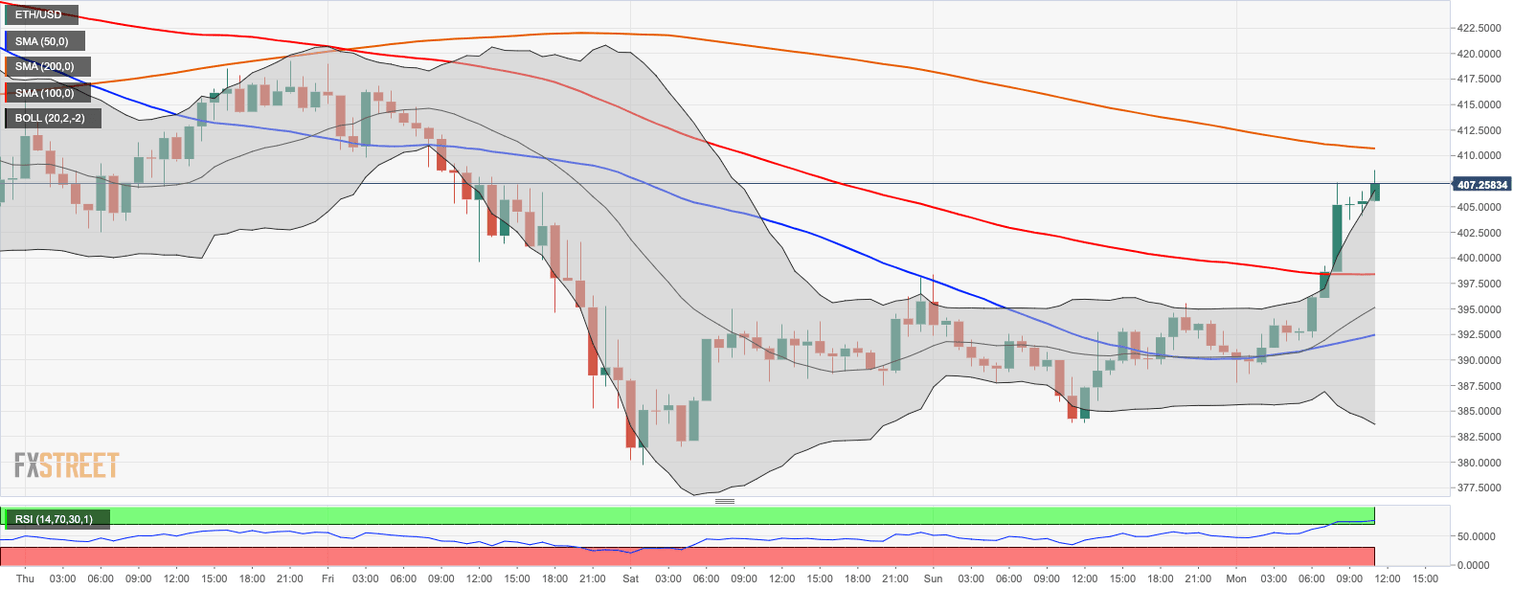

From the technical point of view, ETH/USD used the local support of $390.00 created by 1-hour SMA50 as a jumping-off ground for a strong recovery above $400.00. If the growth is sustained, the price may retest the next bullish target of $410.00 (1-hour SMA200) and $450.00, reinforced by the upper line of the daily Bollinger Band.

ETH/USD 1-hour chart

If $400.00 gives way, the sell-off may be extended to the intraday low of $387.70, with the next bearish target at $330.00 (daily SMA50). This barrier will slow down the bears and allow for an upside recovery. The critical support comes at the psychological $300.00.

While the intraday RSI has entered the overbought territory, the daily indicator is still bullish. It means that the coin may be poised for further growth after a short-term correction.

ETH/USD daily chart

Author

Tanya Abrosimova

Independent Analyst

-637338654139993195.png&w=1536&q=95)