Ethereum is the most correlated crypto asset, research shows

- Binance research published an overview report on the state of the cryptocurrency market.

- ETH/USD is locked in a tight range with a bullish bias.

Ethereum, the second-largest digital asset with the current market value of $18.4 billion, has lost nearly 1% since the beginning of Wednesday and stayed unchanged on a day-to-day basis. ETH/USD attempted a rise above $171.00, but the move proved to be unsustainable and the coin slipped back below $170.00 level.

Ethereum has the strongest correlation

According to the findings revealed in the latest Binance research paper, the cryptocurrency universe is moving towards a tighter correlation between various assets; however, Ethereum has the highest correlation with the rest of the market with the coefficient of 0.69. The least correlated are Cosmos (0.31), Chainlink and Tezos (0.32 and 0.4 respectively).

Also, the researches pointed out that the correlation tends to grow during bearish markets.

As a general rule, a correlation above 0.5 or below -0.5 is considered strong, while a value close to zero means that the assets move independently and have no or very little linear relationship.

The research showed that correlations between all pairs are always positive.

The most significant insight is that the largest change in asset correlations occurred in the third quarter of 2019. Based on manual inspection of the correlation matrices, this indicates that assets might be stronger correlated with each other in adverse market movements of the price. Coherently, crypto assets are less correlated with each other in up- or sidewards movements. Further analysis over a more extended period could substantiate this finding.

ETH/USD: technical picture

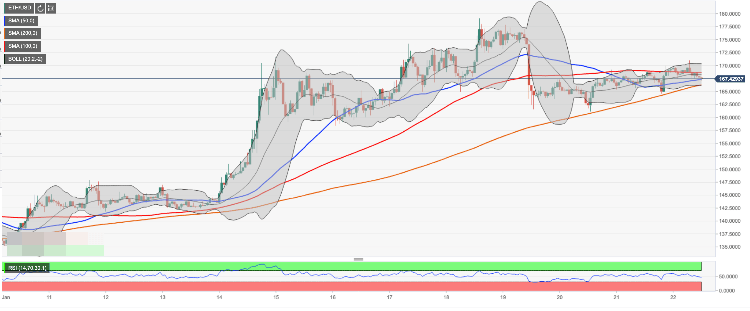

On the intraday charts, ETH/USD is moving within a tight upside channel with the upper boundary created by the upper line of 1-hour Bollinger Band above $170.00. A sustainable move above this barrier will open up the way towards $179.00-$180.00 resistance area. Once it is out of the way, the upside is likely to gain traction with the next focus on psychological $180.00 reinforced by SMA200 daily and the upper line of daily Bollinger Band.

On the downside, keep an eye on the lower boundary of the above-mentioned range created at $166.00 by SMA200 1-hour and reinforced by the lower line of 1-hour Bollinger Band. If it is broken, the sell-off may continue towards his week's low at $161.11 followed by psychological $160.00.

ETH/USD 1-hour chart

Author

Tanya Abrosimova

Independent Analyst