Ethereum holding above 1500 is a buy signal [Video]

![Ethereum holding above 1500 is a buy signal [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Digital Currencies/Ethereum/Ethereum_1_XtraLarge.jpg)

Bitcoin beat strong 200 week moving average resistance at 22500/600 so at last we have a buy signal!!!

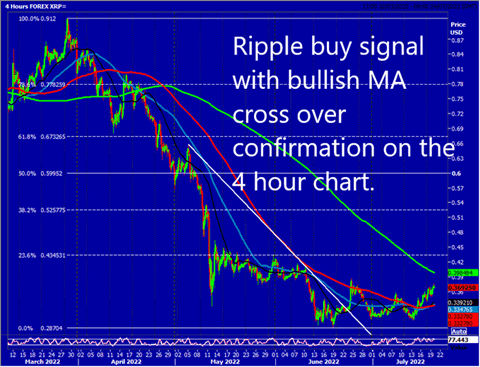

Ripple making a break above 1 month trend line resistance at 3500 for a buy signal!! (I have not written that for a long time) targeting 3580 & even as far as 3850/3900. I would not rule out 4300/4400 in fact.

Ethereum holding above 1500 is a buy signal!

Bitcoin beats strong 200 week moving average resistance at 22500/600 for a buy signal initially targeting 24600/700. We should struggle to beat this level, but I think shorts could be risky now. A break above 24750 signals gains as far as 26300.

Obviously bulls must hold prices above 23000/22500.

Ripple through 1 month trend line resistance at 3500 for a buy signal targeting 3850/3900, 4000 &even as far as strong resistance at 4300/4400.

Support at 3450/3350 if we fall this far.

Ethereum beat strong resistance at 1250/1300 for a short term buy signal targeting 1400 & probably resistance at 1500/1550. Targets hit as we reach 1632. Further gains are possible to 1690/1700, perhaps as far as 1800/1850.

First support at 1500/1460. A break lower targets 1400/1380.

Author

Jason Sen

DayTradeIdeas.co.uk